The Merge: Will Ethereum’s large-scale upgrade reboot the market?

Ethereum’s price recently rose above the $2,000 level for the first time since May. The rally followed the successful Goerli testnet transition to Proof-of-Stake (PoS) and the tentative merge date moved on the mainnet from September 19 to September 15–16.

As The Merge approaches, discussions in the community reignite about the likely price trajectory of the second-largest cryptocurrency by market cap, the viability of a potential ETHW fork, and the prospects for Ethereum Classic.

- The potential impact of The Merge on the market is significant. However predicting its consequences in the coming weeks and months after the upgrade is quite difficult.

- In the medium to long term, the price of Ethereum is likely to rise, aided by deflation and the gradual improvement of the system.

- The future of Ethereum Classic and the potential ETHW fork is hazy — the projects lack broad community support.

- Ethereum-based tokens are unlikely to hold value on the ETHPoW network. The DeFi ecosystem on Ethereum Classic is underdeveloped.

Should investors expect Ethereum to rally after the upgrade?

A number of metrics signal growing market interest in Ethereum ahead of the most important and complex upgrade in cryptocurrency history.

For example, the number of coins staked in the consensus layer (ETH2) continues to rise confidently.

The metric surpassed 13.3 million ETH: in July it rose 1.9%, and since the start of the year — 50%.

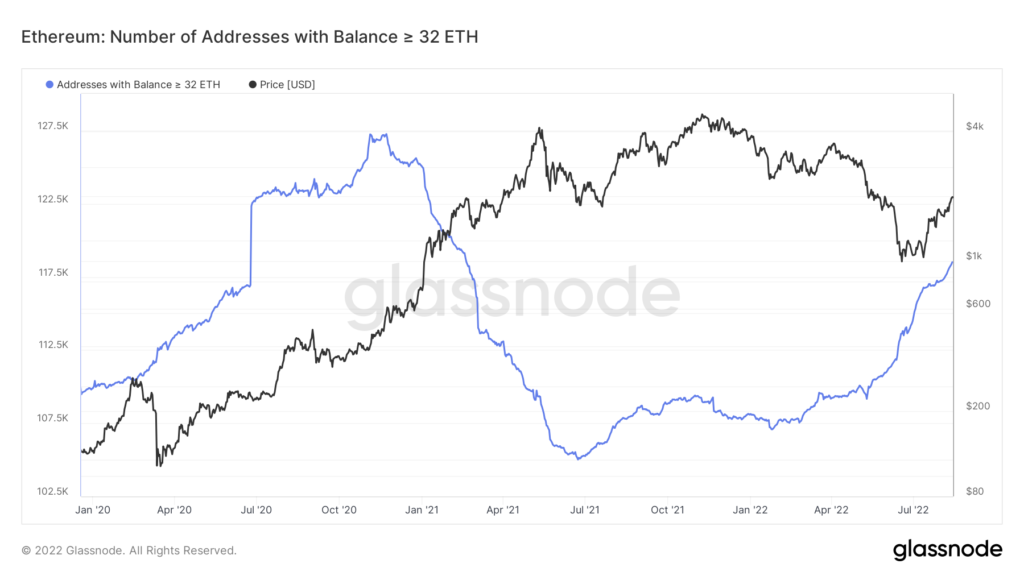

A year ago, the trend of Ethereum 2.0 addresses with balances of ≥ 32 ETH resumed; in May 2022 the growth accelerated significantly.

This points to a strong market interest in staking.

Activity is also rising in the derivatives market. By the end of July, open interest (OI) in Ethereum options first surpassed Bitcoin contracts in historical terms the equivalent Bitcoin contracts.

By mid-August, OI reached a new record at $8 billion.

«September futures and options markets are in backwardation. This suggests that traders expect The Merge, to “buy the rumor and sell the news,” taking corresponding positions», — researchers noted.

“From a technical standpoint, this fork would not affect the current version of Ethereum, i.e., the updated ETH2 network,” analysts at CoinShares said.

«This does not mean exchanges will refuse to list ETHPoW if/when this fork appears», — CoinShares researcher Mark Arjun commented.

«In his view, many will sell the coins earned from the fork for the updated Ethereum.»

