The Mining Industry in 2023: Preparing for the Halving and Its Implications

The United States and public companies have increased their share in Bitcoin’s hashrate, leading manufacturers have released new generations of miners, and cryptocurrency miners are increasingly focused on the upcoming halving.

Reflecting on what else marked the year 2023 in the industry.

- The United States strengthened its leadership in hashrate share.

- Miners improved their balance sheets and focused on enhancing the efficiency of their equipment ahead of the halving.

- Bitmain, MicroBT, and Canaan released new lines of cryptocurrency mining devices.

- The geography of global mining centers began to expand.

The US Strengthens Hashrate Leadership, but Foundry USA Loses Top Spot

On November 25, Bitcoin’s global hashrate, according to Glassnode, reached a peak of 507.14 EH/s (smoothed by a 7-day moving average). At the time of writing, the metric adjusted to 472 EH/s.

The value steadily increased throughout the year, adding over 97% on its way to a record high.

The Cambridge Centre for Alternative Finance (CCAF) has not updated the map of the distribution of the first cryptocurrency’s computing power by country for nearly two years.

In November, MinerMetrics specialists presented their calculations of global hashrate distribution. They acknowledged using a different methodology from CCAF.

During this period, the US further increased its leadership, raising its share from 37.8% to ~40%. China continues to hold the second position with ~15% (previously 21.1%). Russia returned to the top three: ~12% compared to 4.7% two years ago, according to CCAF.

According to MinerMetrics, these three countries account for 67% of the global hashrate. The United States and Canada (5% of the total) ensure North America’s lead among continents with a figure of 45.6%. Asia is close behind at 41.1%. Besides China and Russia, Kazakhstan (3.5%), the UAE (3%), and Malaysia (3%) stand out in the region for their share in Bitcoin mining capacities.

Europe is significantly lagging behind the leading duo with a figure of 7.7%. The main mining centers are Norway (1.5% of global hashrate), Sweden (0.9%), and the island of Iceland (0.6%).

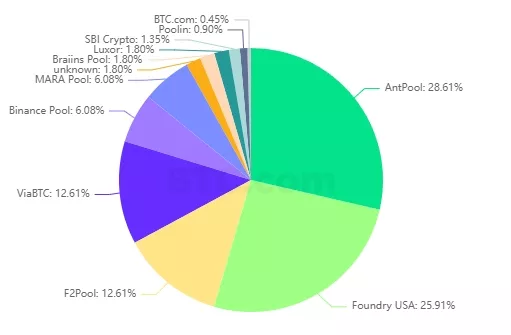

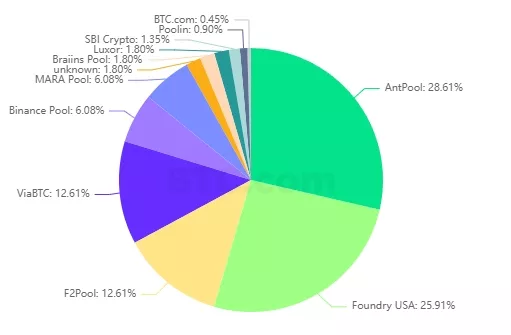

In November, Bitmain’s mining pool Antpool surpassed Foundry USA in computing power, which had led for about the last two years. The narrowing of the lead began in the summer when, according to TheMinerMag, the largest miner manufacturer shipped a significant batch of Antminer S19XP and S19XP Hydro devices to its subsidiary.

Foundry USA’s parent company, Digital Currency Group, spent the year trying to resolve financial issues related to its bankrupt subsidiary Genesis Global.

Moreover, the pool mainly comprises American public mining firms, whose growth in Bitcoin’s hashrate share did not meet expectations. In October 2022, the figure reached 25%, and Hashrate Index specialists anticipated up to 40% by the summer of this year. However, according to Bloomberg, the figure was 28% in October.

According to @hashindex, public miners are 28% of #Bitcoin‘s global hashrate.

The industry is evolving, with public co’s and nation-states now integrally involved. This presents opportunities & challenges to the network.

