Trader outlines likely scenarios for Bitcoin price movement

A practicing trader and founder of the project Crypto Shaman Vadim Shovkun explains the current market situation.

As predicted, Bitcoin’s price hit a new low. Over the past two weeks, a host of factors and indicators have emerged that significantly alter the overall picture. We will examine at which levels the price of the leading cryptocurrency may be headed.

Market sentiment analysis

According to traders and analysts, the vast majority expect the leading cryptocurrency to fall. The main target is $11,000-$13,000.

In this range there has been a lot of trading volume over previous years, PoC of which is $9,000. Many are waiting for quotes there. But that is the first argument that the price will not fall so deeply.

Currently only 30% of analysts lean toward growth, 70% toward decline. Before the recent crash from the $21,000 level, sentiment was distributed as follows: 90% in favor of growth, 10% — decline.

According to an analysis of 15 paid VIP channels, only 26% look toward growth, 53% are convinced of a decline, the rest undecided. Before the sharp drop in price, opinions were distributed as: 76% — rise, 13% — fall.

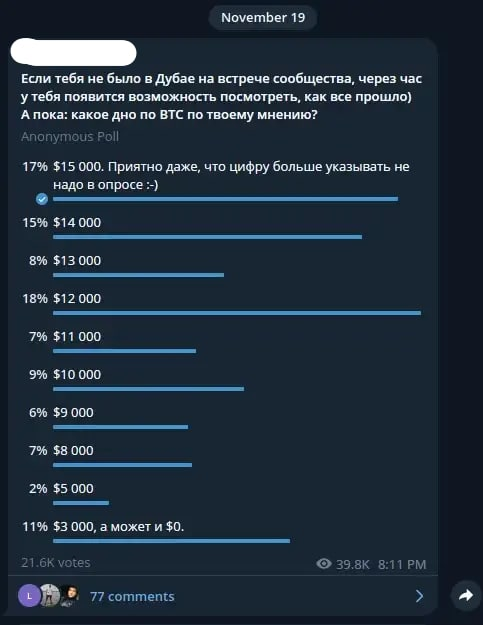

These observations are also confirmed by numerous polls in Telegram:

According to keyword analysis in social networks, those who short Bitcoin and believe in a deep price decline have become more active. The search was conducted on the keyword “short.”

