Stablecoin supply swelled by a record $45bn in three months

Bots drove most stablecoin transactions in Q3

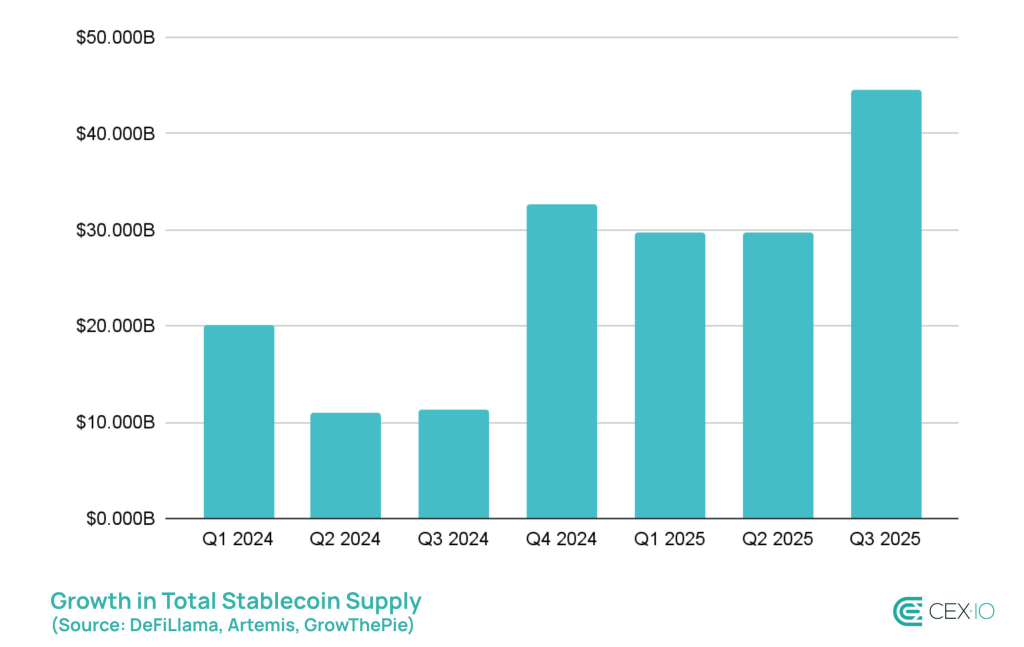

In the third quarter, the total supply of stablecoins rose by more than $45bn—the largest increase on record, according to a CEX.io report.

The aggregate tally exceeded $300bn.

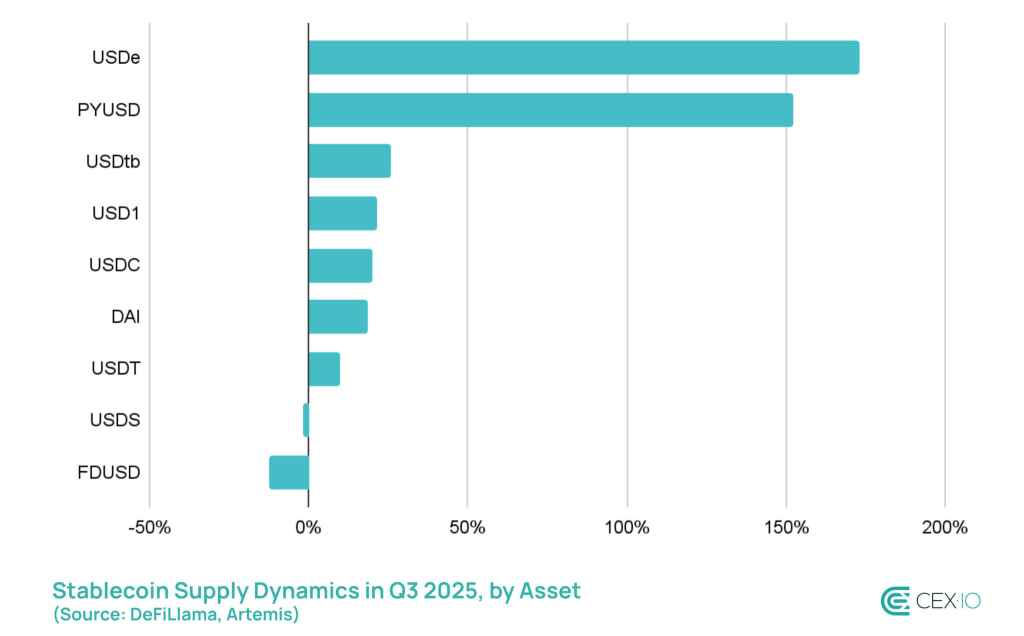

84% of net issuance over July–September came from USDT, USDC and USDe. Of that, 69% was minted on Ethereum’s main network.

