Venture Capital Investment in Crypto Startups Surpasses $90 Billion

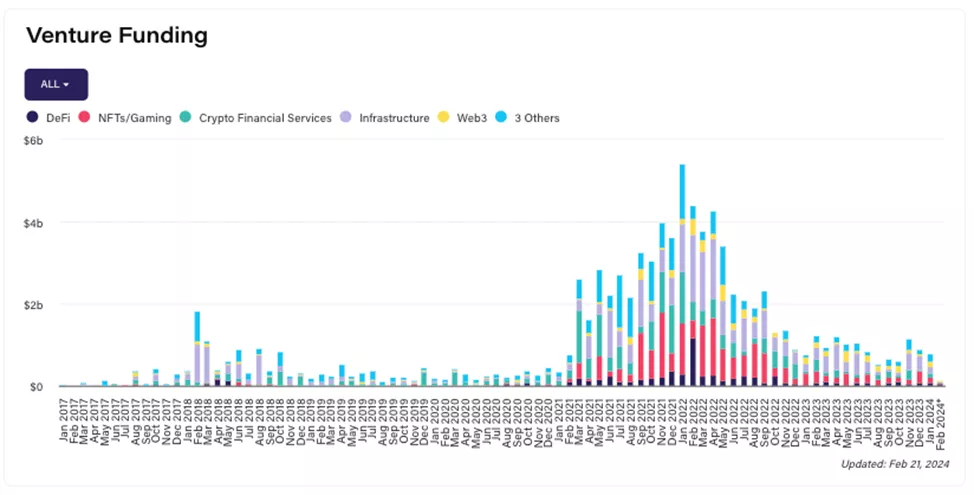

The cumulative amount raised by crypto and blockchain firms from venture investors since 2017 has exceeded $90 billion, according to data from The Block.

In February, analysts counted over 50 deals, with a total of 9500 transactions recorded since the inception of such statistics.

Since the beginning of the year, experts have counted 230 rounds amounting to approximately $1.3 billion.

Projects in DeFi, infrastructure, NFT/gaming, and Web3 attracted the most interest.

High activity was noted from Animoca Brands, Polychain Capital Framework Ventures, and Shima Capital.

“There are encouraging signs, although we do not see a significant increase in funding volumes,” commented John Dantoni, Director of Research at The Block.

Among notable deals, analysts highlighted investments by Tether and Solana co-founder Anatoly Yakovenko in Oobit for $25 million.

“Increased activity predominantly in pre-seed and seed rounds and a high risk appetite from Asian players, combined with growing interest in DeFi & DePIN, sets the stage for the start of a new digital asset cycle,” noted Dantoni.

According to statistics, the number of deals has increased while the average amount of raised investments has decreased. The monthly dynamics of the former remain stable, whereas the latter significantly lags behind the figures of 2021 and 2022.

In February, Hack VC raised $150 million for a fund named Venture Fund I, aimed at supporting projects for the Web3 ecosystem.

In 2023, venture capitalists invested $10.7 billion in blockchain startups.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!