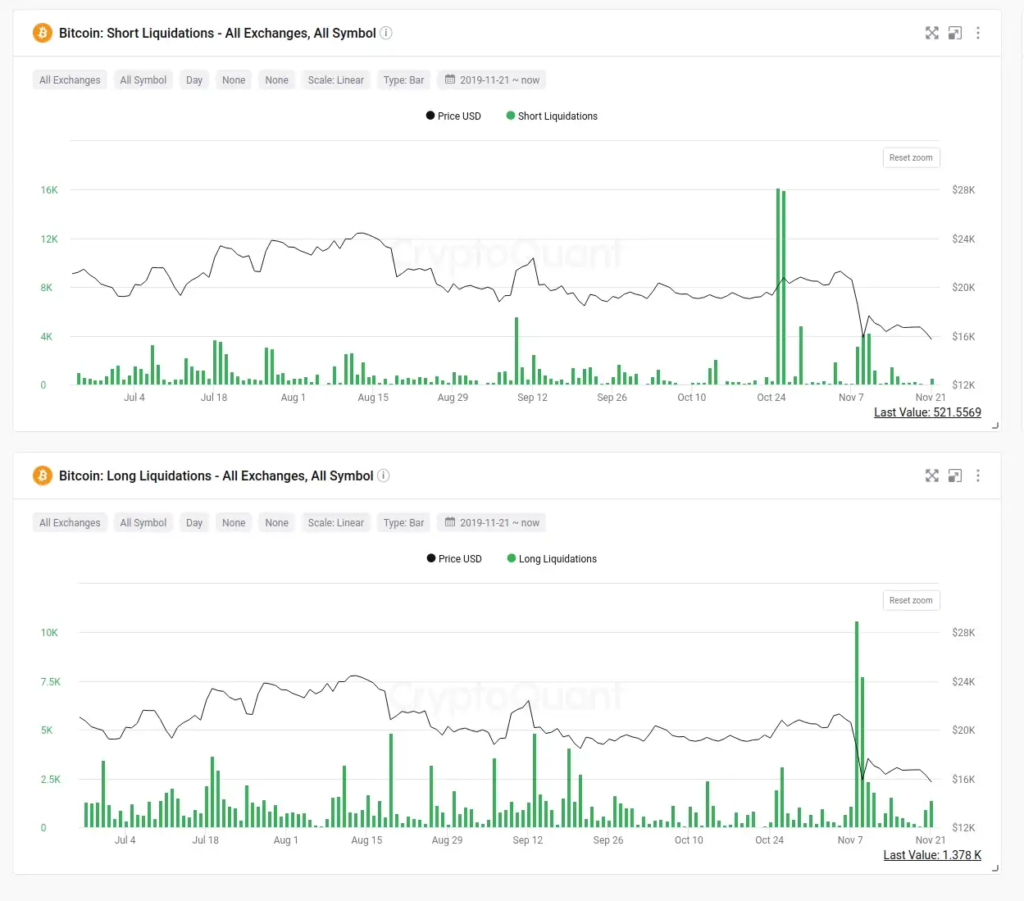

Analyzing the liquidation chart, one can conclude that in the previous four-and-a-half-month flat, the crowd leaned more on long positions. The market rose only modestly within the flat. Over a month and a half, more long positions were liquidated than when the price refreshed the bottom of the flat during the period.

In conclusion of the mood analysis, the enormous amount of FUD circulating in the media cannot be ignored: problems at Digital Currency Group and Genesis Global Capital, mass layoffs at Crypto.com, etc. A lot of negativity, but the market remains flat, not falling.

Under the classic model, price would first fall, then clarifying news would follow. Here, FUD exists but there is no corresponding move.

Technical analysis

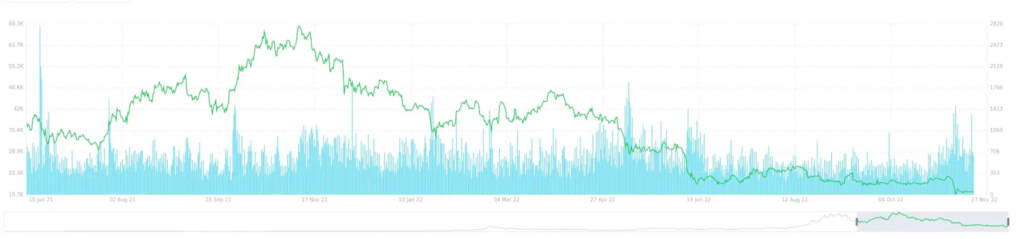

First, focus on historical volumes formed on the higher time frame. In the last five years there have been only a dozen instances when weekly trading volume of the digital gold exceeded 500,000 BTC.

Based on historical data, such a surge in volumes either led to an immediate extreme on the price chart or to a major pause in the move followed by a reversal.

With each new wave of declines, one can notice that its depth, in percentage terms, decreases; selling pressure weakens.

On the weekly time frame, a clear divergence is also visible. If the move runs to full height, it will engulf a large bearish candle and, as a result, push the price higher still.

Conclusions

The market looks much better than media portray it. The FUD yields no results; for two weeks there have been plenty of reasons for a drop, but Bitcoin remains resilient.

The crowd, led by opinion leaders, now leans toward a decline to $12,000. While negativity pervades the market, Bitcoin is showing a number of mid-term signs of a slowdown in declines.

What should we expect from the market? At least a flat or sideways move, possibly a small new low, a range-bound phase lasting several weeks with a gradual move above $20,000 and a continuation to $30,000. This is the most probable scenario.

The optimistic scenario is a rise above $20,000 in the next couple of weeks. A less likely scenario is a deep fall to $12,000 and below.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!