VanEck forecast Ethereum to reach $11,800 by 2030

The fair value of Ethereum is $5,300, and by 2030 the asset could rise to $11,800. Such estimates made by VanEck after incorporating into the scenario model the use of cryptocurrency as an alternative to U.S. government bonds.

The Shapella hard fork, which allowed Ethereum to be withdrawn from staking, prompted a change in methodology.

In their calculations, analysts assumed that the second-largest cryptocurrency would capture 70% of the smart-contract platforms market.

This would be possible thanks to Ethereum’s status as the dominant global open-source settlement network, hosting a substantial portion of commercial activity with the greatest potential to benefit from its migration to the blockchain.

The optimistic scenario foresees the asset price at $51,006 by 2030 and its current fair value at $23,072. In the pessimistic case, the figures are $343.3 and $155.3.

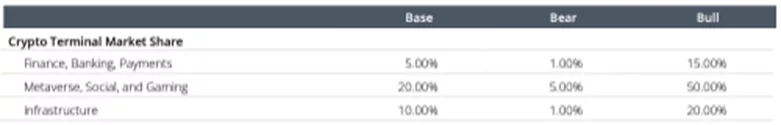

Differences arise from divergences in forecasted shares of economic activity for each business category, which will be to some extent linked to smart-contract platforms such as Ethereum. This, in turn, derives from the pace of blockchain adoption.

Analysts highlighted such areas:

- Fintech, banking and payments (FBP);

- metaverses, social networks and gaming (MSG);

- infrastructure (I).

FBP covers financial activity, including consumer and business payments, banking services and the exchange of value.

MSG encompasses software and online business that revolve around online social networks, data gathering, gaming and value creation in the virtual world.

I covers cloud computing, server space and distributed storage, as well as telecommunications and the internet.

Components of the fair-value model include transaction fees net of coins taken out of circulation, MEV, and Security as a Service.

Conceptually, the value of Ethereum can be used both within the network and beyond it to secure applications, protocols and the ecosystem.

Using projects such as Eigenlayer, coins can be applied to support such objects as oracles, sequencers, validators, bridges, contract agreements and, perhaps, new objects yet to be discovered, experts noted.

In the long term, the hard fork will lead to a positive trajectory for Ethereum’s price by reducing investors’ risk.

Earlier, exchange balances of the second-largest cryptocurrency neared record lows.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!