Tether CEO Criticises MiCA as a Threat to Stablecoins and Banking

- Paolo Ardoino criticised MiCA for its stringent rules requiring stablecoin issuers to hold at least 60% of reserves in the EU.

- The Tether CEO recalled the bankruptcy of Silicon Valley Bank, which led to the USDC depeg.

- By mid-2025, Tether will double its workforce, increasing the number of employees to 200.

The European legislative proposal MiCA poses a “systemic risk” not only to stablecoins but also to the banking system as a whole, according to Tether CEO Paolo Ardoino in a comment to Cointelegraph.

“Instead of making the system safer, MiCA creates an incredibly large systemic risk,” he stated.

On April 20, 2023, the European Parliament approved MiCA. On May 16, it was endorsed by the EU Council. The new rules for stablecoins came into force on June 30, 2024, with the rest following on December 30.

What’s Wrong with MiCA?

MiCA’s provisions impose strict restrictions on stablecoin operations across the European Economic Area, including obtaining a license and holding at least 60% of reserves in EU bank accounts.

Ardoino pointed out the vulnerability of such financial institutions, citing the collapse of Silicon Valley Bank (SVB), which led to the USDC depeg. He also highlighted that deposits in the EU are insured up to $100,000. According to the Tether CEO, this is insufficient for major issuers.

“SVB went bankrupt, we all know that, and our main competitor almost died. So, I think we have a very recent example of why this is a bad idea,” Ardoino explained.

In April, the Tether CEO stated that the company discussed potential risks for stablecoins with the regulator in connection with MiCA. He called it “not a very good idea” to hold reserves in uninsured cash deposits instead of treasury bills.

Tether to Double Workforce by 2025

Ardoino revealed in an interview with Bloomberg that Tether intends to double its workforce, increasing the staff to 200 by mid-2025 to strengthen development, investment, and compliance teams.

“I hate all these companies, especially from Silicon Valley, that hire hundreds of people during bull markets only to lay them off as soon as the market turns,” he stated.

In a comment to The Block, Ardoino added that the company currently employs just over 100 people across more than 50 countries.

“This approach allows us to optimise operations through technology and external partnerships, focusing on core competencies to provide exceptional value to our clients,” he noted.

Undisputed Leadership

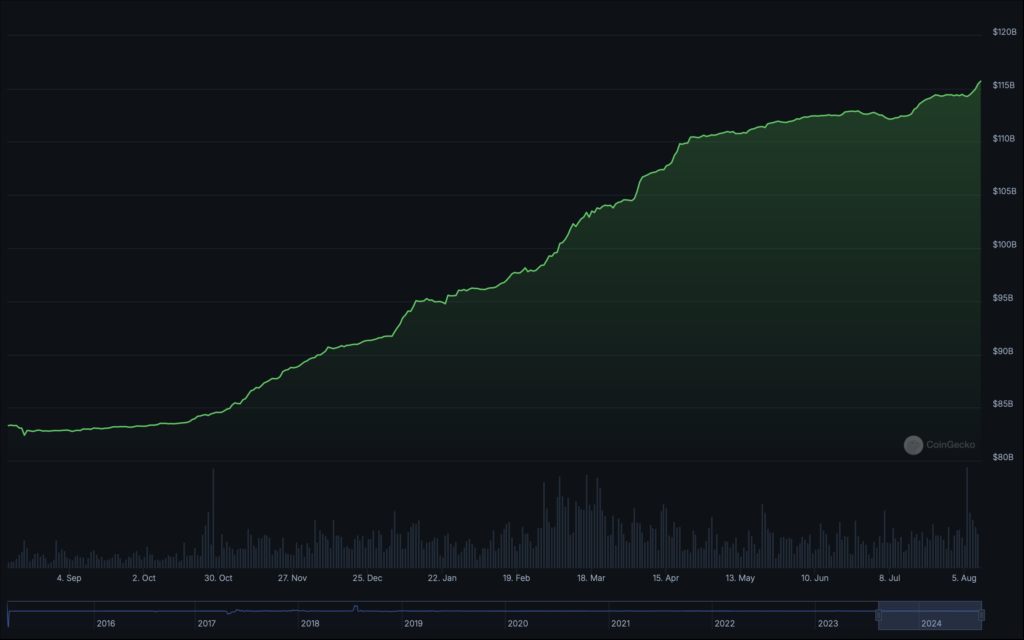

On August 8, the total market value of the stablecoin USDT exceeded $115 billion, according to CoinGecko. This figure gives Tether, the issuer, nearly a 70% share of the “stablecoin” market.

The closest competitor, USDC, has a capitalisation of $34.4 billion, which is only 21% of the total stablecoin supply.

Earlier in 2024, Tether reported a record net profit of $5.2 billion for the first half of the year.

In June, the issuer introduced the aUSDT token backed by Tether Gold (XAUT) in the “pegged assets” Alloy lineup.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!