At the end of 2023 the average fee on the bitcoin network exceeded $37 amid a wave of activity around Ordinals. Yet many users paid far more because their wallets contained a large number of UTXOs.

Together with the team behind the bitcoin mixer Mixer.Money, we explain how to optimise UTXOs and why keeping them in check matters for privacy on the network.

What is a UTXO

A UTXO (unspent transaction output) is a specific amount of bitcoin available for the wallet owner to spend.

It is akin to cash: you do not tear a $10 note in half; you hand over the full bill and get $5 in change. Unlike banknotes, however, UTXOs have no standard denominations and can hold any amount of BTC.

New UTXOs are generated in the coinbase transaction that pays miners for finding a block, as well as when users send bitcoin.

The set of all UTXOs at a given moment is called the UTXO set. Nodes track it to determine exactly how many coins exist and who can spend them. This prevents double spending on the first cryptocurrency’s network.

Why monitoring UTXOs matters

You do not need to manage UTXOs when storing bitcoin on an exchange — the venue handles that. On a non-custodial wallet, however, only you are responsible for your UTXOs.

With cash you decide which notes to use; with bitcoin you choose UTXOs.

You may have spent bitcoin from non-custodial wallets without seeing UTXO selection before sending. Many developers automate input selection to improve the user experience.

For those who want true control over their coins, some apps offer advanced UTXO management. In Ledger Live and Trezor Suite the feature is called Coin Control.

Which UTXOs you spend affects:

- fees. They depend on network activity and the number of UTXOs;

- privacy. UTXOs can tip off outsiders about your wallet’s overall balance and transaction history.

UTXOs and fees

Your wallet stores data about every UTXO. If there are many, the network must process a large amount of data when you move bitcoin to a new address. That can lead to:

- signing failures due to hardware-wallet limits;

- high fees during periods of congestion.

For example, the Coldcard Mk3 hardware wallet released in 2019 signs transactions up to 384 KB, while the 2022 Coldcard Mk4 handles up to 2 MB.

Current hardware wallets from Trezor and Ledger process most transactions, but if you have a great many UTXOs, signing can take minutes or fail. In such cases it is best to send bitcoin in several smaller transactions rather than trying to sign all UTXOs at once.

Investors who accumulate bitcoin via a DCA strategy often end up with lots of UTXOs. That can prove costly: they will pay many satoshis to move their coins.

The fee depends on the price per byte of data and the transaction’s size. Ten UTXOs contain more bytes than a transaction with two UTXOs.

Most wallets let you set the price per byte. If you choose 1 sat/vb (one satoshi per byte), you will pay the minimum. At 10 sat/vb your cost is ten times higher.

Why offer to pay more? It is not generosity; it is to ensure timely confirmation.

The bitcoin protocol adds 1–2 MB of data to the blockchain roughly every ten minutes. Typically users send more data than that. Those who paid less wait in the queue for the next block: miners prioritise higher-fee transactions.

With low network activity, low fees make sense. Otherwise miners may ignore the transaction until demand falls, or until you raise the fee using the Replace-By-Fee feature.

