US Inflation Slows, Bitcoin Holds Above $64,000

Annual inflation in the United States slowed to 3.4% in April from 3.5%, aligning with consensus forecasts.

On a monthly basis, the consumer price index rose by 0.3%, compared to expectations of 0.4% and the same figure for March.

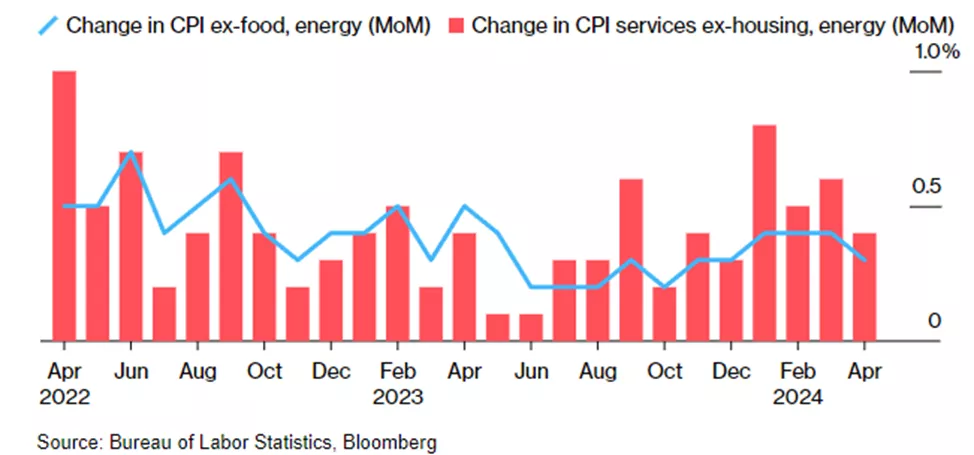

Excluding food and energy prices, the index increased by 0.3% from the previous month and by 3.6% compared to April last year. The previous month’s figures were 0.4% and 3.8%, respectively. This marks the first slowdown in monthly dynamics in six months.

Analysts had anticipated a slowdown in annual rates to 3.6% and monthly rates to 0.3%.

According to Bloomberg, service prices, excluding housing and energy, rose by 0.4% compared to March, the weakest figure this year. The Fed noted the importance of this metric in analyzing the inflation trajectory.

Alongside the CPI, retail sales data were released. Compared to March, the indicator remained unchanged against a consensus forecast of a 0.4% increase. Excluding transportation, the indicator rose by 0.2% in April, matching economists’ expectations.

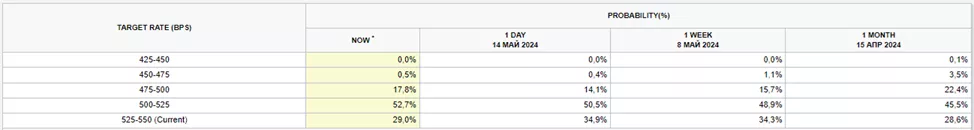

“This opens the door for a possible rate cut later this year. More metrics indicating a decline in inflation will be needed for the Fed to act,” commented Charles Schwab’s chief strategist, Kathy Jones.

The market reacted positively to the macroeconomic data release. Treasury yields fell, S&P 500 futures rose, and the dollar weakened. Traders increased the likelihood of a rate cut in September to about 71% from 65% the previous day.

The macroeconomic data spurred a rise in Bitcoin, whose price jumped 2.6% within an hour. Ethereum rose by 2.4% over the same period. The price of the leading cryptocurrency held above $64,000, while the second approached $3,000.

Bloomberg warned that the data might give the Fed some hope that inflation is resuming a downward trend. However, officials will want to see additional indicators to gain confidence in beginning rate cuts.

A day earlier, Federal Reserve Chairman Jerome Powell stated that the central bank “must be patient and allow restrictive policy to do its work.”

Earlier in May, former BitMEX CEO Arthur Hayes suggested that digital gold prices could surpass $60,000 and move towards $70,000 by the end of August. He attributed the potential recovery to increased dollar liquidity.

Previously, Galaxy Digital CEO Mike Novogratz predicted Bitcoin would rise to $75,000 by the end of June, citing Fed actions and the US presidential elections as drivers.

Later, Cane Island Alternative Advisors analyst Timothy Peterson noted that for the leading cryptocurrency to reach $100,000, a factor related to US central bank policy would be necessary.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!