The Great Chinese Migration: Will Russia Become a Haven for Bitcoin Miners from China?

Bitcoin criticism and calls to combat cryptocurrency mining by Chinese authorities and state media have forced local mining companies to rethink their jurisdiction.

Among the possible relocation options, miners from China are considering North America and Central Asia, and are also looking at Russia.

ForkLog spoke to experts about how likely relocation from China to Russia is and what attracts miners.

- In Russia, crypto mining-related companies from China are attracted by the availability of platforms to host equipment and relatively cheap electricity.

- Mass migration of Chinese miners to Russia has not yet occurred, and overall the business is taking a wait-and-see stance.

- Experts say that at this stage no country can quickly provide everything needed to relocate a large number of devices from China.

China’s long struggle with Bitcoin

Interest from Chinese mining operations in relocating has persisted for years due to concerns about the authorities’ rhetoric.

While ruling circles in China consistently support blockchain and actively develop the digital yuan, attitudes toward the crypto industry are quite different. As far back as 2017 the central bank issued an order prohibiting initial coin offerings (ICOs), and local media in 2018 wrote about the fight against cryptocurrency trading.

Occasionally there are proposals to ban mining. In March 2021, the authorities of Inner Mongolia restricted cryptocurrency mining, and in April the State Council’s vice-premier Liu He stated the need to fight mining.

In May, the Reform and Development Commission of Inner Mongolia created a platform, where residents will be able to report observed cryptocurrency mining activity, and presented a list of measures to combat illegal mining.

In June the authorities of Xinjiang required residents of one of the largest mining hubs to cease operations. Miners in Qinghai Province were also ordered to suspend activity.

Experts assume that in the near future the Supreme People’s Court will extend criminal law to mining and speculation of digital assets.

Against these developments, crypto mining-related business began seeking other jurisdictions.

“I think Chinese miners do not harbour illusions and do not expect the government to slow things down,” said ForkLog, a representative of BitRiver data-centre operator Roman Zabuga.

According to him, local companies are actively seeking platforms to host mining equipment and are ready to ‘fill any region that offers them sites’.

Such a region could be Russia, too.

What attracts Chinese miners to Russia?

Experts interviewed by ForkLog confirmed Chinese miners’ interest in Russia.

“Interest is being recorded. There are requests from absolutely everyone,” said Roman Zabuga of BitRiver.

Yevgeny Zolotoy, director of 51ASIC, spoke about incoming requests to place equipment in Russia. He noted that one attracting factor for Chinese miners is the established logistics between the two countries, which makes delivery and deployment “not raise questions.”

A BitRiver representative said that Russia could be a priority jurisdiction, because “simply geographically closer,” as is Kazakhstan, to which Chinese miners are also showing interest.

Moreover, Chinese companies are attracted by the relatively low price of electricity in Russia.

According to LAZM co-founder Roman Nekrasov, miners “look for places where they will be guaranteed electricity, not ‘unplugged from the socket’ in case of shortage, and where tariffs are comparable or lower than those offered in mainland China”:

“There are few such places, so if a miner wants to operate legally, relocation options are not many.”

BitRiver says electricity is one of the defining factors for Chinese miners.

“Russia has surplus electricity. Moreover, it can be considered ‘green’. I don’t know how important this is for the Chinese, but for European, American, Japanese investors it is very important,” said Roman Zabuga.

The regions most popular with miners in Russia are those with hydroelectric stations and, accordingly, lower electricity costs, or regions with stations whose capacities are not fully utilized, says LAZM co-founder Roman Nekrasov.

He emphasised that cheap electricity does not always pay off, as specialists working in data centres and other infrastructure are needed.