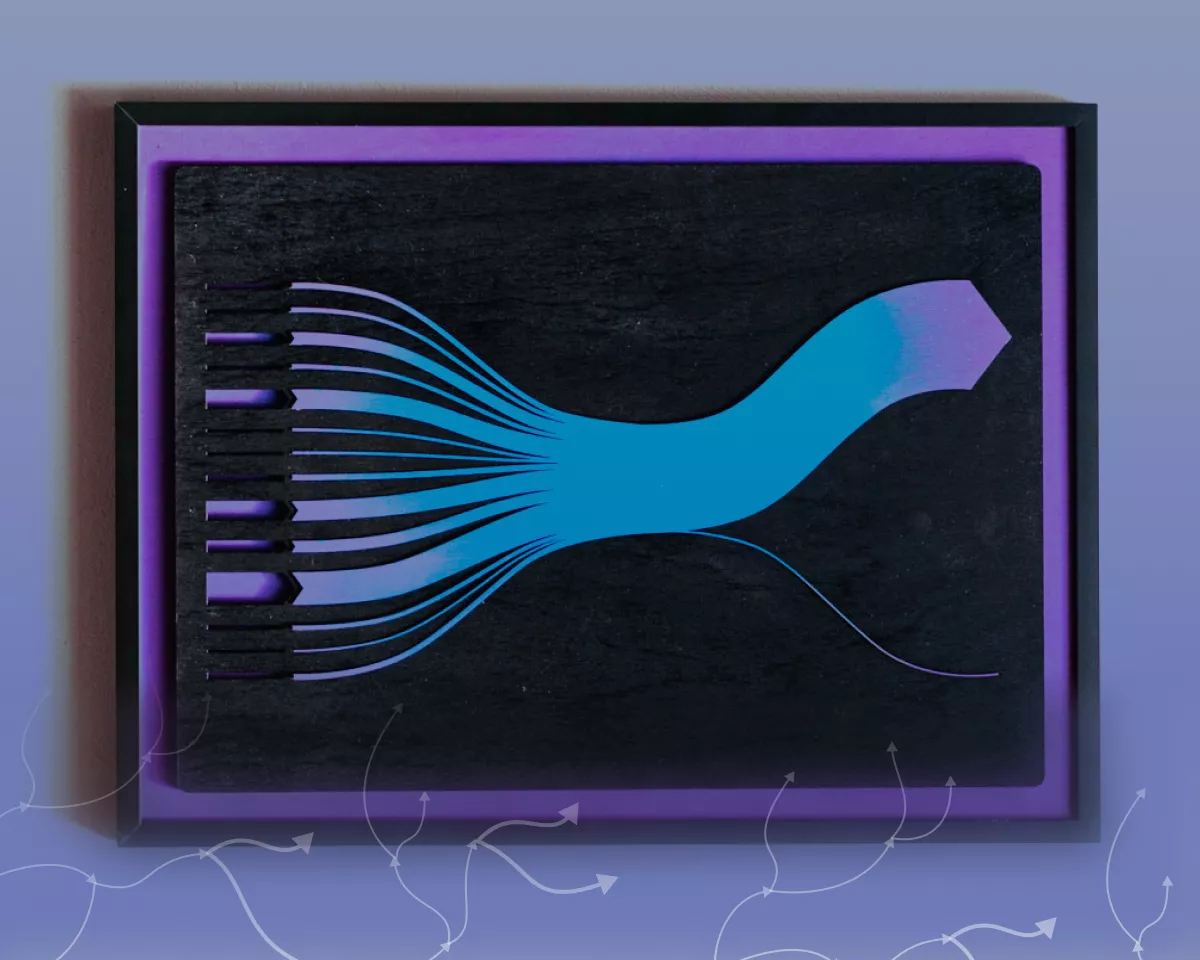

To visualise varying network conditions, look at the mempool over the past two years.

The height of the coloured area shows how much data is awaiting processing. Colours denote feerates: pink — 1–2 sat/vb, green — 10–12 sat/vb, yellow — 30–40 sat/vb.

In 2022 spikes faded within days. Miners relatively quickly included low-fee transactions.

A year later the picture changed. The mempool grew on strong demand. Low-fee transactions went unprocessed for weeks. To speed confirmation, users chose ever-higher feerates.

In congested periods you will pay more, and holding many UTXOs makes it worse.

Analysts at bitcoin company Unchained calculated that increasing the number of UTXOs from 5 to 100 can lift network fees by 20 times. Sending 1 BTC as 100 UTXOs at 100 sat/vb costs roughly 2,000 times more than sending the same amount as 5 UTXOs at 1 sat/vb.

Moving coins when fees are low is preferable, but not everyone knows when they will need to spend. With high feerates it is hard to predict how long it will take for fees to fall — demand may climb further.

You cannot control network activity, but you can manage the number of UTXOs via consolidation and by moderating how often you fund your wallet.

For example, with DCA you might transfer bitcoin to an external wallet once or twice a month, not daily or weekly. You would end up with fewer than 25 new UTXOs a year.

This approach means keeping part of your funds on an exchange. That adds risk, but if the bulk of your coins are already in cold storage, the compromise can be justified.

If your wallet already holds many UTXOs, you can still lower future fees by consolidating — combining them on one address. Create a transaction with the UTXOs you want to merge and send them to a new address generated by your wallet.

Say you have 10 UTXOs of 0.1 BTC. You can combine them and send to yourself. You will end up with a single UTXO. You will not have exactly 1 BTC, because you must pay a transaction fee.

So why consolidate if you must pay a fee — potentially a large one due to many UTXOs? You do it during periods of low demand to prepare for high fees, which are part and parcel of bull markets. Users often consolidate at weekends or use txfees.watch to catch a “discount”.

UTXOs and privacy

If anonymity matters, do not reuse an address for receiving bitcoin. That way you avoid revealing extra information about your transactions to third parties.

“The UTXO model provides a relatively high level of anonymity. You can interact with each UTXO separately, keeping them on unique addresses.

Modern wallets can generate new addresses for each transaction, allowing you to hide the link between them from an external observer,” representatives of Mixer.Money comment.

Two further points to bear in mind when sending bitcoin.

First, when you spend UTXOs you can reveal information about people you transacted with in the past.

For example, you combine several UTXOs from different addresses into one transaction. In doing so you demonstrate ownership of them. A company like Chainalysis may have known one address belonged to you; now it knows about the others as well. Analysts can study this and glean more about your activity.

Choose carefully which UTXOs to consolidate. For privacy’s sake it may be better to avoid consolidation altogether.

Second, the size of the UTXO you spend determines the change. For instance, you use a 1 BTC UTXO to send 0.1 BTC. The remaining 0.9 BTC goes to a new address as change. The recipient will see the sender controls at least 0.9 BTC.

Keeping coins in smaller UTXOs makes it more likely you can avoid revealing your overall balance via change.

However, to make a large payment you will have to combine UTXOs from different addresses, which can harm privacy. Two approaches can help:

- precisely determine how much bitcoin you will send to others in future and what you will buy, factoring in the exchange rate at the time. This is highly impractical;

- hold UTXOs of different sizes. Think of them as notes of different denominations in your wallet.

It is also best to select UTXOs each time you move bitcoin and to label each receiving address (wallets such as Sparrow Wallet support this). That can be a chore, especially if you acquired coins long ago and no longer recall who sent them.

In such cases coin-mixing services can help restore privacy. They break transaction chains so outsiders cannot link UTXOs to your identity.

“If you care about anonymity, you should not combine UTXOs from different trading platforms at one address. You can label them in your wallet and consolidate them separately. That way you will not disclose any additional information about your bitcoins to the owners of a specific trading platform.

However, users who decide to engage in UTXO management before a bull market often do not remember the details of old transactions. A bitcoin mixer will help correct possible mistakes.

In addition, by mixing coins you are essentially performing consolidation: you send all UTXOs and receive bitcoins to two addresses,” representatives of Mixer.Money comment.

In the “Full anonymity” mode, Mixer.Money sends the user “clean” bitcoins from large exchanges. Their participation reduces to zero the chance of receiving your own assets back or coins of dubious origin.

Conclusions

UTXO management is a useful habit for investors who regularly buy bitcoin and move it from exchanges to external wallets. Periodic consolidation can significantly cut fees in a bull market.

It also markedly improves privacy and helps disclose as little as possible about yourself to third parties.