1/ pic.twitter.com/S6bFNTknMO— Jamie Coutts CMT (@Jamie1Coutts) September 27, 2023

Public Miners Slow Growth. For How Long?

Amid the previous Bitcoin peak in autumn 2021, this industry segment experienced a significant capital influx. The status of public companies facilitated financing, allowing them to purchase large batches of cryptocurrency mining equipment.

The bear market of 2022, which hit revenues, led to difficulties in servicing accumulated loans. Bloomberg estimated the total risk at $4 billion.

For public companies, key trends included reducing debt and cutting operating expenses. In 2023, this became particularly important in light of the approaching halving and increased competition amid rising hashrate.

As a result, for example, Core Scientific, which filed for creditor protection in December 2022, eliminated $563 million in debt. The second-largest American miner by hashrate reduced its debt-to-equity ratio from 2.12 to 1.58.

This week, Core Scientific announced that it’s on track emerge from its Chapter 11 bankruptcy by the end of the year.

For today’s newsletter, we break down how the company shed $568 million of debt to come back from the brink ?https://t.co/4duofqeF5C pic.twitter.com/HFrpSh8C2S

— Hashrate Index ?⛏️ (@hashrateindex) November 2, 2023

Marathon Digital Holdings, the segment leader in capitalization and computing power, for the first time achieved a surplus of reserves in fiat and Bitcoin over debt — $388 million versus $325 million (0.84). One of the most efficient Canadian companies by this measure, Bitfarms, had a ratio of 0.17.

Throughout the year, hashprice was mainly near or below levels around $80 per PH/s per day, according to Hashrate Index. In May and November, there were spikes in the indicator due to increased fee income related to activity in the Ordinals and BRC-20 token markets. By the end of the year, profitability rose somewhat with the price climbing above $40,000.

According to Hashrate Index, the full costs for exchange-traded industry players to mine 1 BTC averaged around $18,000. Throughout the year, such cost ensured positive cash flow, which, combined with balance sheet improvements, allowed for active equipment upgrades ahead of the halving.

However, miner prices fell throughout the year. This was especially noticeable in the segment of devices with energy efficiency above 26 J/TH.

According to TheMinerMag, public miners spent $744 million on purchasing cryptocurrency mining equipment since the beginning of 2023, and by the end of the year, they accumulated obligations for future deliveries worth over $1.2 billion. Contracts worth approximately $750 million were signed in October-November alone.

Notably, this coincided with an accelerated decline in the prices of the most advanced miners amid the emergence of a new generation of devices.

Miner Manufacturers Engage in a Technological Race Ahead of the Halving

In September, the largest Bitcoin miner manufacturer Bitmain unveiled the flagship of the new generation, Antminer S21, announced a month earlier. The device provides a hashrate of about 200 TH/s with energy efficiency of 17.5 J/TH.

In the same month, Canaan Technology showcased the next 14 series installation — AvalonMiner A1466l with immersion cooling, boasting claimed characteristics of 170 TH/s and 19.5 J/TH.

In October, the new generation line was presented by Bitmain’s main competitor, MicroBT. The most powerful model, Whatsminer M63S with hydro cooling, offered consumers 360-390 TH/s at 18.5 J/TH.

Here #WhatsMinerM60 series came! #MicroBT is thrilled to announce that #WhatsMiner fully stepped into the 1X J/T era?

For more info: https://t.co/Ovw2Rvp6sW pic.twitter.com/dW6olCjnlm— WhatsMiner (@Whatsminer_MBT) October 24, 2023

So far, only these three companies have managed to release equipment for mining the first cryptocurrency with an energy consumption indicator below 20 J/TH.

Back in June, Riot Platforms announced the purchase of devices from MicroBT with a total hashrate of 7.6 EH/s for $162.9 million. The batch consisted of 8,320 units of Whatsminer M56S+ and 24,960 Whatsminer M56S++.

In December, the American company activated a contract option to supply another 66,560 units with a total capacity of 18 EH/s for $290.5 million. This time, it was mainly about Whatsminer M66S.

In the same month, Phoenix Group from the UAE agreed with the manufacturer to purchase hydro-cooled miners worth $136 million with an option for another $246 million.

