Tether’s Net Profit Reaches $5.2 Billion in First Half of 2024

The company behind the USDT stablecoin, Tether, reported a record net profit of $5.2 billion for the period from January to June.

According to the report, operating profit amounted to approximately $1.3 billion, primarily from interest income on US Treasury bills.

Direct investments in these instruments exceeded $80.9 billion, and including cash and other equivalents, such as indirectly through REPO transactions, reached $97.6 billion.

In this regard, Tether surpassed Germany, the UAE, and Australia, ranking 18th. In terms of US Treasuries purchases, the company ranked third after the United Kingdom and the Cayman Islands. Management sees potential for reaching leading positions, according to the press release.

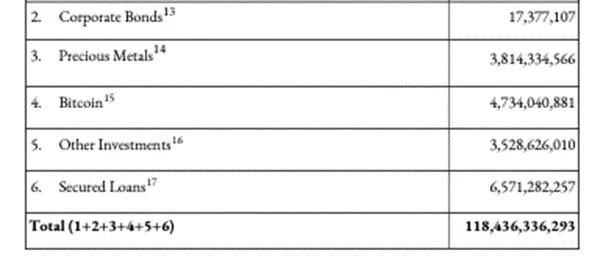

The remaining net profit of approximately $3.9 billion was derived from the appreciation of positions in Bitcoin ($4.7 billion) and gold ($3.8 billion).

Tether’s equity increased to $11.9 billion. As of March 31, the figure stood at $11.37 billion. The level of excess reserves decreased from $6.26 billion to $5.3 billion.

The company reinvested profits into strategic projects for ecosystem development in AI infrastructure, P2P communications, as well as renewable energy and mining. Their total amounted to $3.5 billion ($4.7 billion as of March 31). Tether did not disclose details.

The issuer also reported an increase in overcollateralized loans in the second quarter from $4.7 billion to $6.6 billion.

The volume of USDT issued in the second quarter rose by $8.3 billion, reaching $118.4 billion.

Earlier, Cantor Fitzgerald CEO Howard Lutnick defended Tether amid accusations of using USDT to finance illegal activities. The financial group holds the backing for its stablecoin.

In June, the issuer introduced the aUSDT token backed by Tether Gold (XAUT) in the Alloy “pegged assets” lineup.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!