Tether posts $700m in net profit for Q4

The issuer of the USDT stablecoin, Tether Limited, posted net profit of $700m for October–December, according to the updated attestation report.

#Tether Continues To Demonstrate Strength Of Reserves, Reveals $700m Profits For Q4/2022 In Latest Attestation Reporthttps://t.co/NlPLC3Qil9

— Tether (@Tether_to) February 9, 2023

The veracity of the figures in the document was confirmed by the accounting firm BDO.

The profit added to the company’s equity.

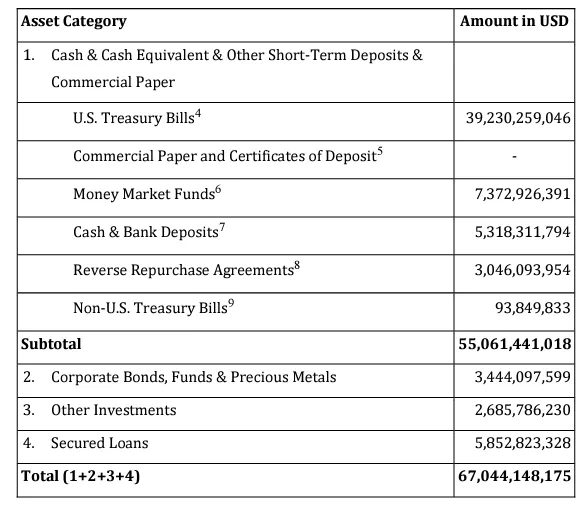

«Tether’s reserves remain highly liquid. A large portion of its investments is held in cash, cash equivalents and other short-term deposits», the report states.

As of December 31, 2022, the company’s assets stood at $67.04 billion, liabilities at $66.08 billion, and equity at $960 million.

The volume of secured loans declined by $283 million, to $5.85 billion. In December, WSJ journalists pointed to risks for the USDT issuer due to the existence of such investments linked to lending collateralized by crypto assets. Tether Limited called the journalists’ conclusions “the media’s hypocrisy, asleep at the wheel of information”.

Corporate bonds, funds and precious metals accounted for $3.44 billion, other investments — $2.68 billion.

The share of Treasury securities in assets during the latest reporting period rose from 58.1% to 58.5%. As of June end it stood at 43.5%.

The CTO of the issuer, Paolo Ardoino, noted the company’s resilience in the face of the crypto-winter, as well as direct and indirect FUD attacks.

«In 2022, Tether, as promised,zeroed out its commercial papers on the balance sheet. The firm also undertook an obligation to reduce secured loans during 2023. The process has already started», — сообщил он.

3/ In 2022, Tether, as promised, reduced to 0 commercial papers, and just before the end of the year promised a reduction of secured loans throughout 2023. The process started already.

— Paolo Ardoino ? (@paoloardoino) February 9, 2023

In September 2022, a court in New York ordered Tether Limited to provide financial documents for assessing the reserves of the stablecoin in a case of possible market manipulation.

A month later it emerged that the US Department of Justice had resumed a review of the company, according to reports.

As reported in February 2023, The Wall Street Journal disclosed the owners of Tether.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!