DeFi enthusiast going by the handle olimpio noted that forks like Bitcoin Cash and Bitcoin Gold trade far below digital gold.

1/13

If you were here for BCH/BTG Bitcoin forks, then you know these were amongst the first airdrops in history 🪂

Now:

Bitcoin Cash (BCH) — Mkt cap: 2B. Price: $140

Bitcoin Gold (BTG) — Mkt cap: 500M. Price: $30BTC price: $24,000

BCH, BTG and BTC have the same supply, 21M pic.twitter.com/v63fCNSzWF

— olimpio ⚡️ (@OlimpioCrypto) August 10, 2022

According to him, miners will try to keep the new coin afloat for short-term profit before selling their gear.

2/13

When the merge happens and ETH transitions to POS, there will be two chains. POW and POS.

Miners will try and get the last breath of value before selling their hardware:

They will keep the POW Ethereum alive, effectively hard-forking the blockchain.

— olimpio ⚡️ (@OlimpioCrypto) August 10, 2022

olimpio noted that after the fork, assets in wallets, NFTs, as well as positions in lending and AMM protocols would be duplicated on the PoW chain.

«In other words, ETHPoW would effectively be a fork of the chain from the moment London activated», — Twitter user zhijie commented.

Besides ETC Cooperative, CoinShares experts questioned the viability of the PoW fork. They argued that:

- the current chain has much more social support;

- stablecoin issuers will almost certainly remain with ETH2 for reputational and regulatory reasons;

- wrapped tokens like WBTC and RenBTC would lose value on the alternate chain since they cannot be redeemed for the underlying asset;

- in the ETHPoW scenario, staking tokens and rewards would become non-recoverable, making proper distribution difficult.

«From a technical standpoint, this fork would not affect the current version of Ethereum, i.e., the updated ETH2 network», — CoinShares analysts said.

They allowed for some price volatility in the future, excluding “direct on-chain risks”.

«This does not mean exchanges will refrain from listing ETHPoW if/when this fork appears», — CoinShares researcher Mark Arjun commented.

In his view, many will sell the forked coins as a bet on the upgraded Ethereum.

DeFi enthusiast olimpio noted that forks like Bitcoin Cash and Bitcoin Gold trade far below digital gold.

7/13

In the first minutes of the fork, everyone will want ETHPoW. Price might even briefly surpass ETH

Everyone will:

• dump everything they got for ETHPoW

• send ETHPoW to one of the supporting CEXes

• lastly, trade it for other assets, like ETH.Airdrop money for bots! 🪂

— olimpio ⚡️ (@OlimpioCrypto) August 10, 2022

In closing the thread, olimpio stressed that he supports PoS and decentralization. He also said he would try to “merge” ETHW at the earliest opportunity.

What will happen to Ethereum Classic’s price?

Analysts at JPMorgan concluded that Ethereum’s shift to PoS will push miners to seek alternative sources of income.

They believe switching GPUs to altcoins such as Ethereum Classic, Ravencoin or Ergo will yield meaningful profits only in the short term. A sudden influx of major players into altcoin ecosystems could sharply reduce mining profitability.

Yet, JPMorgan argues that among the main beneficiaries of the upgrade will be Ethereum Classic miners. They will gain access to a “multitude of devices for mining this cryptocurrency.”

«Some investors also view Ethereum Classic as a hedge against any potential problems with Ethereum during the PoW-to-PoS transition», — the report notes.

