Tether Reveals 7.6 Tons of Gold Backing for XAUT

Tether announced that by the end of the second quarter, nearly 250,000 “gold” stablecoins (XAUT) were in circulation. This marks the second official attestation of the asset, launched in 2020.

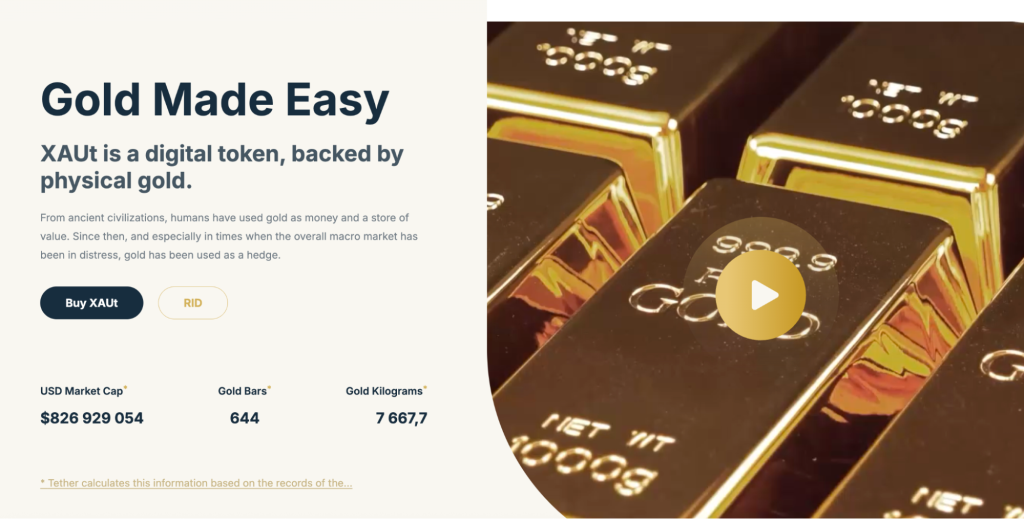

XAUT is a “stablecoin” pegged to the value of a troy ounce of London Good Delivery gold. According to the company, its market capitalization exceeded $814 million. The backing amounted to 7.6 tons, slightly less than the previous quarter’s figure of 7.7 tons.

The issuer has already sold XAUT worth $617 million. By the end of June, the company’s unrealized profit stood at $197 million.

The token is available on exchanges Kraken, KuCoin, and Bitfinex. It allows investors to access the precious metal without the need to own it physically. Holders can exchange coins for gold from Swiss vaults.

Tether noted that the popularity of the “gold” stablecoin is growing. This is supported by the strengthening price of the precious metal, which has risen by 27% since the beginning of the year. At the time of writing, gold is trading at $3354.

“Digital gold assets like XAUT are increasingly seen as an important tool for hedging investment portfolios,” the issuer stated.

Entry into the US Market

Meanwhile, preparations for entering the US market are “in full swing,” noted Tether CEO Paolo Ardoino in a Bloomberg interview on July 24. According to him, strategy details will emerge in the coming months.

The company aims to achieve foreign issuer status for “stablecoins” and obtain a reserve audit from one of the “Big Four” firms. This is necessary to comply with the recently enacted GENIUS Act in the US.

Back in June, a Tether-affiliated company, Tether Investments, acquired a 31.9% stake in the gold mining company Elemental Altus Royalties.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!