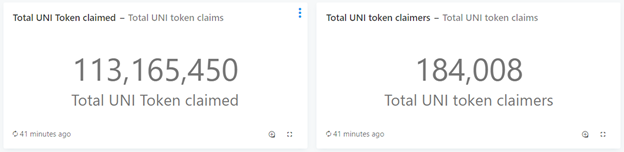

Uniswap distributed 113.17 million UNI tokens among users

Leading non-custodial exchange Uniswap distributed 113.17 million of the 150 million native UNI tokens earmarked for the airdrop.

The recipients were 184,000 DEX users, including liquidity providers and SOCKS token holders.

The number of distributed UNI tokens and the number of recipient addresses. Data: Dune Analytics as of September 21.

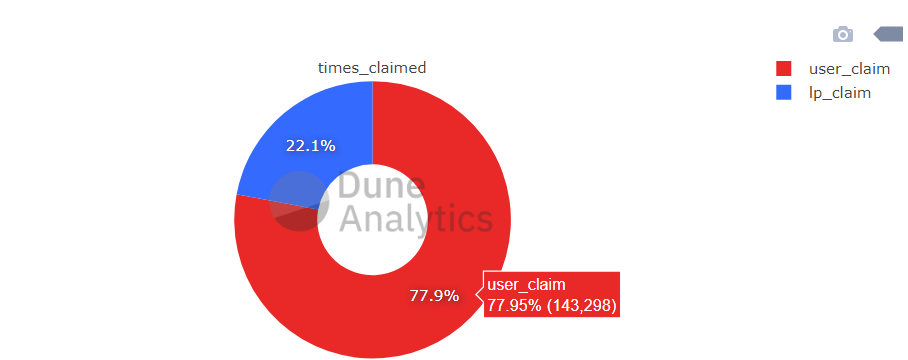

Four of these addresses belong to Uniswap traders. The remainder belong to liquidity providers.

UNI token distribution by recipient type. Data: Dune Analytics.

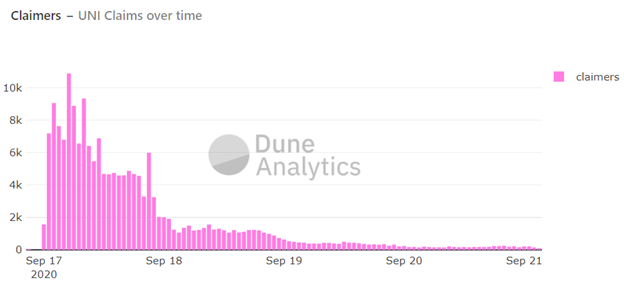

On September 17, 138,693 airdrop participants submitted applications for funds on the day of release of the token.

UNI token distribution by time. Data: Dune Analytics.

The surge surrounding the UNI launch led to a new record in the daily transaction count on the Ethereum network. According to Etherscan, on September 17 this metric reached 1.406 million. The previous peak of 1.35 million was set on January 4, 2018.

