Tether Reveals USDT Holder Statistics

As of the start of the fourth quarter of 2024, there were 109 million USDT holders, more than double the number of Bitcoin holders and close to Ethereum’s 128 million. These figures were reported by Tether.

The company noted that these numbers make USDT one of the most widespread digital assets.

For their analysis, specialists used data from Chainalysis for Ethereum, TRON, Binance Smart Chain, Polygon, Optimism, Arbitrum, and Avalanche, as well as from Artemis for Solana, Base, and TON.

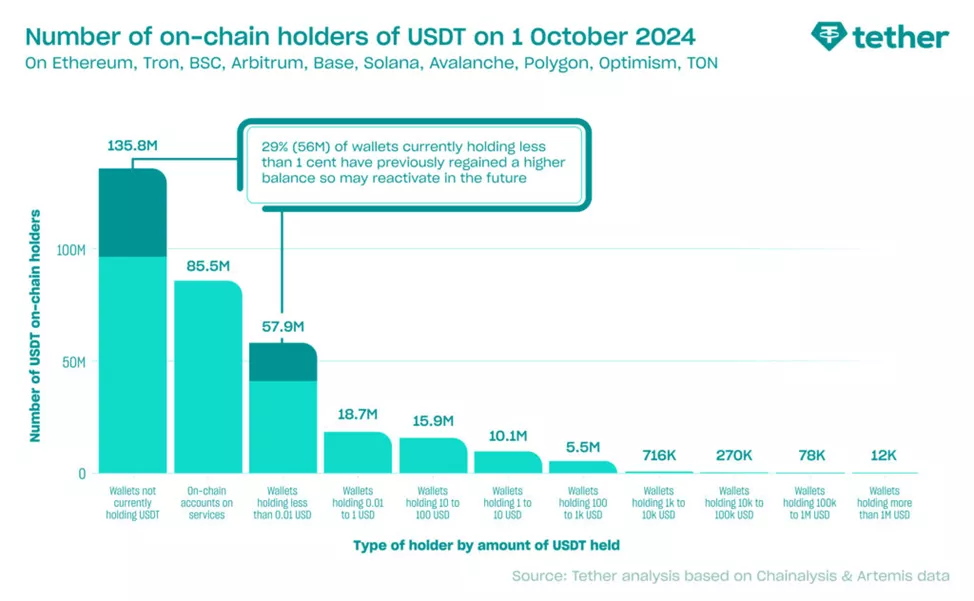

In October, the issuer reported that at the end of the third quarter, the stablecoin was used by 330 million cryptocurrency wallets and on-chain accounts.

This figure does not include several tens of millions of people who work with USDT exclusively off-chain on CEX, indicating a broader distribution of the asset, the company emphasized.

Role in Emerging Markets

There are 85.5 million accounts with Tether on 513 centralized platforms. CEXs are a core part of the ecosystem — since the beginning of the year, there have been 4.5 billion visits.

46% of this figure came from countries with emerging economies. Most buy, store, and send USDT within the platforms.

According to the issuer’s estimates, at least a third (about 109 million) of all 330 million users who have ever received Tether continue to hold it. The company believes a more realistic estimate might be 50%, considering two-thirds of the 84 million wallets that may have token remnants.

This underscores the trust and utility of the stablecoin as a store of value, the company indicated.

Users who have spent all their USDT often reactivate wallets by receiving more “stablecoins” in the future. This is particularly because they use the token for recurring payments.

This was the case for 29% of holders with a balance of less than $0.01 in Tether, indicating the potential for their continued activity.

Thus, the total number of wallets containing USDT (109 million), as well as those likely to be reactivated (56 million), reached 165 million. To this should be added several tens of millions of accounts on centralized platforms.

18.7 million wallets with balances from $0.01 to $1 in USDT highlight the importance of stablecoins for economic development, considering that 4.5 billion people, or 59%, live on less than $10 a day (World Bank data). Most tokens are used for savings.

Just over 1 million wallets hold more than $1,000 in Tether, two-thirds of them between $1,000 and $10,000.

Comparison with Competitors

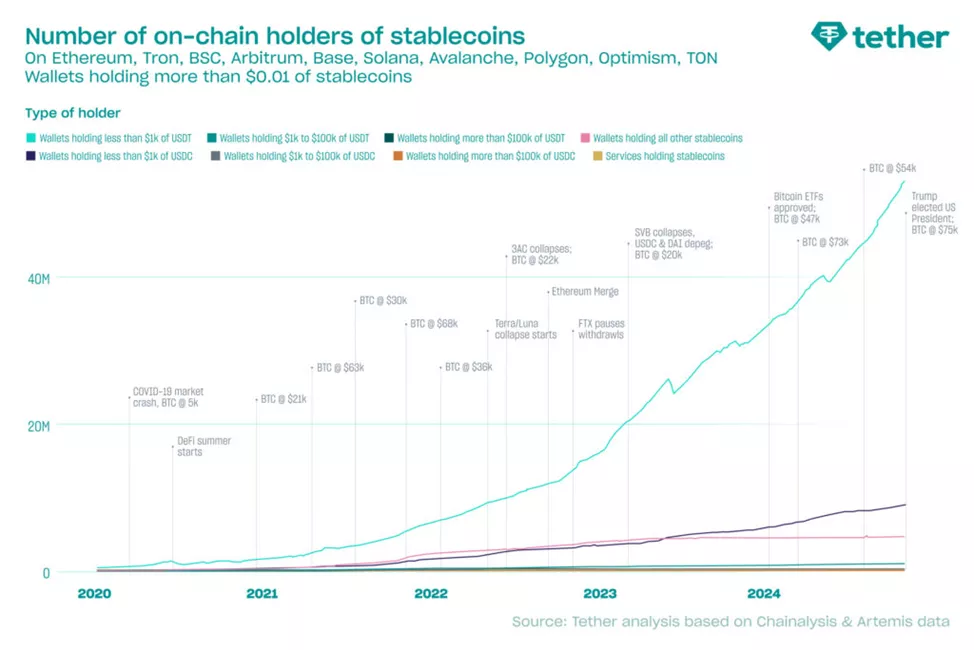

The number of wallets with non-zero USDT balances is four times greater than that of other stablecoins combined — 54 million versus 13.8 million. The sample covers 25 “stablecoins” on 10 blockchains, accounting for 97.5% of the sector’s total capitalization.

Over the past year, the number of wallets with USDT increased by 71%, whereas the previous year’s growth was 129%. Most of the increase came from addresses with balances under $1,000.

The trend intensified after the collapse of FTX, when users preferred to store their tokens themselves rather than trust centralized platforms. The pace did not slow even after the depegging of USDC and DAI during the Silicon Valley Bank collapse.

USDT is the fastest-growing stablecoin in the sector. Over the past 12 months, its number of holders increased by 20%, while for 24 other stablecoins, excluding USDC, growth was only 3%.

USDC is strengthening its position particularly on Solana and Base, where Tether accounts for more than 30% of holders.

Back in September, the consumer advocacy group Consumers’ Research accused Tether of lacking transparency regarding its US dollar reserves and compared the company to the collapsed cryptocurrency exchange FTX.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!