Strategy Reports $5.91 Billion in Unrealized Losses

Strategy reported $5.91 billion in unrealized losses for the first quarter of 2025.

The losses were attributed to the decline in Bitcoin’s price amid a challenging macroeconomic environment.

From January to March, the company acquired 80,715 BTC, spending $7.66 billion. The average purchase price was $94,922, while Bitcoin’s value at the end of the quarter was below $84,000.

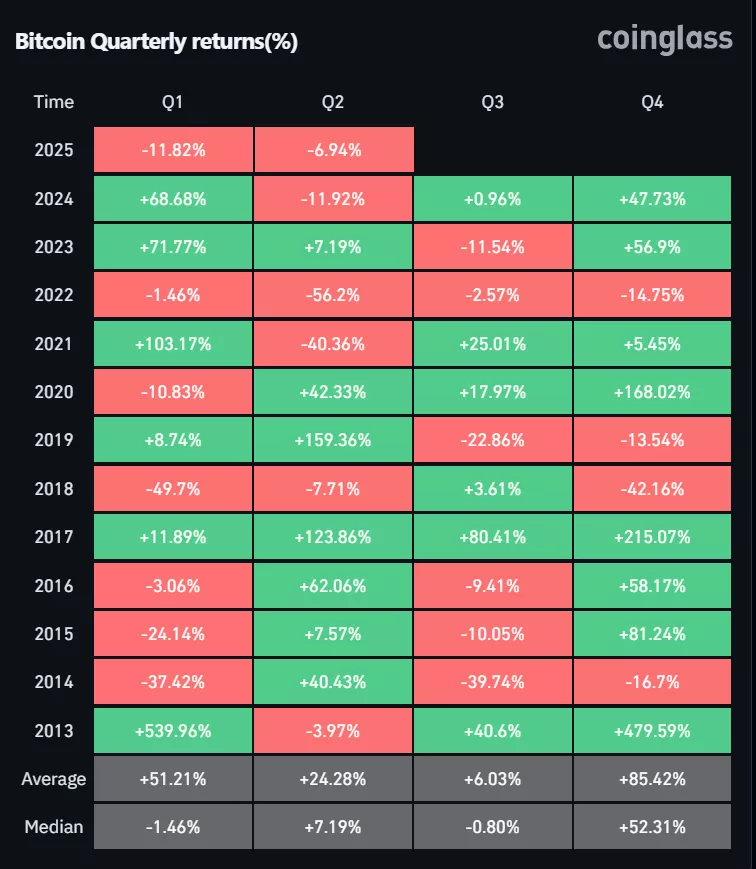

Bitcoin depreciated by 11.82% over the three months, marking the worst quarterly performance since 2018, according to Coinglass.

After March 31, Strategy did not purchase any more digital gold.

As of April 7, the company holds 528,185 BTC. The total value of its reserves exceeds $43 billion, with the volume of coins equivalent to nearly 3% of Bitcoin’s total supply.

The previous quarter ended with the addition of 22,048 BTC for $1.9 billion.

The decline in cryptocurrency and global markets following the introduction of “liberation tariffs” by U.S. President Donald Trump led to a decrease in Strategy’s asset values.

The company’s shares (MSTR) fell by more than 8% in premarket trading, according to TradingView.

Earlier, Standard Chartered described Bitcoin as a hedge against tariff risks amid increasing U.S. isolation.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!