Tom Lee predicts a ‘grand rally’ for bitcoin and Ethereum in the fourth quarter

The main driver would be a potential cut to the Fed’s policy rate.

Sensitivity to monetary liquidity, global central-bank easing and seasonality will propel the two largest cryptocurrencies, Tom Lee, Fundstrat co-founder and BitMine chairman, told CNBC.

“I think we are in for a grand move in the next three months, truly grand,” he said.

He said bitcoin and Ethereum will offer “outstanding investment opportunities” by year-end, driven chiefly by a potential cut to the Fed’s policy rate.

Lee drew a parallel with September 2024, when a market-friendly decision by the regulator boosted liquidity and investors’ confidence in cryptocurrencies.

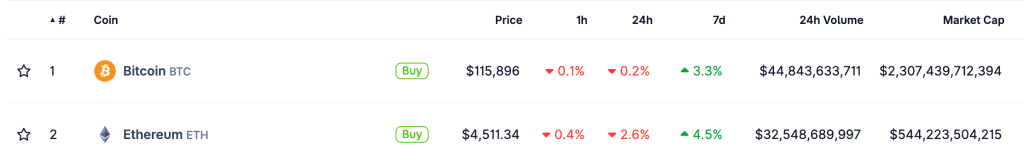

At the time of writing, the digital gold is trading around $115,800. ETH is priced at $4,500.

Ethereum’s uniqueness

The Fundstrat co-founder separately commented on Ethereum’s prospects. He likened the asset to Wall Street in 1971—the period when the gold standard was abandoned.

In his view, the second-largest cryptocurrency benefits from two trends: the migration of TradFi into the digital realm and the integration of artificial intelligence with blockchain. Lee called Ethereum “a next-generation growth protocol” and said this underpins BitMine’s aggressive strategy to accumulate ETH.

On September 15, the company said it managed more than 2 million coins worth $9.6 billion.

🧵

1/6BitMine provided its latest holdings update:

$10.771 billion in total crypto + “moonshots”

— 2,151,676 ETH at $4,632 per $ETH tokens

— 192 $BTC coins

— $214 million Eightco stake (NASDAQ-$ORBS)

— unencumbered cash $569 millionKeep reading 📕

Link…

— Bitmine (NYSE-BMNR) $ETH (@BitMNR) September 15, 2025

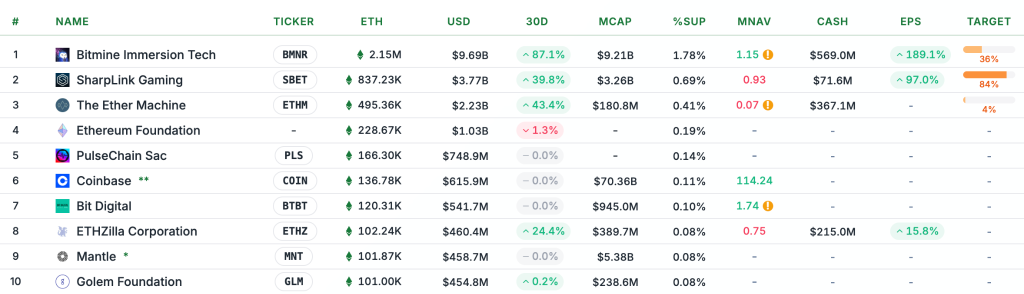

BitMine is the largest holder of Ethereum among public firms. The top three also include SharpLink Gaming and The Ether Machine, which hold 837,230 ETH ($3.7 billion) and 495,360 ETH ($2.2 billion).

Bitcoin reserves

Strategy reported buying 525 BTC worth $60 million over the past week. The average purchase price was $114,562 per coin.

Strategy has acquired 525 BTC for ~$60.2 million at ~$114,562 per bitcoin and has achieved BTC Yield of 25.9% YTD 2025. As of 9/14/2025, we hodl 638,985 $BTC acquired for ~$47.23 billion at ~$73,913 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/DiMeJVmEVD

— Michael Saylor (@saylor) September 15, 2025

The company’s total balance rose to 638,985 BTC, worth more than $47 billion, with a per-coin price of $73,913.

Meanwhile, China’s Next Technology Holding—the country’s largest bitcoin holder—announced a $500 million share sale. Part of the proceeds will go toward buying cryptocurrency.

The firm’s digital-asset accumulation strategy differs from peers. For example, Metaplanet and Semler Scientific aim to amass 210,000 and 105,000 BTC (1% and 0.5% of the total supply, respectively) by the end of 2027.

Next Technology sets no targets, planning to “monitor market conditions” and make bitcoin purchases based on monthly assessments.

Standard Chartered’s warning

In recent months, the volume of share issuance by digital-asset treasuries (DATs) to buy cryptocurrency has declined compared with previous quarters.

According to analysts at Standard Chartered, the reason is the slump in the mNAV indicator at many companies, which reflects the ratio of a firm’s market capitalisation to the value of its crypto reserves. A reading above 1 permits accumulation; dropping below makes expansion harder and riskier.

The bank’s experts noted that several well-known DATs have recently fallen below this critical threshold, effectively losing the ability to keep buying.

“The recent collapse in mNAV may lead to market consolidation. Winners will be large players, companies with low financing costs and those that earn staking yield,” Standard Chartered added.

The analysis covered several companies, including Bitmine, Metaplanet, Sharplink, Upexi and DeFi Development Corp. Their valuations have fallen amid market saturation, investor caution and weak business models.

If mNAV at crypto-treasury firms stays below 1, giants such as Strategy could move to acquire weaker rivals, the analysts said. In the longer term, bitcoin-focused DATs face greater risk due to the lack of staking income and an overcrowded market.

Standard Chartered argues that reserves in Ethereum and Solana look more resilient, with the former set to benefit the most.

Earlier, JPMorgan called the decision not to include Strategy in the S&P 500 “a blow to crypto treasuries”.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!