Traders Eye Ethereum at $4000

The second-largest cryptocurrency by market capitalization continued its ascent. The asset’s price surpassed $3600, marking a weekly increase of over 20%.

At the time of writing, Ethereum is trading at $3616 (+5.2% over the day), according to CoinGecko.

The rally was driven by the liquidation of short positions and demand for call options.

According to Coinglass, Ethereum shorts worth $128 million were liquidated in 24 hours.

Derive.xyz researcher Sean Dawson stated that market participants are “aggressively targeting a swift move to $4000.” He described the price surge as a “regime change” for the asset.

He estimates a 14% probability of Ethereum rising above $4000 by the end of July, and a 27% chance of reaching $5000 by the end of 2025.

“Bitcoin is part of the movement, but this rally belongs to Ethereum. The technical picture, option flows, and liquidations indicate a structural shift,” added Dawson.

The rise was supported by positive news from US regulators. Investors perceived the advancement of cryptocurrency bills as a step towards clearer rules for the crypto industry. Against this backdrop, the total market capitalization exceeded $4 trillion for the first time.

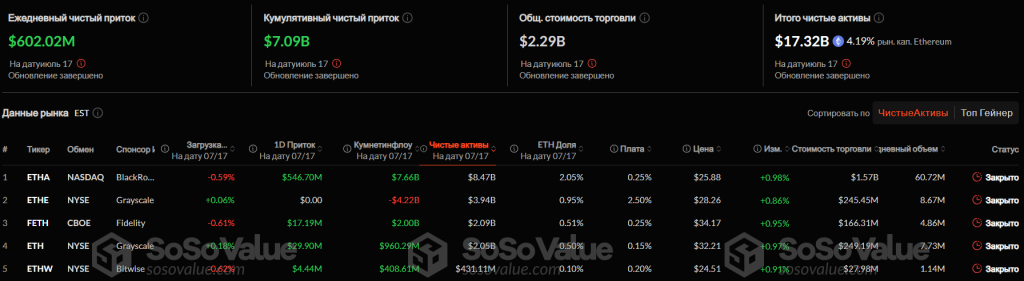

According to BRN analyst Valentin Fournier, “Wall Street’s appetite for crypto funds remains extremely strong.” Spot ETFs based on Ethereum attracted $602 million in a day, while Bitcoin funds drew $523 million.

Fournier warned of the risk of market overheating. In his view, new highs could trigger profit-taking and volatility. However, he expects that institutional inflows and regulatory clarity will support the upward trend.

“The Fear and Greed Index stands at 71 out of 100. This indicates positive investor sentiment, but not yet euphoria,” explained Fournier.

Whales and Ether

A premium on Ethereum emerged on the Coinbase exchange, indicating a surge in purchases by American whales and institutions. This was reported by CryptoQuant analyst known as Crypto Dan.

According to him, the daily inflow into spot ETH ETFs reached a historic high. This confirms that US investors are “aggressively” accumulating the asset.

Crypto Dan believes the market is not yet overheated. After short-term consolidation, further growth in Ethereum’s price is likely.

However, the expert cautioned that if similar surges in activity occur in the second half of 2025, it could indicate overbought conditions. In such a case, investors should consider risk management.

Back on July 11, Ethereum prices surpassed $3000 for the first time since February.

On July 17, Ether broke through the $3400 mark amid record inflows into ETFs.

The daily net inflow into BlackRock’s ETHA exchange-traded fund reached $546.7 million.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!