VanEck Predicts Ethereum L2 Tokens to Reach $1 Trillion Market Cap

The market volume of second-layer network tokens within the Ethereum ecosystem is projected to reach at least $1 trillion by 2030, according to analysts at VanEck in a report.

The investment company’s experts based their calculations on expected cash flow with a multiplier. Their revenue estimates include not only transaction fees but also income from MEV.

According to their forecast, the net revenue of L2 networks by 2030 will be approximately $41 billion, which, after applying a multiplier of 25, results in a fully diluted valuation (FDV) of tokens at around $1.02 trillion.

According to CoinGecko, at the time of writing, the market capitalization of coins in this segment reaches $34 billion, with the leading Polygon (MATIC) at $8.6 billion.

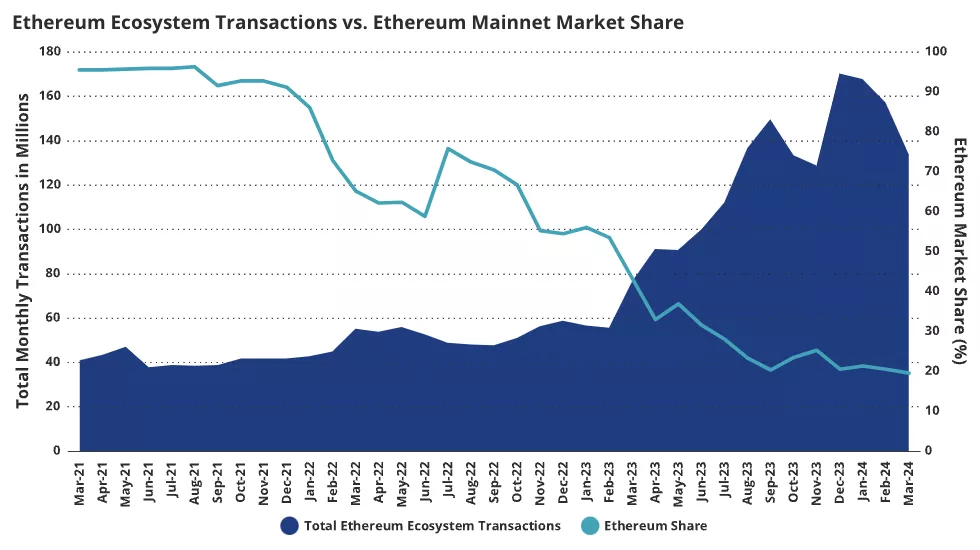

VanEck specialists noted that the development of L2 solutions for scaling Ethereum has led to a sharp decline in the base blockchain’s share of transactional activity.

Intense Competition Awaits the Sector

The implementation of the Dencun update allowed second-layer solutions to further reduce fees significantly. Networks based on Optimistic Rollups are in the most advantageous position due to a substantial reduction in the cost of publishing Ethereum data.

Among the most efficient rollups post-hard fork, VanEck specialists identified Mantle, zkSync, and StarkNet. The latter uses zero-knowledge proofs for verifying “bundles.”

To assess potential in the growing competition within the segment, experts analyzed 46 networks. They believe that beyond economic appeal, one of the crucial components will be projects competing for users by improving interfaces and user experience.

Security was also highlighted as a significant aspect by VanEck, with Arbitrum being defined as the “gold standard” in this regard.

Another important factor identified by analysts is the size of the TVL of networks. In this respect, Arbitrum ($16.3 billion), Optimism ($7.85 billion), and Blast ($2.43 billion) have demonstrated that they have created ecosystems attractive to users, they noted.

Ultimately, a few L2 networks are expected to dominate, although “thousands” of smaller rollups focused on specific tasks will continue to exist, VanEck suggested.

Overall Bearish Outlook for L2 Tokens

As the segment faces “ruthless competition,” analysts are skeptical about the prospects for the value of most network assets.

They noted that the seven largest L2 tokens already have a full capitalization of $40 billion, with “many strong projects” on the horizon in the medium term.

“This means that potentially another $100 billion in FDV could enter the market over the next 12-18 months. It seems like too large a volume for even a limited amount of this supply to be absorbed without massive discounts,” concluded VanEck specialists.

Back in March, Ethereum co-founder Vitalik Buterin explored scaling paths for the blockchain post-Dencun, which mainly focused on further expanding L2 network capabilities.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!