UST Stablecoin Loses Dollar Peg Amid Crypto-Market Collapse

Against the backdrop of the crypto market crash, Terra’s algorithmic stablecoin TerraUSD (UST) again lost its peg to the US dollar. In the night of May 10, the asset traded below $0.62 (Coinbase).

Due to the incident, the cryptocurrency exchange Binance temporarily froze withdrawals on the Terra blockchain. Users noted the platform’s order book was empty.

It’s not for a lack of demand to bid below $.70. It’s simply not possible to submit orders via frontend/API. Dunno what’s going on

— Hasu⚡️🤖 (@hasufl) May 10, 2022

As of writing, UST is trading near $0.91.

TerraUSD is one of the largest dollar-pegged stablecoins. According to CoinGecko, its market capitalization exceeds $16 billion. Because UST issuance uses a mechanism that burns the native token LUNA, the prices of the two assets are closely correlated.

“The existence of such a correlation creates significant inflationary risks arising from the withdrawal of stablecoins from the Terra ecosystem. Such an assessment of market processes shows that removing a large amount of UST from circulation does not affect its price thanks to arbitrageurs; however the operation stimulates a decline in LUNA’s price. In a downward trend and in the presence of negative news, a substantial drop in the price of the cryptocurrency may be observed,” said Sergey Strutinsky, a specialist in mathematical modelling and a regular ForkLog author.

In the last 24 hours, LUNA has lost more than 40% of its value and is trading near $36 at the time of writing. On Friday, May 6, the cryptocurrency price had been above $80.

The parity-preserving model for UST’s dollar peg largely relies on arbitrageurs. If the stablecoin falls below $1, traders can buy it and redeem for $1 in LUNA, earning a profit.

1/ To help others understand the $UST arbitrage and why the peg doesn’t come back straight away…

There are some parameters that determine the spread when minting and burning $UST / $LUNA. The more mint/burn happens in a day, the higher the spread. #terraluna— My Life in Defi (@MyLifeInDefi) May 9, 2022

However, for this mechanism to work, demand for the target asset must be ensured. In UST’s case, the protocol providing such demand is Terra’s largest protocol — Anchor. The latter pays deposits in UST at over 19% per year.

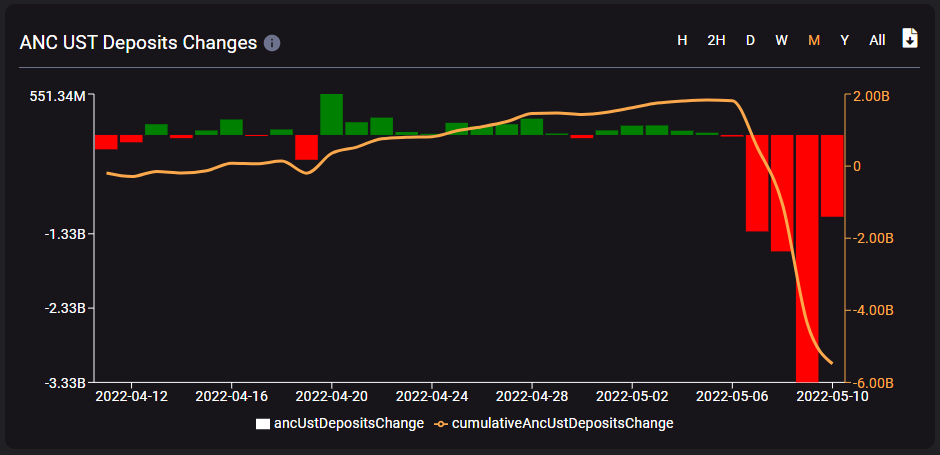

According to SmartStake, on May 9 users withdrew more than 3.3 billion UST from the protocol. In the first 24 hours of May 10, outflows totaled another 1.1 billion UST.

Users withdrew funds due to the deposit rate dropping to 17.87%. On May 8 this led to a a temporary loss of UST’s peg to the US dollar. However, by May 9 the figure had returned to around 20% — as outflows from Anchor eased, it became easier to pay the higher yield.

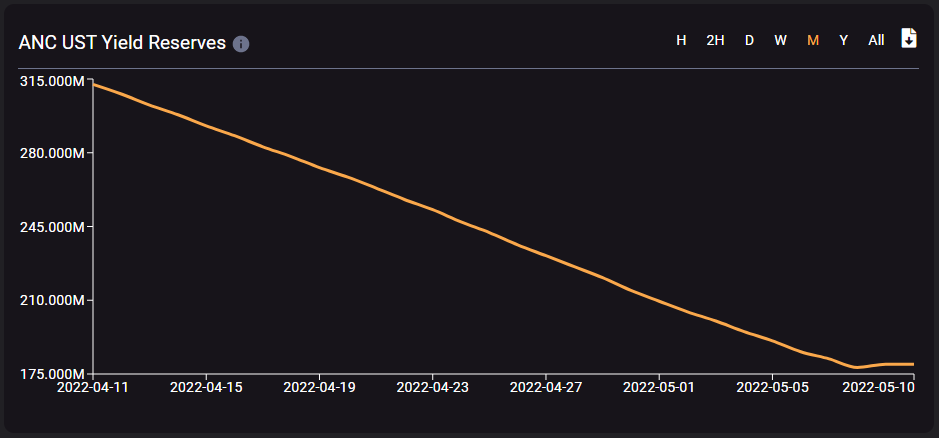

At the same time, the protocol’s yield reserve continues to shrink. As of writing, the pool holds less than 180 million UST.

