Unprofitable mining and dump accusations: how the Filecoin community greeted the launch

On October 15, took place the long-awaited launch of the Filecoin mainnet, one of the industry’s most promising projects. In 2017 it attracted over $250 million from accredited investors and funds.

However, already a day after the network launch, information about a Filecoin miners’ strike emerged, and some — notably Justin Sun — accused the Protocol Labs development team of dumping the price of the FIL token. The greatest concern was raised by Chinese analysts’ conclusions about the possible movement of coins from the testnet to trading platforms.

ForkLog examined what happened after the launch and how justified the claims were.

What is wrong with Filecoin mining?

Filecoin is a famous, but until recently enigmatic, long-running project in the crypto industry. It is a project of the California-based Protocol Labs, announced as early as 2014. Protocol Labs itself is known as the creator of the IPFS internet protocol, which operates on a decentralised registry and is meant to replace the HTTP protocol. Filecoin, meanwhile, was conceived as a kind of ecosystem around IPFS for decentralised data storage.

https://forklog.com/chto-takoe-filecoin/

The Filecoin token sale was the first conducted in the United States under a SAFT framework. It was developed by Protocol Labs Juan Benet and Jesse Kleinberg in collaboration with lawyer Marco Santori. For a long time it seemed to strike the right balance in its dealings with the U.S. Securities and Exchange Commission (SEC), but in 2020 its flaws were laid bare in the Telegram Open Network case.

The Filecoin mainnet launch, which had been postponed several times, did not go smoothly despite the lengthy preparations.

Already the next day, the Chinese portal 8btc reported a “strike” by Filecoin miners. According to the report, they unplugged almost all equipment to protest the incentive scheme: block rewards are paid over six months, but to start mining one must stake FIL tokens.

The CEO of Protocol Labs Juan Benet called the news of the strike nonsense. He said miners earn a ton of money, even though the entry threshold is high.

As later stated by Filecoin’s COO Ian Darrow, there was no strike, but the equipment indeed did not operate due to miners lacking coins for collateral. To address this, the team changed the incentive scheme for miners: miners now receive a quarter of the block reward immediately after mining. According to one of the miners, IPSFMain, this would raise hardware utilization to 80%.

Filecoin is very complex and requires high-end hardware, including min 128GB mem.

Example of 1 miner, that is 3 servers with 2 computing and 1 storing, from @6block2

Price is a very high retail $40k (includes hosting and maintenance ), regular prices min. $20k, 350TB (2/n) pic.twitter.com/M5Tof8N6fq— Nico Deva (@NicoDeva_) October 18, 2020

6Block, meanwhile, removed the pages for two Filecoin miner models from its site, though promo banners for them remained on the homepage. Miners for Filecoin from another company, released for sale earlier this year, elicited only confusion from Twitter users.

However, Filfox, the Filecoin network watcher, shows somewhat different figures. The total cost of equipment for the network’s largest miner, according to @NicoDeva, is $16 million. That miner’s earnings for October 20 were about 10,800 FIL ($324 000). In other words, the payback for the equipment, excluding additional costs, would take roughly two months. Note that the distribution of block rewards for Filecoin is spread over six months.

Price Dump

A solution to the miner shortage could be to buy FIL tokens on the open market, but circulating supply, according to CoinMarketCap, is currently about 18 million out of 2 billion, less than 1%. The greater barrier is FIL’s high volatility.

After listing on exchanges, the token’s price jumped from $60 to $125 (on some platforms briefly reaching $400). Then, over the next few days it fell just as rapidly to $30. Has the price stabilized yet? It’s hard to say.

Price dynamics of FIL on Bitfinex, HitBTC, Binance, Bittrex, Gemini and Kraken. Data: TradingView.

Despite a loss of roughly half the value, CoinMarketCap still values FIL’s ROI at more than 160%.

Opinions on why FIL’s price fell diverged in the community. lashed out at the Filecoin team with accusations of a dump. He claims that at the price peak they sold 1.5 million FIL at $200 each (allegedly there should have been 2 million coins in circulation from day one, not 420 thousand).

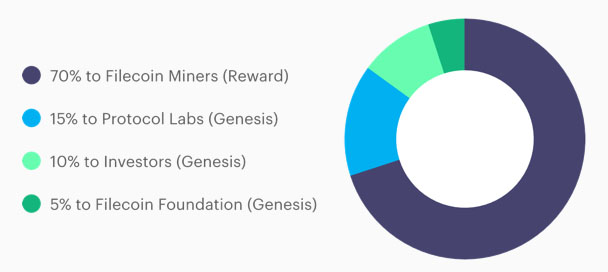

According to Filecoin’s roadmap, 70% of all FIL coins are destined for public circulation. The remaining 30% are company funds (15%), investors (10%) and the development fund (5%). These funds began to be distributed after the network launch under vesting terms, i.e., they will be unlocked gradually. For the Filecoin team and the foundation, vesting lasts six years; for investors, six months to three years.

Structure of FIL token issuance.

That is what Sun accused the creators of Filecoin of selling coins outside vesting. As evidence, he cited screenshots from a user who, without details, claimed these were transfers totaling 800,000 FIL to the Huobi exchange. Juan Benet said Sun is lying, and that neither the team nor Protocol Labs sold anything. He claimed that tokens were sent to exchanges to stabilise the market via liquidity.

(8.1.) The FIL in question is part of a market stabilization program which has become an industry standard. These programs engage firms to provide liquidity & stability to the market in the early days after launch, when prices are at risk of being volatile. pic.twitter.com/RUzZC8sA8P

— Juan Benet (@juanbenet) October 19, 2020

According to another version, on the first day Filecoin began trading on exchanges extra 1.5 million tokens from the testnet ended up on exchanges. The testnet organizers allegedly carried out a swap of test coins for real ones as a reward for launch participants. According to this version, as many as 26.5 million FIL ended up on exchanges. The community questioned the veracity of these statements and urged waiting for an official reaction, but Filecoin has not commented on the rumors.

In any case, the tokens in the wallets of the team and the future development fund, according to Filfox, remain unmoved.

In social media, people are already start comparing Filecoin to its main competitor — Amazon Web Services. As Anish Agnihotri calculated, the price of renting cloud storage on Filecoin per gigabyte is already substantially cheaper than AWS’s offering.

📂 With today’s @Filecoin launch, I was curious how much it actually costs to store data on the network. So, I spent 2hrs and built a website where you can see it too: https://t.co/CV2RWMCMX4

— Anish Agnihotri (@_anishagnihotri) October 16, 2020

For now, Filecoin’s problems look solvable, and the claims of a FIL dump appear unfounded.

Protocol Labs has big ambitions: with IPFS to change the technological foundations of the internet, and through Filecoin to take leadership in cloud services from giants like Amazon. But will these developments be in demand? The verdict rests with users.

Follow ForkLog in Telegram: ForkLog Feed — the full news feed, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!