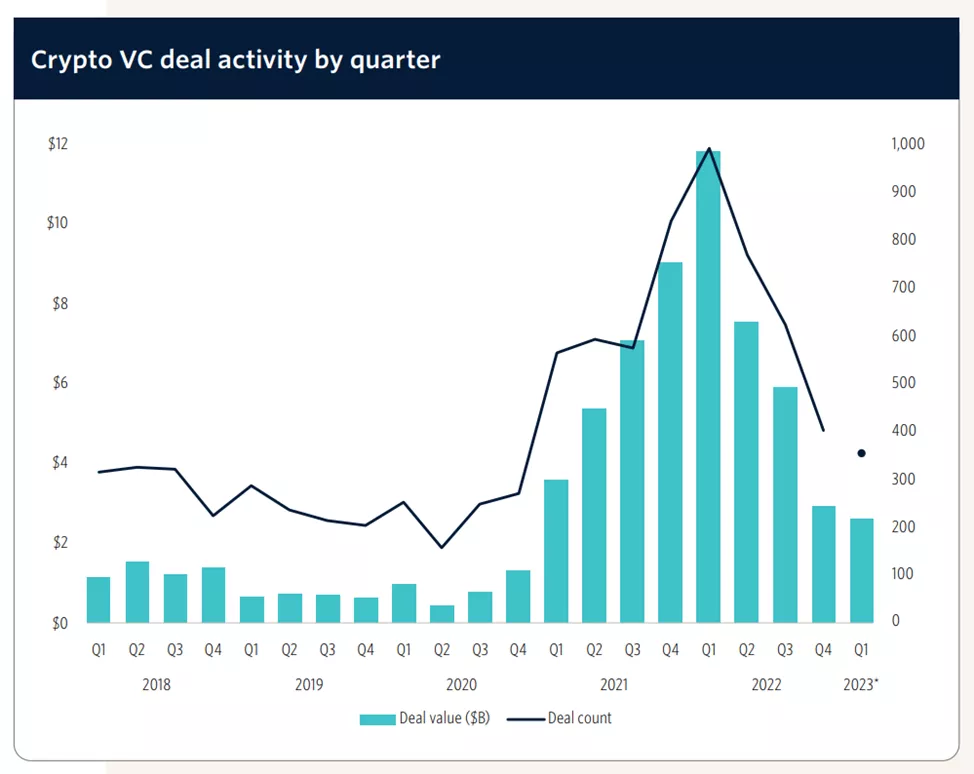

Venture capitalists invested $2.6 billion in crypto startups in Q1

For January–March 2023, venture investments in crypto startups across 353 funding rounds totaled $2.6 billion — the lowest since Q4 2020. The calculations are contained in the PitchBook report.

In monetary terms, the figure was 11% lower than the previous quarter, and the number of deals closed was down 12.2%.

The main metrics showed mixed dynamics. Year-over-year, funding in seed rounds rose by 33.3%, in late-stage rounds by 209.22%, while early-stage funding fell by 16.7%.

Analysts noted sustained investor interest in Ethereum-layer-2 solutions.

Among notable deals, they highlighted Blockstream $125 million for Bitcoin mining infrastructure development, Scroll — $50 million to build a network based on ZK-Rollup.

Experts also noted substantial fundraising by custodial services — Ledger ($493 million) and Taurus ($65 million).

PitchBook analyst Robert Le attributed the slowdown in venture activity to rising interest rates and the collapse of SVB — the backbone bank for such firms. The analyst suggested that the worst stretch of the ‘financial drought’ may be ending.

In February, Abu Dhabi launched a $2 billion fund to back startups in the sector.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!