Venture Deals in Crypto Industry Surge to $6 Billion in Q1

The volume of venture deals involving cryptocurrency startups reached $6 billion by the end of January-March, according to data from PitchBook, reports Cointelegraph.

For comparison, the figure for the same period last year was $2.6 billion, and $3 billion for the fourth quarter.

In terms of quantity, 405 deals were recorded, which is 39.5% less than in January-March 2024 (670), but slightly more than in October-December (372).

Despite macroeconomic upheavals during the quarter, “capital continued to seek out the primary useful applications of cryptocurrencies,” analysts noted.

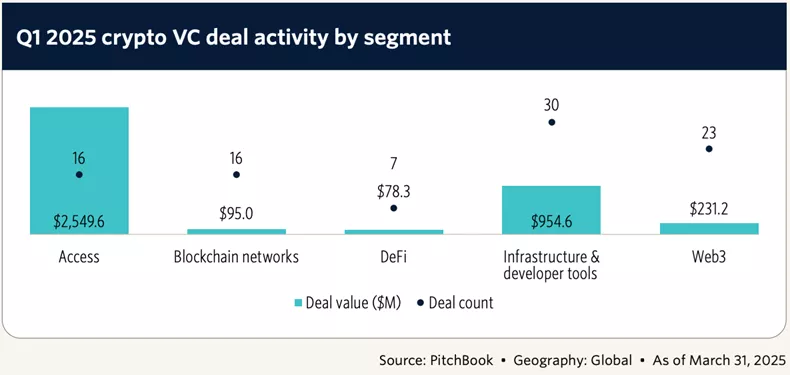

The main recipients of funds were digital asset managers, exchanges, and financial service providers — $2.55 billion across 16 deals.

Next in line were infrastructure and development firms — approximately $955 million across 30 deals.

Third place was taken by startups focused on Web3 — $231.2 million across 23 deals.

Experts noted that the anticipated IPO of Circle “represents the most significant event for cryptocurrencies since Coinbase went public in 2021.”

If the market values the company above the stated range of $4 billion to $5 billion, venture investors will receive a signal of the resilience and profitability of business models similar to Circle, as well as a clearer benchmark for future deals.

Separately, experts highlighted the “disruptive impact” of applications with dollar stablecoin settlements. In the first quarter, the capitalization of “stablecoins” grew by 12%, from $202.3 billion to $227.1 billion, amid stagnation or decline in other market sectors.

PitchBook forecasted further interest growth in startups in the fields of payments, remittances, and treasury management, “which directly monetize the velocity of stablecoins.”

In light of the Bybit hack, analysts noted the potential for increased institutional demand for real-time proof-of-reserves tools, improved custodial solutions, and key management software.

In May, the share price of trading platform eToro was $52, exceeding the initial IPO range of $46-50, reflecting increased investor demand.

In April, Circle postponed its securities offering amid a correction following the announcement of “liberation tariffs” by U.S. President Donald Trump.

From May 19, Coinbase will become the first crypto company whose shares will be included in the S&P 500 index.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!