By supply growth, USDe and PYUSD led (+173% and +152% respectively), despite the GENIUS Act, which bans yield-bearing stablecoins in the US.

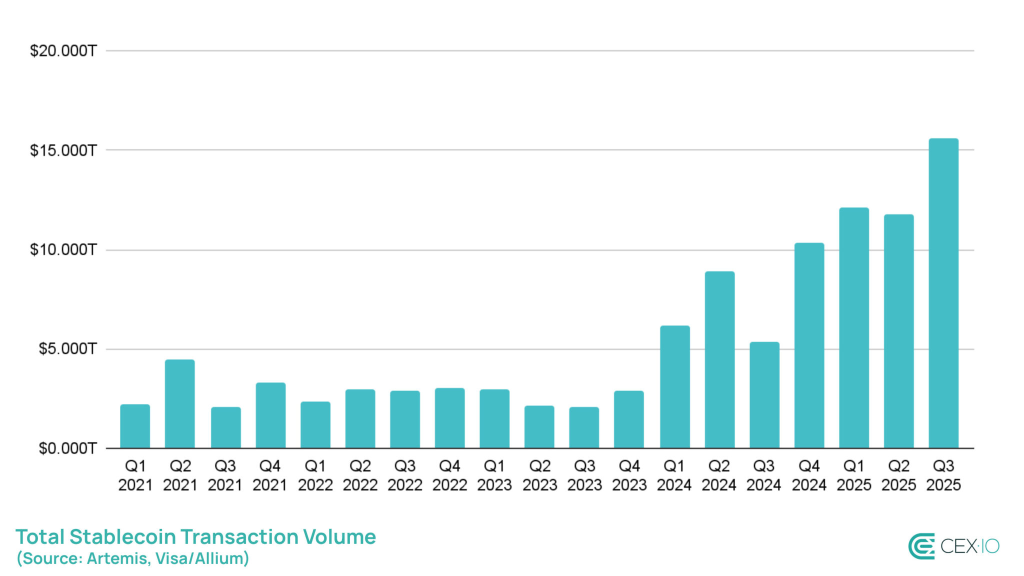

Total stablecoin trading volume in Q3 reached $10.3trn, the busiest since the first half of 2021. The daily average climbed to $124bn—more than twice June–August levels.

“Initially the rebound was driven by increased activity across broader crypto markets, but later in the same quarter stablecoins also became a key instrument for capital rotation as caution began to rise,” the report’s authors explained.

