US debt-ceiling deal sparks Bitcoin volatility

On May 28, the Speaker of the US House of Representatives, Kevin McCarthy, announced that there was a principled agreement with the White House on the debt ceiling. The news sparked volatility in the cryptocurrency market.

I just got off the phone with the president a bit ago. After he wasted time and refused to negotiate for months, we’ve come to an agreement in principle that is worthy of the American people.

I’ll deliver a statement at 9:10pm ET. Watch here:https://t.co/vmn31INPH5

— Kevin McCarthy (@SpeakerMcCarthy) May 28, 2023

“I just spoke with the president [Joe Biden]. After he wasted time and for months refused to negotiate, we have reached a principled agreement,” the statement said.

The achievement of the agreement was also confirmed by the head of state. According to him, this is an important step forward, “which reduces spending” and “represents a compromise.”

Earlier this evening, Speaker McCarthy and I reached a budget agreement in principle.

It is an important step forward that reduces spending while protecting critical programs for working people and growing the economy for everyone. And, the agreement protects my and…

— President Biden (@POTUS) May 28, 2023

“And this agreement is good news for the American people because it prevents what could have been a catastrophic default and lead to an economic downturn, eroding pension funds and costing millions of jobs,” Biden emphasised.

The agreement is expected to need approval in the Republican-controlled House of Representatives and the Democratic-led Senate before the president signs it. The process could take more than a week.

The US debt ceiling currently stands at $31.4 trillion. Under McCarthy’s plan, the ceiling would be raised by $1.5 trillion and spending cut by $4.5 trillion.

The stock market responded positively to the news — Nasdaq-100 futures rose 0.59%, the S&P 500 by 0.37%.

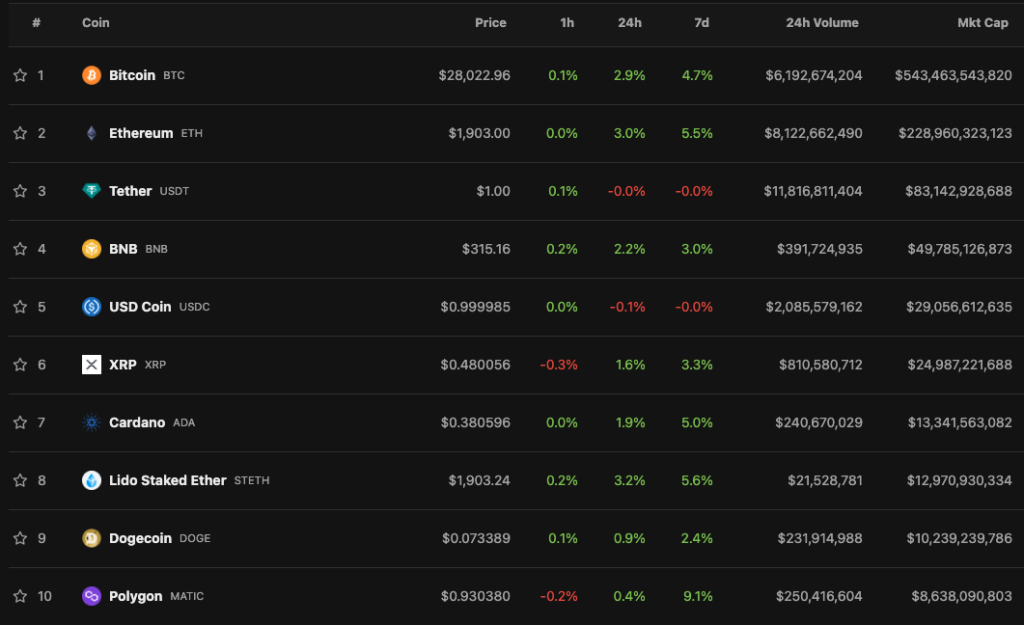

In the night of May 29, Bitcoin’s price briefly rose above $28,400. The asset has since corrected toward around $28,000, up 2.9% over the last 24 hours (CoinGecko).

Assets in the top-10 by market capitalization moved into the green zone following the leader. The biggest gains at the time of writing were Ethereum and stETH — 3% and 3.2% over the last 24 hours respectively.

Trader going by the pseudonym Rager thanked the White House for the “weekend pump” of Bitcoin.

Thanks for the weekend pump White House$BTC pic.twitter.com/sQlv1LvKsD

— Rager (@Rager) May 28, 2023

Some members of the crypto community, in a tongue-in-cheek manner, contrasted Bitcoin with gold against the printing of dollars.

#Bitcoin fixes this pic.twitter.com/LolrZ4yFvL

— The ₿itcoin Therapist (@TheBTCTherapist) May 28, 2023

One user reminded that the US authorities sell Bitcoin and at the same time “print an unlimited amount of fiat.”

#bitcoin, meanwhile they’re printing unlimited FIAT

Regarded move pic.twitter.com/RTvSH4Obez

— Hodlius ₿ Maximus (@MAKS_Diogenes) May 28, 2023

In early May, the issuer of USDC, Circle, revised its stake in Treasury bills due to the risk of a US default.

In the same month, Bloomberg Intelligence senior strategist Mike McGlone allowed that stock and cryptocurrency markets could be hurt should negotiations to raise the US debt limit fail.

Recall that in March, CNBC-polling influential figures in the industry demonstrated bullish sentiment toward Bitcoin. According to their forecasts, this year the asset could test its previous high and even reach $100,000.

In the run-up to that level, but within 12 months, expressed confidence by Messari founder and CEO Ryan Selkis.

Standard Chartered analysts put the timeline for Bitcoin to reach $100,000 at a later date — by the end of 2024.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!