Tether readies $540 million in USDT for investors as Bitcoin rallies to $11,000

The issuer of the largest market-cap stablecoin, Tether, has authorised the issuance of 540 million new USDT tokens over the past seven days. This occurred amid the recent rise in Bitcoin’s price to a ten-month high.

According to Whale Alert, on July 29 Tether issued 300 million USDT on the Tron blockchain. Chief Technology Officer Paolo Ardoino explained that the issuer decided to replenish USDT reserves in anticipation of additional demand.

“This is an authorised but not issued transaction. These assets will be used to back the next period of issuance requests,” he wrote.

PSA: 300M USDt inventory replenish on Tron Network. Note this is a authorized but not issued transaction, meaning that this amount will be used as inventory for next period issuance requests.https://t.co/xw0crkzn3d

— Paolo Ardoino (@paoloardoino) July 29, 2020

On July 22 and 23, Whale Alert tracked two other USDT minting operations on the Ethereum blockchain, each for 120 million USDT.

💵 💵 💵 💵 💵 💵 💵 💵 💵 💵 120,000,000 #USDT (120,764,833 USD) minted at Tether Treasury

— Whale Alert (@whale_alert) July 22, 2020

💵 💵 💵 💵 💵 💵 💵 💵 💵 💵 120,000,000 #USDT (119,926,116 USD) minted at Tether Treasury

— Whale Alert (@whale_alert) July 23, 2020

According to сайту Tether, the aggregate size of USDT’s circulating supply stands at $10.63 billion, of which $6.28 billion has been issued on the Ethereum blockchain.

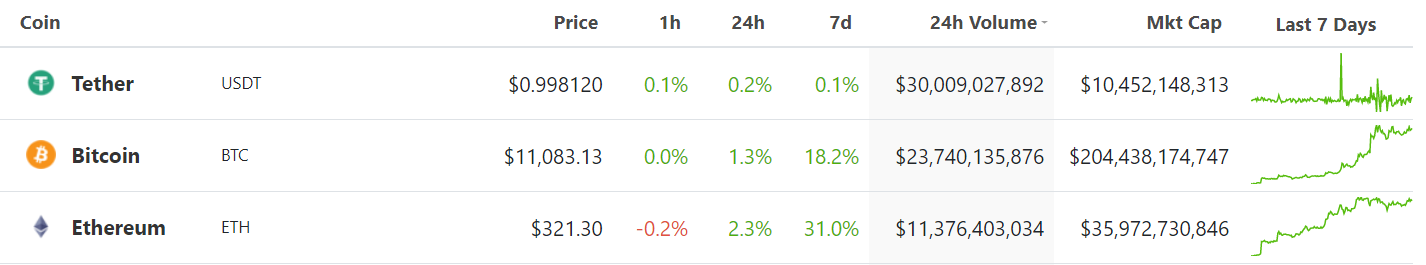

USDT has recently become the principal traded asset in the cryptocurrency market. According to CoinGecko, daily trading volume of the stablecoin exceeded $30 billion. The corresponding Bitcoin metric stood at $23.7 billion.

Earlier, Messari analyst Ryan Watkins warned of a potential loss of Bitcoin’s leadership in this metric.

As noted in June, the aggregate value transferred in stablecoins first exceeded Bitcoin’s comparable figure. The growing popularity of stablecoins has already drawn concerns from the FATF.

Subscribe to ForkLog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!