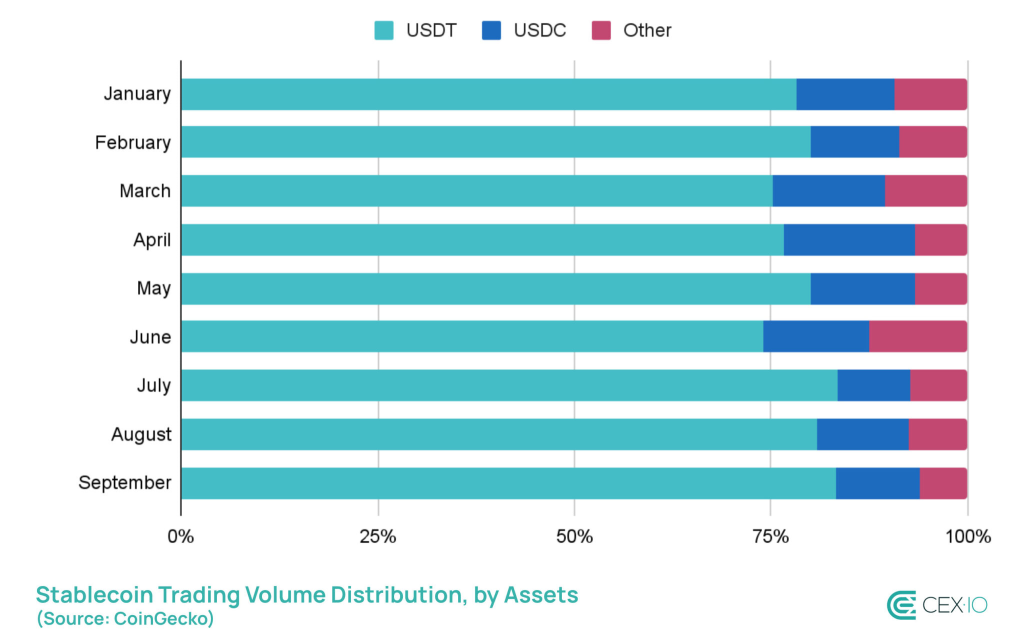

USDT strengthened its dominance by trading volume. Its quarterly share rose from 77.2% to 82.5%, while USDC’s fell from 14.5% to 10.5%. Others also lost ground.

Tether’s stablecoin overtook Circle’s by volume on DEX, surpassing $100bn in a month for the first time. This suggests USDT’s dominance is spreading to decentralised exchanges, potentially undermining USDC’s position in DeFi, CEX.io noted.

Record turnover and bots

Over the past three months, the total volume of stablecoin transactions rose to an all-time high of $15.6trn. The share of organic transfers increased by more than 30%, reaching a new record of $2.9bn.

Yet bots continue to dominate, accounting for 71% of all on-chain stablecoin transactions.

“The growth in automated transfers was most noticeable in August and remained high through September, despite some cooling of the market. The surge in bot activity and unlabelled high-frequency transactions may raise questions about the possible spread of wash trading and economically meaningless operations,” the researchers noted.

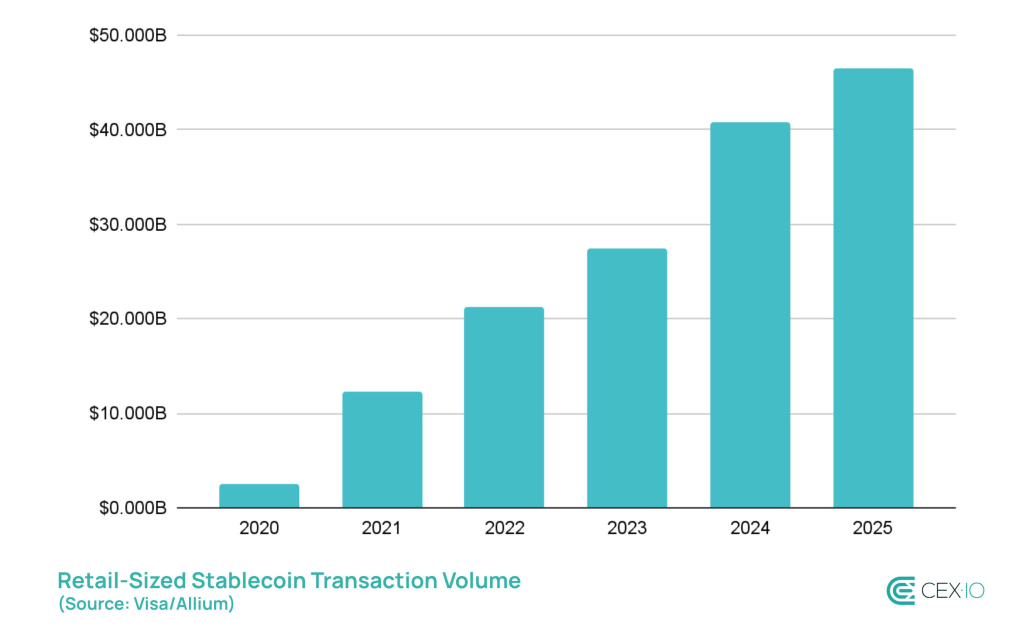

Among organic transfers, retail (transactions under $250) stood out most. The metric hit a new all-time high, helping make 2025 “the most active year in the history of retail stablecoin use”.

“The third quarter confirmed that stablecoins are no longer merely an auxiliary tool for cryptocurrency markets—they are becoming the core of settlement and even a gateway for retail adoption. Looking ahead to the fourth quarter, this dynamic is likely to persist,” the experts concluded.

In September, Moody’s analysts highlighted the risks a stablecoin boom poses to monetary sovereignty and financial stability.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!