US inflation slows but falls short of expectations; Bitcoin under pressure

The year-over-year growth in US consumer prices in August slowed from 8.5% to 8.3%, its core gauge — accelerated from 5.9% to 6.3%. The data reinforced the case for maintaining an aggressive policy by the ФРС and led to selling in the cryptocurrency market.

The market reaction was painful. In the first 15 minutes after the release, prices of Bitcoin and Ethereum fell by more than 4.5%. Half an hour later, among the top-30 most capitalised cryptocurrencies, only Litecoin maintained a positive trajectory over the last 24 hours.

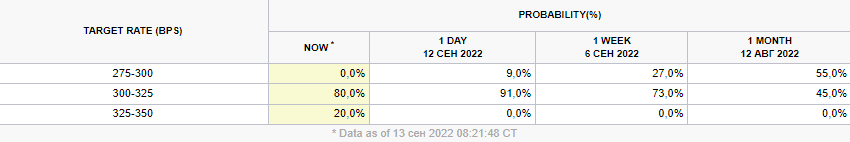

According to the futures market, the probability of lifting the federal funds rate at the September 21 meeting jumped to 80%. A month ago it stood at 45%.

The rise in the core gauge, contrary to expectations, reinforced the perception of Powell’s remarks at the Jackson Hole symposium. The official warned of the intention not to rush to cut rates to keep inflation expectations in check.

The data could prompt investors to reassess their expectations, who had previously anticipated a policy pivot in spring 2023.

Ahead of the September 21 meeting, the Fed has only to assess the retail sales data due on September 15. In light of the inflation report, they are unlikely to alter their willingness to raise the rate by 75 basis points in one go.

Following the release of macro data, FTX experienced outages. According to platform head Sam Bankman-Fried, the short-term issues affected the company’s website. Specialists quickly resolved them.

Many traders reported that FTX experienced downtime in the violent price fluctuations after the US August CPI announcement. SBF said FTX didn’t actually go down but the website did wonky auto-refreshing, rolling out a fix for that momentarily. https://t.co/JXIriDzgvG

— Wu Blockchain (@WuBlockchain) September 13, 2022

«This [Bitcoin’s reaction to inflation] underscores how closely cryptocurrency is intertwined with other risk assets, which requires a deeper understanding of these correlations», — said in an interview with The Block Jon Van Bourg, head of global trading at Cumberland.

Earlier, a trader using the pseudonym filbfilb predicted Bitcoin could fall from current levels to around $10,000–$11,000. The analyst noted that the leading cryptocurrency has become strongly correlated with Nasdaq, which is under heavy pressure from Federal Reserve policy.

Earlier, former hedge-fund manager at Cramer & Co. and host of Mad Money on CNBC Jim Cramer said that tighter monetary policy would bring about a washout of speculative instruments such as digital assets.

Read ForkLog’s Bitcoin news on our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!