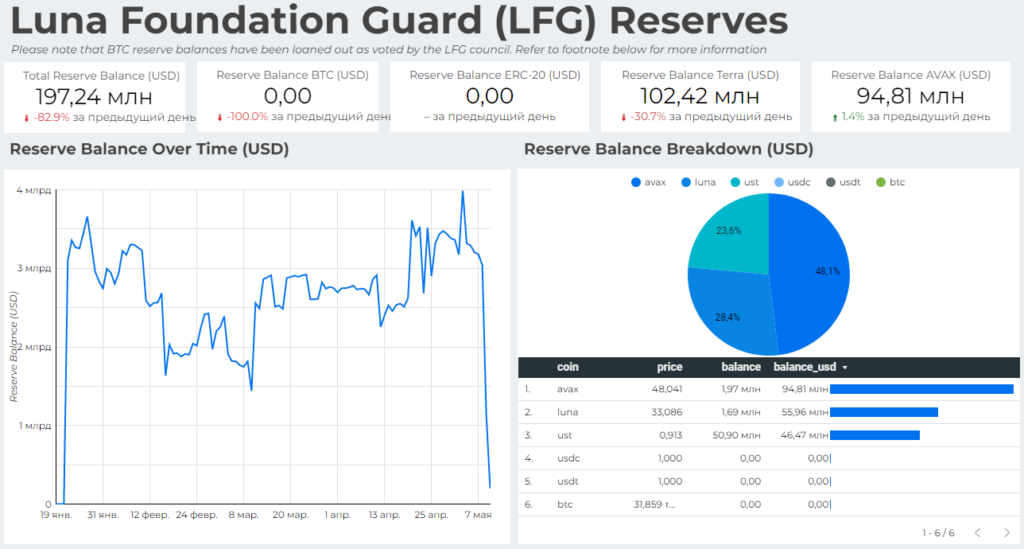

LFG board member Jose Maria Masedo told CoinDesk that reserves would be sufficient to restore a stable price for UST. However critics say the organisation has merely bought another day of time.

LFG using market makers to stabilize UST is fine imo. They were going to monetize their treasury one way or another. It buys them some time but it’s too little, too late. Optimistically it buys them a week. Pessimistically, less than a day.

— Galois Capital (@Galois_Capital) May 9, 2022

Analyst The Block Larry Cermak noted rumors that Jump Crypto, Alameda Research and other entities supporting the Terra ecosystem allocated an additional $2 billion to rescue UST. In his view, the only way to preserve the asset is to fully collateralize it.

I personally think the only way to save it now is by fully (or potentially very close to fully) collateralizing. Otherwise I don’t see it ever being used again

— Larry Cermak (@lawmaster) May 10, 2022

Terraform Labs chief Do Kwon stressed that LFG does not plan to abandon its Bitcoin holdings. He explained that transferring capital to market makers would provide the liquidity needed to stabilise UST.

2/ First, *LFG is not trying to exit its bitcoin position*.

The goal is to have this capital in the hands of a professional market maker such that:

1) Buy UST if price < peg

2) Buy BTC if price ≥ pegthus significantly strengthening the liquidity around UST peg

— Do Kwon 🌕 (@stablekwon) May 9, 2022

Jonathan Wu also suggested that trading companies are prepared to do whatever it takes to prevent a death spiral of UST. He said the outcome would depend on whether pressure from market makers overwhelms selling pressure from retail traders.

So what’s next?

Friendly marketmakers go to work on deploying a piece of the $BTC treasury to market-buy $UST and keep the peg up.

Hope is there’s more (falling-knife) $BTC collateral in LFG than there is bank-run pressure from people fudding $UST.

— jonwu.eth (@jonwu_) May 9, 2022

Popular analyst Hasu noted that Terraform Labs and LFG had another possible course of action.

Hate to give tips to ponzis but I’d just let the peg break down, not burn the treasury trying to support it. Wait until UST supply reaches treasury parity, then rebuild the asset as a collateralized stablecoin

— Hasu⚡️🤖 (@hasufl) May 9, 2022

“Hate to tip Ponzi schemes, but I’d simply let the peg break down, not burn the treasury trying to preserve it. Wait until UST supply reaches treasury parity, then rebuild the asset as a collateralized stablecoin,” he wrote.

Meanwhile, Terraform Labs said skeptics overstate the significance of what’s happening. The firm emphasised that UST is also backed by activity within the Terra ecosystem, and arbitrageurs need time to stabilise the asset.

2/ UST MCAP > LUNA — No death spiral happens.

https://ZjaaESPytt— Terra (UST) 🌍 Powered by LUNA 🌕 (@terra_money) May 9, 2022

Some say the incident, regardless of the outcome, will have serious implications for the crypto markets. Blogger Dennis Porter noted that regulators will use the UST collapse as the main argument for sweeping stablecoin regulation.

Mark my words. The UST failure will be used as evidence by policy makers to regulate stablecoins to death and champion CBDCs.

This is not good.

— Dennis Porter (@Dennis_Porter_) May 10, 2022

As ForkLog recently reported, Anchor’s problems could collapse Terra’s economy and the crypto market.

Follow ForkLog’s Bitcoin news on our Telegram — crypto news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!