UK banks tighten rules for crypto firms, reports say

UK-based crypto firms have been having trouble accessing banking services. According to sources Bloomberg, banks have been denying applications, freezing accounts, and requesting more information about client transactions.

The agency reminded about HSBC and Nationwide Building Society‘s decision to ban retail customers from buying digital assets with credit cards. Paysafe, a payments provider, said it was ending its partnership with Binance, citing the “complex” regulatory environment.

According to Coinpass co-founder and CEO Jeff Hancock, banking access problems run counter to Prime Minister Rishi Sunak’s turning the country into a crypto hub plan.

“There are few viable options — most traditional banks will not offer banking services to firms in the industry. Given the recent run of events, it will become even harder. We are seeking licences in France, where, in our view, it will be easier,” said SavingBlocks co-founder Eduard Donizo.

In response to the worsening situation, CryptoUK representatives wrote to the government with a proposal to create a ‘white list’ of companies registered in the country to ease restrictions.

“There are concerns that payment service providers will follow the banks’ example. We believe government intervention is warranted,” the self-regulatory organisation said.

During the talks with Economy Minister Andrew Griffith and the heads of unnamed crypto firms, the official pledged to carefully review the situation and maintain dialogue with industry representatives.

Coinbase’s vice president of global regulatory policy Tom Duff-Gordon pointed to a more severe reaction from local banks compared with the EU. He noted that the EU’s cryptocurrency regulation proposal (MiCA) led to greater loyalty among local lending institutions to industry firms.

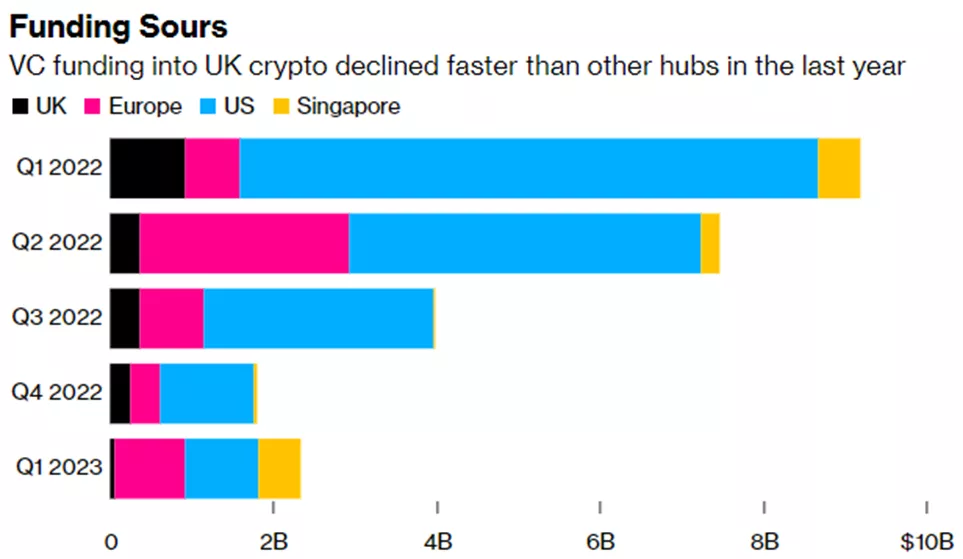

According to PitchBook, venture capital investments in UK digital-asset companies in the first quarter of 2023 fell 94% year on year to $55 million. In the European Union, the figure rose by 31%.

In March, the UK authorities unveiled a three-year Economic Crime Plan, which includes measures to strengthen the crackdown on the use of cryptocurrencies for criminal purposes.

In February, the Treasury unveiled plans to introduce oversight of Bitcoin exchanges.

In December 2022, the Bank of England urged the development of a regulatory framework for the industry to avert systemic problems.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!