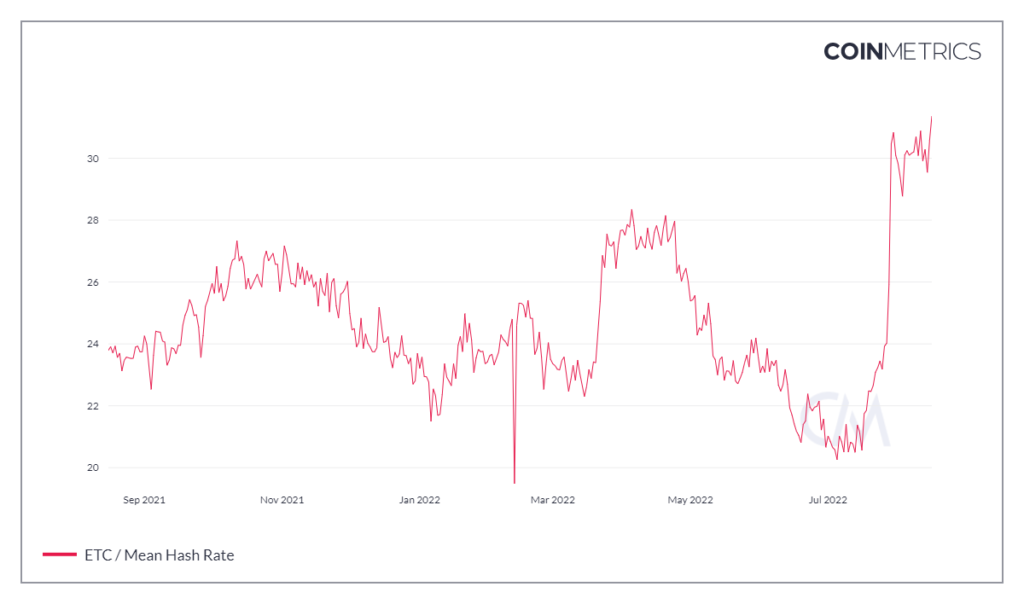

Miners appear to be already pivoting toward Ethereum Classic. The evidence lies in the rising hashrate of the cryptocurrency — up almost 50% since mid-July.

However, Ethereum’s hashrate remains roughly 30 times higher than Ethereum Classic’s — about 900 TH/s versus around 31 TH/s.

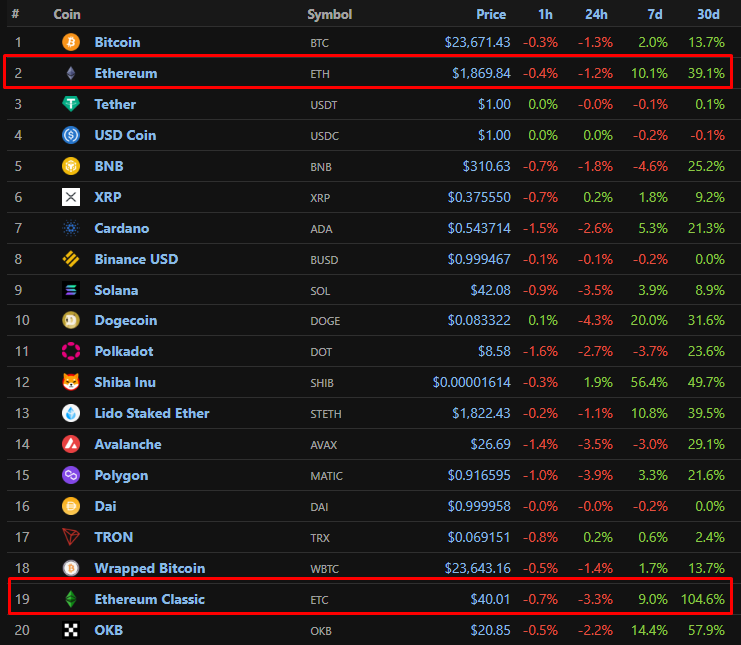

During that period, ETC’s price rose by 104.6%, while ETH rose by only 39.1%.