In September, Core Scientific, undergoing restructuring, signed a contract with Bitmain to purchase 27,000 units of Antminer S19J XP. The terms provided for a payment of $23.1 million in cash and $53.9 million in common shares of the American miner.

In early October, Iris Energy entered into an agreement with the manufacturer for the supply of 7,000 units of Antminer S21. The Australian company received a one-year deferral from Bitmain on the payment of $2.9 million out of a total of $19.6 million, and the device price was set at $14 per TH/s.

Subsequently, CleanSpark also announced the purchase of a batch of Antminer S21 from the Chinese firm at the same price. The manufacturer agreed to receive a 20% advance of the total amount of $61.75 million, providing the opportunity to repay the remainder within a year after receiving the equipment. Deliveries, as in the case of Iris Energy, are expected in the first half of 2024.

Amid such sales conditions, reports of Bitmain’s financial difficulties in September, when the company failed to fully pay employee salaries, are not surprising.

In November, Bitfarms placed an order for the supply of 35,888 Antminer T21 units from Bitmain for ~$95.5 million. This less powerful model of the latest line was introduced by the manufacturer a month earlier.

The Canadian firm did not disclose the payment terms for the equipment expected in March-May. However, a comment from Bitfarms’ mining director, Ben Gagnon, indirectly confirmed miners’ wait-and-see strategy amid the declining market value of even the latest devices.

“Our patience paid off. These next-generation T21s are being sold at a contract price of $14 per TH with 190 TH/s per unit,” he noted.

Experts Note Industry’s Move Towards Diversification and Consolidation

Amid the bear market and halving prospects, mining companies have increasingly sought opportunities to diversify their income, analysts noted.

One direction has been high-performance computing (HPC), driven by the AI technology boom. Several industry players, like Hut 8, redirected freed-up GPU capacities after Ethereum’s transition to the PoS algorithm.

In November, infrastructure and mining company Northern Data agreed with Tether on receiving credit financing of €575 million. However, the primary goal of raising funds in the German firm was to acquire equipment for the Taiga Cloud division, serving AI projects.

Bitcoin miners have become more active in expanding their operational geography, mostly in search of “cheap electricity.” As a result, enterprises have emerged or expanded in countries such as Argentina (Bitfarms), Paraguay (Marathon, Sazmining), and the UAE (Marathon).

Tether has made a bid to become a major player in the industry. The company, which issues the most popular stablecoin USDT, plans to invest $500 million in mining the first cryptocurrency. Previously, the firm participated in financing the government-backed El Salvador project Volcano Energy, worth $1 billion.

However, experts believe the industry’s focus will shift towards public companies, whose geography will expand — currently, most are based in the US. One confirmation of this forecast was the successful IPO of Phoenix Group in the UAE. The company raised $370 million with a 33-fold oversubscription of securities upon closing the order book.

Analysts also anticipate a wave of consolidations after the halving — not all market participants will withstand the reduction of block rewards from 6.25 BTC to 3.125 BTC. But public firms, most of which have efficient miner fleets and significant reserves (like Marathon), are better prepared for future acquisitions. According to Luxor Technologies COO Ethan Vera, an example is the completed merger of Hut 8 with American US Bitcoin in December.

Conclusion

The halving will be a true stress test for the industry, whose income still largely depends on block rewards. Improving mining efficiency and reducing operating costs will transition from preparatory measures to critical survival elements.

Companies with access to cheap electricity will gain an additional advantage. Meeting these conditions will help small and medium enterprises, while large players will find it more promising to focus on growth, according to former Galaxy Mining head Amanda Fabiano.

Another Bitcoin rally could support miners, but most experts predict it traditionally after the halving. In this case, industry participants face several challenging months, during which public companies will gain an advantage in terms of accumulated reserves and access to capital.

Considering the ongoing purchases of large batches of the latest powerful installations, continued growth in hashrate and mining difficulty can be expected, which will exert additional pressure on profitability.

BitMEX Research’s two-year-old forecast that only 2-3 major players would remain in the market of manufacturers has effectively come true. But none of the trio Bitmain, MicroBT, and Canaan seem ready to concede. At least technologically.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!