US inflation slows; Bitcoin fails to react to macro data

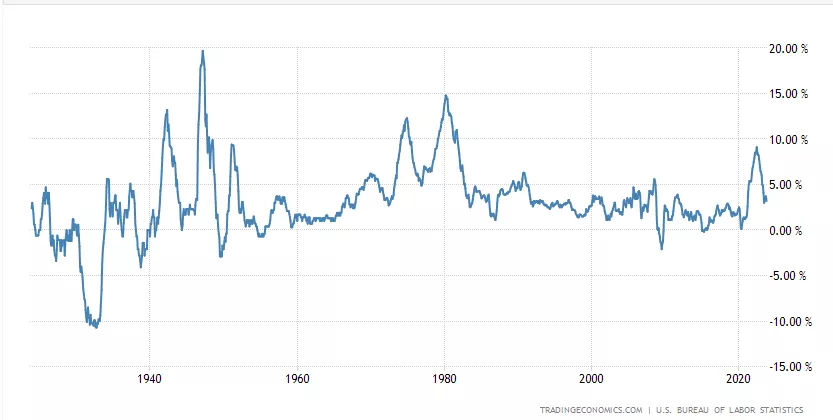

Year-over-year inflation in the United States for October замедлилась до 3,2%, below the consensus forecast (3.3%). This is the first decline in the indicator за четыре месяца.

The corresponding reading for September stood at 3.7%.

On a monthly basis, the Consumer Price Index was unchanged after a 0.4% jump in the prior month. According to the U.S. Bureau of Labor Statistics, October’s rise in housing costs was offset by a 5.3% drop in gasoline prices.

“Overall, inflation proved softer than expected,” said Kaiko researcher Desislava Ober in a conversation with Decrypt. — And this is fairly good news for risk assets, since ФРС has stopped raising rates.”

MN Trading founder Michaël van de Poppe is likewise confident that the regulator is moving toward a less hawkish monetary policy.

BREAKING: CPI hitting 3.2%, while 3.3% expected.

The FED hiking policy is coming to an end.

CPI comes in lower than expected, where M/M is at 0.0%.

Markets trend higher again, dips are still for buying. Also on #Bitcoin.

— Michaël van de Poppe (@CryptoMichNL) November 14, 2023

“Markets are moving higher again. Dips remain attractive for buying,” the analyst said.

At the time of writing, Bitcoin and Ethereum were trading at around $36,630 and $2,050 respectively (according to CoinGecko), having shown no reaction to the U.S. macro data.

The Fed had been aggressively raising rates for more than a year to curb inflation, which in June last year peaked at a 40-year high of 9.1%.

The regulator has partly managed to stabilise the macroeconomic indicator. However, inflation remains above the Federal Reserve’s 2% annual target. On 1 November, the Federal Reserve System kept the target range for the federal funds rate at 5.25-5.5% per annum.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!