Stablecoin Startups Secure Over $600 Million in 2025 Investments

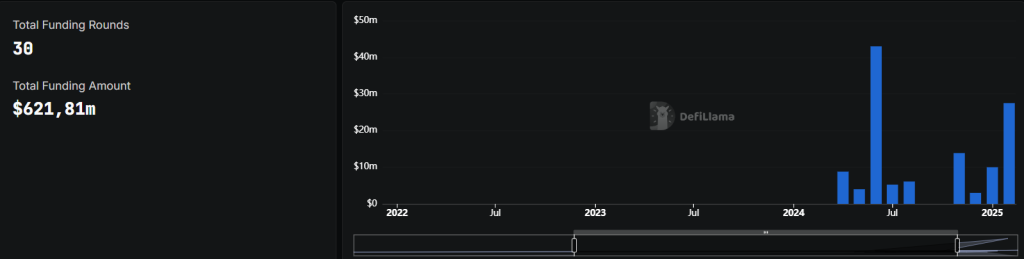

Stablecoin startups raised $621.81 million in 2025, seven times more than in 2024.

Since the beginning of the year, startups in the stablecoin sector have attracted $621.81 million, according to Defi Llama. This is seven times more than the total for 2024, which stood at $84 million.

The largest deal was closed by Hong Kong-based OSL Group. In July, it secured $300 million for global expansion.

“There is a buzz around stablecoins,” stated Confirmo’s CEO Anna Strebly, adding that the hype is justified.

The surge in investments is linked to the industry’s regulatory successes. A key event was the signing of the GENIUS Act by U.S. President Donald Trump. MNEE’s CEO Ron Tarter described the law as a “green light for corporate America, legitimising the industry.”

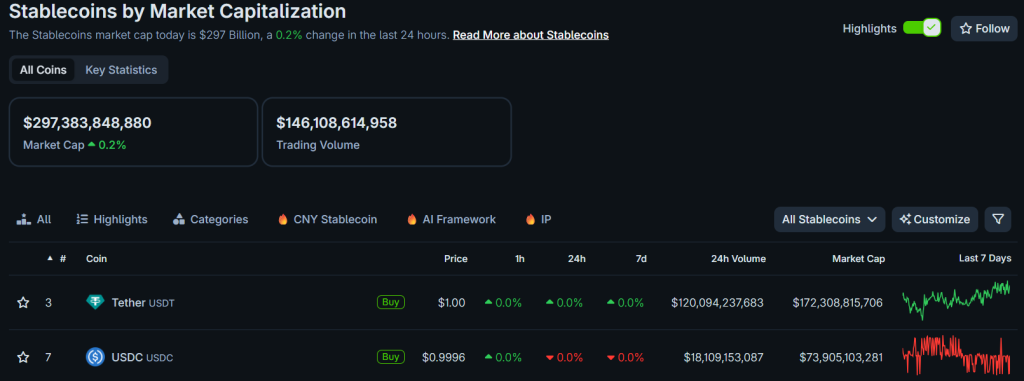

Amidst this, the total capitalisation of stablecoins exceeded a record $297 billion. Analysts at Coinbase forecasted that by 2028, the figure will reach $1 trillion.

Another signal is the June initial public offering by stablecoin issuer Circle, raising $1 billion. At the time of writing, the company’s shares are trading at $144.

Including the rounds by Circle and Figure Technologies, which DeFi Llama categorises under CeFi— and RWA-sectors, the total funding exceeded $2.4 billion.

Competition Intensifies

Market leaders like Circle and Tether face increasing competition. Fintech giant Stripe and major Wall Street players have announced plans to launch stablecoins.

Societe Generale’s crypto asset division, SG-FORGE, introduced the stablecoin USDCV. At JPMorgan, they confirmed the launch of the JPMD token on the Base blockchain. According to WSJ, Bank of America, Wells Fargo, and Citigroup are also exploring the development of their own assets.

Institutional players now view fiat-pegged coins as “building blocks of digital finance,” says Zerion co-founder Evgeny Yurtaev.

Banks Push Back

In August, several banking lobby groups claimed that the GENIUS Act gives crypto companies an unfair advantage. Their argument: unlike financial institutions, firms can pay interest to stablecoin holders. This threatens to drain more than $6 trillion in deposits from banks.

Coinbase dismissed this possibility as a “myth.” The company’s policy director, Faryar Shirzad, noted that banks are merely protecting their $187 billion annual transaction fee revenue.

Back in July, Standard Chartered analysts observed that clients show more interest in stablecoins than in Bitcoin.

In September, JPMorgan experts stated that the anticipated wave of stablecoin launches in the U.S. could turn into a zero-sum game.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!