Trading Volume on Lighter Exchange Plummets Threefold After Airdrop

Lighter exchange sees sharp activity drop; Hyperliquid regains top spot.

The decentralized exchange Lighter, known for its perpetual contracts, is experiencing a sharp decline in activity. Hyperliquid has reclaimed its leadership in the segment, according to analysts at CryptoRank.

Hyperliquid reclaims the perps throne

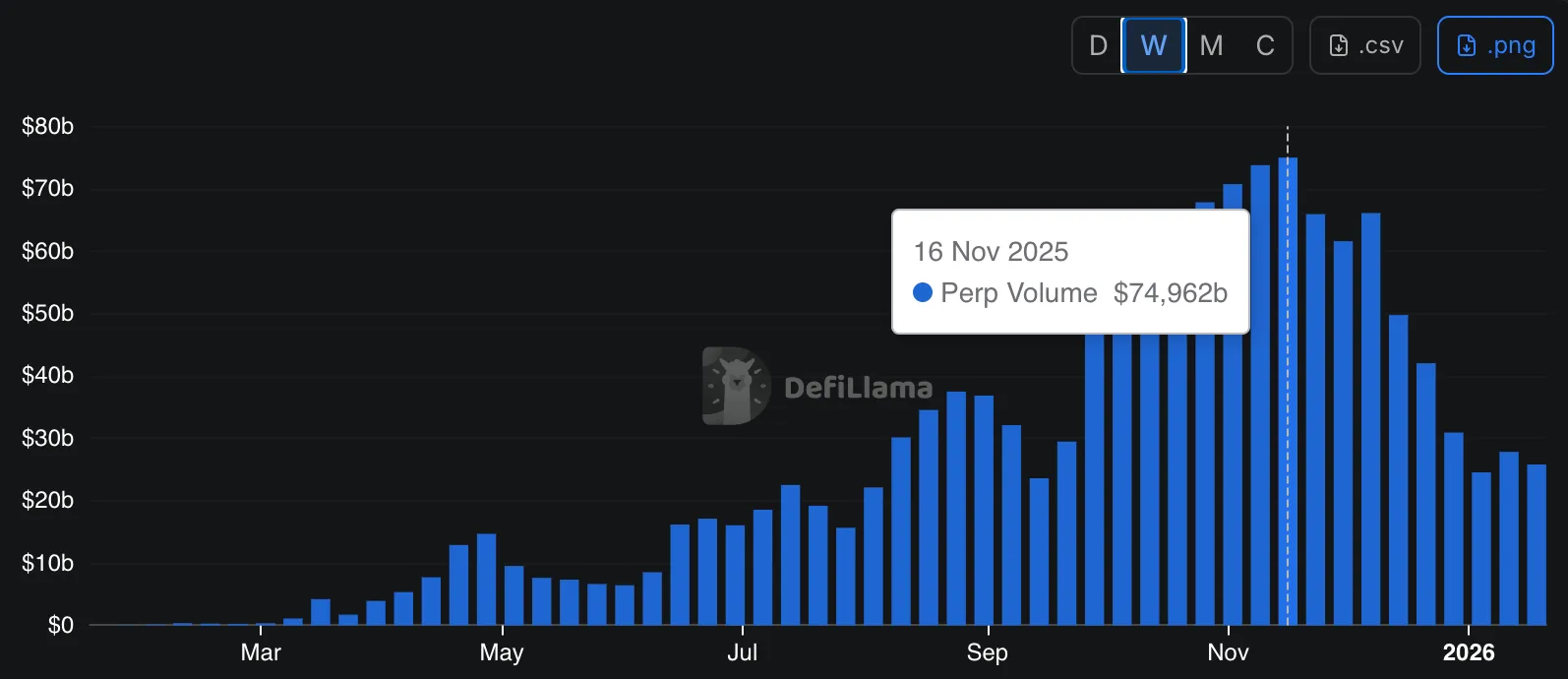

As Lighter’s airdrop is distributed, the platform’s volumes have started to fade – weekly volume has decreased nearly 3x from its peak.@HyperliquidX has captured the lead and is now ranked 1st by volume and open interest.@variational_io… pic.twitter.com/LChbSdaU8a

— CryptoRank.io (@CryptoRank_io) January 18, 2026

According to experts, Lighter’s trading volume over the past week amounted to $25.3 billion. For comparison, at its peak in mid-November, the figure reached $74.9 billion.

” class=”wp-image-273559″/>

” class=”wp-image-273559″/>At the end of December, the platform conducted an airdrop of LIT tokens worth $675 million. The event ranked among the top ten largest asset distributions in the industry’s history, noted CoinGecko.