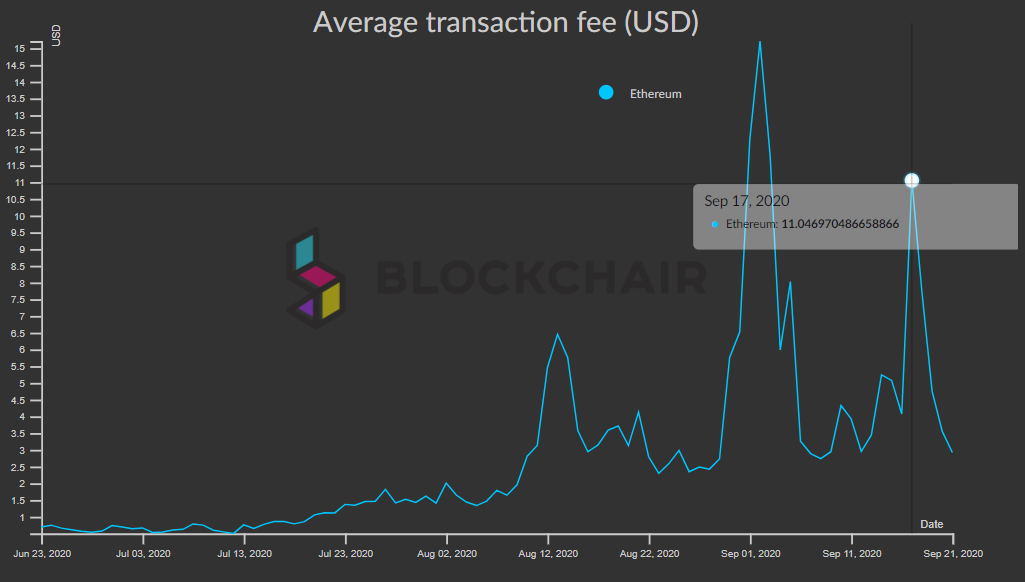

Also on September 17 there was another jump in the average Ethereum transaction fee:

Against the backdrop of the UNI launch, the average Ethereum transaction fee rose above $11. Data: Blockchair.

The total UNI supply will amount to 1 billion; 60% is allocated to the community, including 15% for liquidity providers and early users, to be distributed over four years.

The team, current and future employees, will receive 21.51% of the tokens under the vesting programme. A further 17.8% was allocated to investors, and 0.069% to project advisers. After four years, an inflation mechanism will kick in, with annual inflation at 2%.

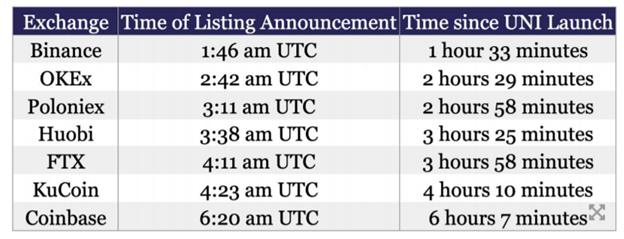

Within an hour and a half of the UNI release, it appeared on Binance. Soon, other leading centralised exchanges followed suit, including Coinbase Pro. The Block analysts described the reaction as “lightning-fast and unprecedented”.

Time elapsed from the release to UNI listing on leading Bitcoin exchanges. Data: The Block.

According to CoinGecko, the UNI price rose to $8.40, having started trading at $1.03. At the time of writing, the token traded around $5.19, about 38.2% below the peak. In market-cap terms, the asset has dropped 34 places to $590 million.

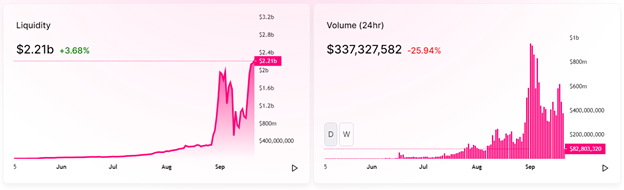

The UNI issuance acted as a catalyst for liquidity to return to Uniswap. As of writing, the value of assets locked in the DEX stood at $2.21 billion.

Liquidity and trading volumes on Uniswap. Data: Uniswap.

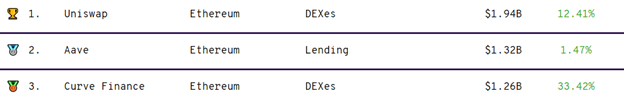

Uniswap reclaimed the lead in DeFi Pulse’s ranking. With $1.94 billion in locked funds, the platform leads the field by a wide margin.

Total value locked in DeFi protocols. Data: DeFi Pulse.

The Block analyst Larry Cermak warned that Uniswap’s success could prompt similar platforms lacking viable business models to issue useless governance tokens. He argues this would reduce liquidity and take the market back to 2017.

You’d have to be a fool not to start using DeFi protocols or DeFi infra apps that don’t have tokens just to gamble on the chance they do something similar to Uniswap

— Larry Cermak (@lawmaster) September 19, 2020

Earlier, Tone Vays and Jay Hao voiced similar concerns.

In late August, Uniswap’s daily turnover surpassed the corresponding figure at Coinbase, the largest US crypto exchange.

In mid-September, Messari analysts noted that Uniswap, Curve and Balancer account for more than 90% of the decentralised-exchange market.

Follow ForkLog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!