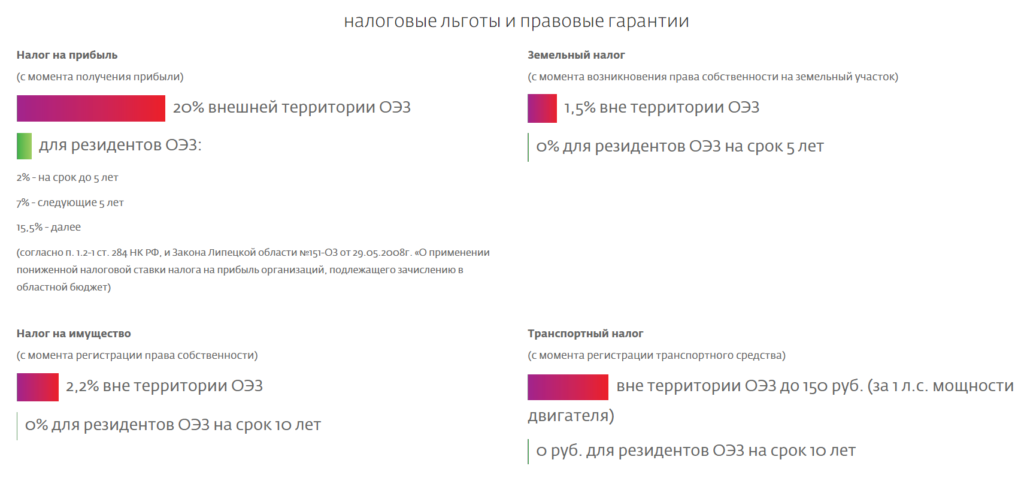

According to Nekrasov, one region potentially meeting all these needs is the Lipetsk Special Economic Zone:

“In it, besides favourable electricity tariffs, there are tax and customs incentives, there is support from local regional authorities — all this together yields a tangible effect on mining costs.”

LAZM said the average electricity price for 100% operation of equipment is 4–4.5 rubles per kWh. At 65% operation, the price ranges from 2.35 to 2.9 rubles. This also includes placement, maintenance, repair, and VAT.

A BitRiver representative noted that miners are not looking at specific regions; they are looking at companies and their terms, though they traditionally focus on Siberia.

The data-centre energy price including VAT for mining data-centres in Irkutsk Oblast is about 2.9 rubles per kWh, says Sergei Mayorov, executive director of the energy-supply company Faraday.

Prices could be even lower thanks to high voltage and miners’ consumption, Zabuga noted.

“There are fewer losses in transmission, in other words, logistics are more efficient,”

However, electricity costs in Russia are far from the only factor for Chinese miners, Nekrasov says.

According to him, from this perspective it is advantageous to continue operating in China—in regions with many hydroelectric plants such as Sichuan:

“If miners are fleeing China, it is not because electricity is expensive, but due to unfriendly actions by authorities and uncertainty whether their operations will reliably receive electricity.”

The primary consideration in migration for Chinese companies is the availability of large sites to host devices, experts noted.

Russia has such platforms, but it is unlikely to fully satisfy Chinese miners’ needs immediately.

“There is currently a shortage of hosting spaces, and it will only worsen,” Zabuga says.

According to him, Chinese miners “will go where they can place” devices:

“The Americans have bought a lot of new equipment; they are not ready to take old equipment from China. No region in the world can immediately accommodate these hundreds of thousands of devices.”

He noted that another problem could be a “shortage of workers”:

“No data centre has enough people to install hundreds of thousands of devices at once. This could drag on for two to three months just to install, not to mention moving the equipment. Even if miners find sites, the whole process will drag on plus or minus six months.”

The co-founder of LAZM says the process was also hampered by the pandemic.

“It is not as easy or fast to move into Russia or Kazakhstan now, let alone to transport equipment and staff here,” Nekrasov said.

BitRiver noted that in the future sites may raise deployment requirements and will prioritise large investors with substantial capacities.

Another advantage for Russia for Chinese miners could be the absence of a legislative ban on mining at this stage.

“There is no special regulation of mining in the Russian Federation. The good news is that it is not banned, although such ideas did appear at certain stages of discussions of sectoral legislation,” said ForkLog lawyer and Moscow Digital School expert Yefim Kazantsev.

He noted that if amendments to the digital currency are adopted into the Tax Code, miners, as its owners, “will have to comply with the new provisions concerning notifying the tax authorities about the possession of digital currency and deals made with it in the reporting year.”

The bill was passed in the first reading, but since then has stalled in discussions due to “issues with substantive categories”.

The regulatory and tax picture for computing centres in Russia is unclear and could slow Chinese miners, Nekrasov said.

Not more than interest?

Although Chinese miners are studying other jurisdictions and are eyeing Russia, there has not yet been mass migration to Russia.

“I haven’t seen Chinese miners massively relocating their operations to Russia, although there are indeed decent hosting options here,” Nekrasov said.

Yevgeny Zolotoy, director of 51ASIC, suggested that a deterrent could be “the poor political and economic climate that could deter even friendly foreign partners.”

Roman Zabuga of BitRiver noted that Chinese mining companies could “satisfy the needs of all data centres oriented to mining.”

“The Chinese with their equipment will flood somewhere. Where they will flood to is unclear — the market is not ready to take them, no one has such capacities.”

All in all, it seems business leaders are surveying all jurisdictions for possible migration but are not taking bold steps yet.

Nekrasov believes that for now, despite government rhetoric, “the majority of Chinese miners will remain in their provinces”:

“Perhaps there will be some churn between different Chinese provinces, but there is no mass exodus of mining enterprises from China yet. China still holds the largest share of the mining market.”

Read ForkLog’s bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!