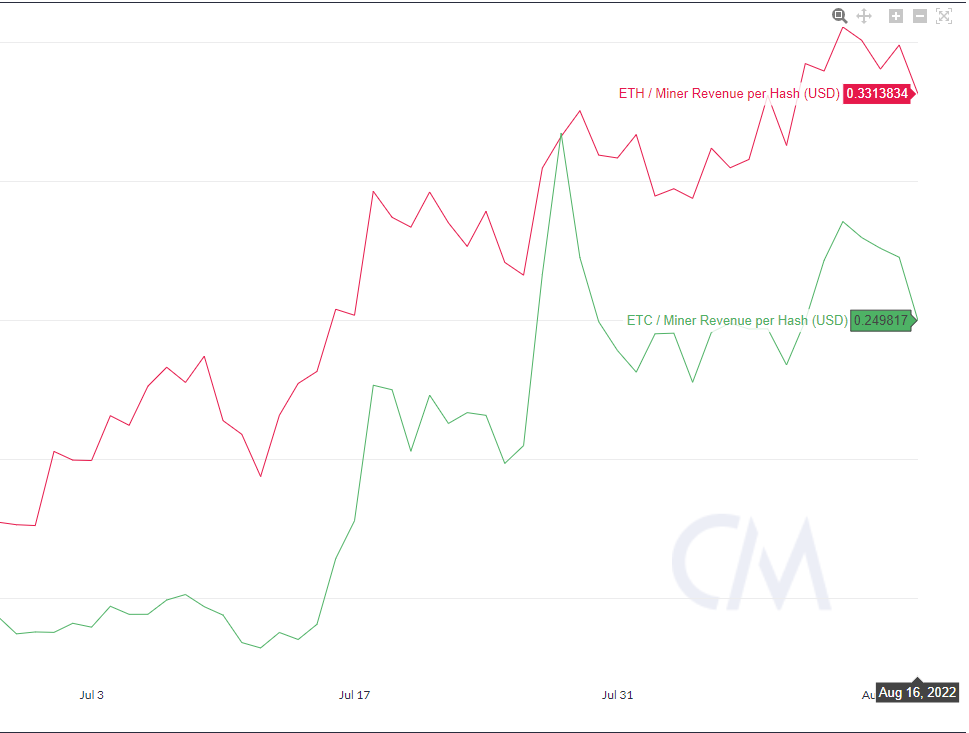

Nevertheless, ETH’s hashprice remains more than 20% higher. Put differently, the second-largest cryptocurrency is still more profitable to mine than Ethereum Classic, despite ETC’s rapid rise.

Huobi Research analysts suggested that future potential forks may have a hashprice comparable to ETC.

«In that case, miners would very likely accept these tokens as an alternative», — the experts noted.

They say that even with The Merge, miners remain influential. One possible path is to shift to GPUs-based chains where token mining is possible: ETC, ERG, RVN, CFX, FLUX, FIRO, etc.

«Among the coins listed above, ETC has the largest hashrate and market cap, and the best compatibility with Ethereum», — Huobi Research noted.

They believe a sizable portion of hashrate could migrate to Ethereum Classic, which would, they say, bolster confidence in the ecosystem.

«If the ecosystem’s development keeps pace with hashrate growth, the price could rise», — the researchers hypothesized.

According to their calculations, migrating just 3% of Ethereum’s hashrate could double Ethereum Classic’s hashrate. That would halve miners’ revenues by 50%.

«It’s unclear whether the pace of ecosystem development and innovation can keep up with price growth. If ETC can seize 10% of ETH’s hashrate, ETC’s price could potentially be four times higher than now ($148 vs $37 today)», — Huobi Research researchers noted.

As of now, Ethereum’s ecosystem remains vastly more developed than Ethereum Classic’s. The latter hosts a handful of decentralized apps with a total TVL of about $1 million, while the Ethereum ecosystem features numerous DeFi platforms with a combined TVL of around $65 billion (DeFi Llama data as of 17.08.2022).

Conclusions

The forthcoming Ethereum upgrade is important and anticipated, but it does not solve scalability by itself. It will lay the groundwork for a sequence of future upgrades and improvements. A long, winding path lies ahead.

ETH’s current price rise has a speculative component. The uptrend is driven largely by investor optimism and broader market revival, aided by the likely end of the bear cycle. Given Ethereum’s historically high correlation with Bitcoin, one can expect the two assets to continue moving in tandem.

On the other hand, the new issuance of Ethereum will fall enormously compared with today. This suggests a gradual price rise in the medium- to short-term. Much also depends on on-chain activity, DeFi ecosystem development, and the success of developers in delivering The Surge, The Verge, The Purge and The Splurge.

The prospects for the ETHW fork remain hazy given the lack of broad community support. If it materialises at all, it is likely to be short-lived. For instance, Bitcoin Cash initially showed speculative growth and looked attractive to miners, but never became Bitcoin’s killer.

Long-term prospects for Ethereum Classic also appear bleak, given the underdeveloped DeFi ecosystem. Its level of on-chain activity, transaction demand, and ultimately price depend on that ecosystem’s vitality.

Only time will tell how accurate these hypotheses and forecasts prove to be. In any case, there are many interesting events ahead.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!