Previously, the platform changed its operating rules: it introduced mandatory staking for participation in liquidity pools and revised fees for market makers and HFT traders.

Amid the decline in trading turnover on Lighter, Hyperliquid has once again taken the top spot among perp-DEX. The platform’s weekly trading volume exceeded $40.7 billion. Another competitor, Aster, recorded $31.7 billion.

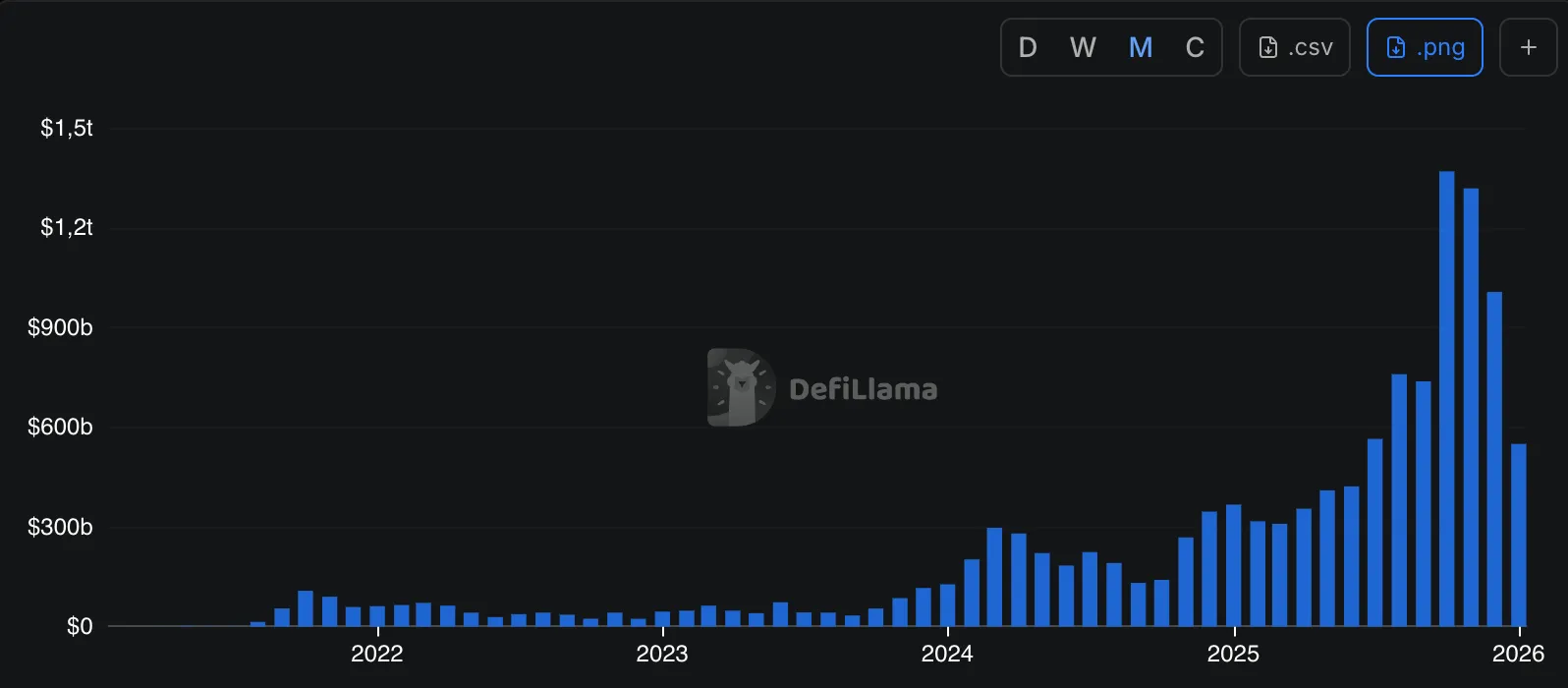

The total turnover of decentralized derivatives for January so far is $549 billion, still far from the October record of $1.3 trillion.

” class=”wp-image-273560″/>

” class=”wp-image-273560″/>Hyperliquid’s leadership is also confirmed by open interest over the past 24 hours — $9.57 billion. The combined value of all other major platforms (Aster, Lighter, Variational, edgeX, Paradex) is about $7.34 billion.

Back in November, former BitMEX CEO Arthur Hayes predicted a rise in the popularity of perp-DEX.

In his view, by the end of 2026, the pricing of major American stocks will shift from traditional exchanges to the on-chain space: the market will begin to focus not on Nasdaq, but on perpetual contract charts.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!