Study finds hedge funds will raise crypto exposure to 7.2% of assets by 2026

By 2026, the share of cryptocurrencies in hedge funds’ net assets will reach 7.2%, equivalent to $312 billion at current prices. The results, from a опроса, conducted by Intertrust, the fund administrator.

The study surveyed strategists at 100 firms with assets under management averaging $7.2 billion.

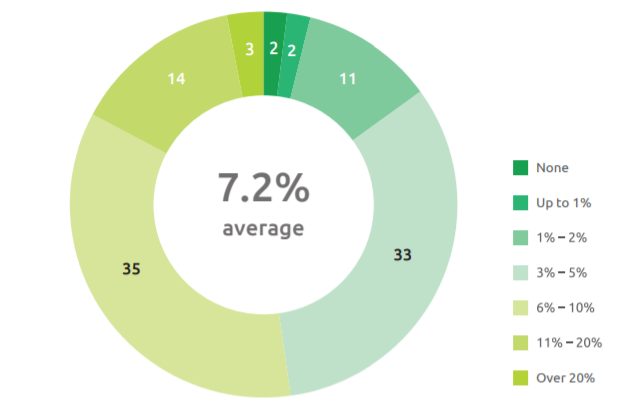

Fourteen per cent of respondents are prepared to invest more than 10% of their entrusted assets in digital assets, while 3% are willing to go beyond 20%. Only one in fifty respondents rejected the idea of investing in cryptocurrencies outright.

Geographically, North American funds are more aggressive than European ones: on average, the North American segment is prepared to lift the crypto share to 10.6%, while the European segment to 6.8%.

The researchers noted that organisations will face challenges related to secure custody and operational controls of digital assets.

According to the Financial Times, hedge funds’ current exposure to cryptocurrencies is unknown. The publication notes that price rallies and market inefficiencies that lend themselves to arbitrage have previously driven hedge funds to this asset class.

Thus, Man Group trades Bitcoin futures within its quantitative strategies division, AHL. Renaissance Technologies has allowed the possibility of investing a portion of assets from its flagship Medallion fund into the same instrument. The manager Paul Tudor Jones previously said he was prepared to allocate 5% of capital for buying Bitcoin.

Brevan Howard also in the process of transferring a portion of its assets under management into cryptocurrencies. Co-founder Alan Howard is an active supporter of the industry.

The positive momentum of Bitcoin has yielded strong returns for SkyBridge Capital. Its founder Anthony Scaramucci began actively increasing his position late last year. Just before the May crash he reduced it.

“Hedge funds are well aware not only of the risks but also of the long-term potential of cryptocurrencies,” said David Miller, managing director at Quilter Cheviot Investment Management.

There are sceptics. Paul Singer of Elliott Management, in a note to investors, wrote that Bitcoin could turn out to be ‘the greatest scam in history,’ the publication notes.

According to PwC’s latest report, 21% of AUM of $180 billion have already invested in this new class of instruments, averaging 3% of assets, and 85% of them plan to increase this exposure. Twenty-six percent do not rule out adding cryptocurrencies in the future.

Subscribe to ForkLog news on Telegram: ForkLog Feed — the full news feed, ForkLog — the most important news, infographics and opinions

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!