The Buterin effect: how meme tokens are refreshing the DAO idea

After a burst of innovation, crypto appears to be in an ideas slump. The impasse has spawned narratives out of thin air that will, sooner or later, peter out. What comes after memecoins?

Oleg Cash Coin takes a closer look.

Hype cycles

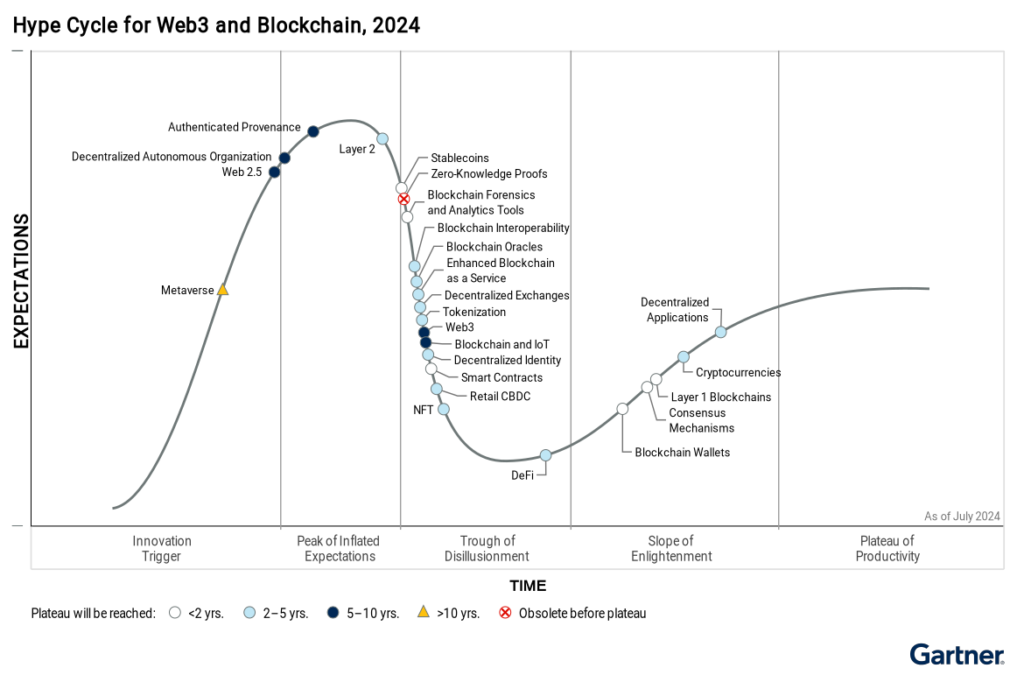

To make sense of the moment, consider Gartner, an American research and consulting firm focused on information-technology markets. It periodically publishes its flagship “hype cycle” report. In the summer of 2024 the firm issued an update on blockchain and Web3 trends.

Gartner’s model charts the path of new technology trends from birth (the steep rise on the left), through a peak, a trough, a modest incline and, finally, a plateau of productivity (on the right). Any durable technology, the model holds, must traverse this S-shaped arc from start to finish.

The firm has tracked crypto for almost a decade, but 2024 is the first year its analysts saw no genuinely fresh innovations in the field. In their view, only a handful of older trends sit near peak hype: L2 solutions, stablecoins, DAOs, provenance, and Web 2.5.

The last of these is usually taken to mean a bridge between Web2 and Web3, covering infrastructure built for the “new internet”. Telegram provides a telling example, integrating blockchain features into its messenger app.

Most other trends have ebbed, and no longer stir much excitement—something obvious even without professional analysis. Legacy projects jostle for position within their niches, while launching new ones is harder amid intense competition and limited liquidity. In that vacuum a fresh look at memecoins has emerged.

Birth of a trend

It suddenly became clear that one could attract an audience with minimal effort by selling the very urge to make money, rather than finished products like blockchain networks or apps.

No promises, no accountability, nothing typical of investment activity—just the desire for a quick return. That, in effect, is today’s product.

However utopian it seems, this tendency could spawn a distinctive market with novel forms of community, whose tokens are backed by deeds or, say, an idea.

It resembles MicroStrategy’s approach: buying bitcoin for its balance sheet, educating institutions and tirelessly promoting the first cryptocurrency and the HODL creed. That buoys its share price, yet is not tied to the firm’s operating success.

A new metric even emerged—“bitcoin per share”. Public companies far removed from crypto have started acquiring digital gold. For instance, American firm Semler Scientific, which makes products for managing chronic diseases, holds 1,012 BTC on its balance sheet.

Canadian miner Cathedra, in a letter to clients, went further, saying a bitcoin accumulation strategy is far more effective than mining and announcing a pause in expanding production.

This strategy can be described as boosting one’s own value by funding a third-party brand—in this case bitcoin—rather than improving one’s own operations.

The “Buterin effect”

A similar shift in how value is created is visible in crypto. One example—so far unsuccessful—was Friend.Tech, which let users of its social network trade “shares” of accounts. Popularity itself, the pitch went, could be sold in tokenised form.

An even bolder experiment is to create or augment value through “good intentions”, championed by Vitalik Buterin, who sells almost all liquid meme tokens and sends the proceeds to charity, thereby drawing liquidity and attention to the tokens.

“Although I would prefer that you guys send the money directly. Maybe even create a DAO and involve your community in the decision-making and process,” the Ethereum founder commented on another token sale.

Buterin’s post on the episode sent one memecoin up nearly 20-fold.

It is plausible, then, that the rush to buy anything with a ticker will give way to new forms of DAO—or satellite communities—built around brands or a culture of action.

Perhaps there is no longer a need to build new “physical” products; it may be enough to harness the “desire to move money” in support of existing infrastructure.

How is a DAO, dedicated to buying, say, bitcoin with revenues from trading a memecoin, worse than MicroStrategy’s shares? To make it work, there is no need for intricate corporate linkages, a team of specialists or a downtown office.

Back to Gartner

Such DAOs fit neatly into Gartner’s cycle, in which decentralised communities have yet to reach the initial sheer peak, with a time to the productivity plateau of five to ten years. That suggests a serious trend toward users banding together by interest and goal over the coming decade.

This could mean co-investing in projects or ideas capable of nudging individual capital into motion. Note, too, that launching a DAO does not require smart contracts with a governance token—only distributed control.

The first cryptocurrency has no governance token, yet it is a bona fide decentralised autonomous organisation, steered by multiple independent stakeholder groups.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!