What a US government shutdown would mean for crypto

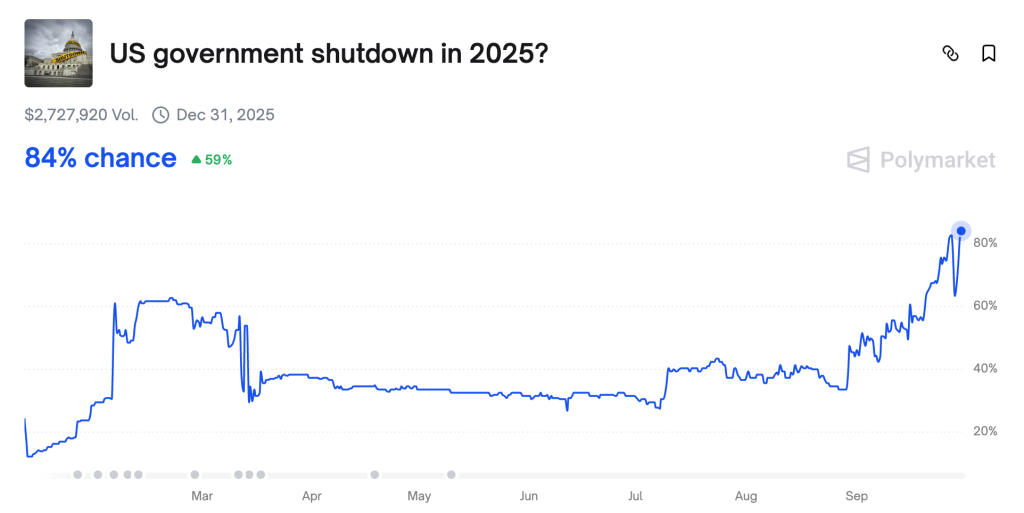

Polymarket puts US shutdown odds at 84%; analysts warn of crypto risks.

The probability of a US government shutdown from October 1 has risen to 84% on Polymarket. The threat of a shutdown poses risks for the cryptocurrency market, analysts warned.

“A shutdown of the US federal government is not just political games in Washington. It creates uncertainty that spills over into global markets, and cryptocurrencies feel this shock too,” said AvaTrade chief market analyst Kate Lyman in a comment to DL News.

The potential shutdown stems from a lack of agreement on the budget. Democrats are pushing to increase health-care funding. Republicans oppose it, proposing only to extend the budget temporarily until 21 November, Bloomberg wrote.

Earlier, US President Donald Trump predicted high odds of a shutdown.

“We will continue negotiations with the Democrats, but I believe the country may face a temporary cessation of government operations,” he said.

According to Reuters, US Vice President JD Vance noted that such an outcome is “inevitable”.

Implications for the crypto market

In the event of a shutdown, the government will stop publishing employment and inflation data. Without these signals, Lyman said, it becomes “harder to read the economy and predict the next moves of the Fed”.

The Fed is considering a second key-rate cut in October. Monetary easing is usually a bullish factor for the crypto market.

“A shutdown [of the government] will slow critical progress on crypto policy,” said Blockchain Association representative Jessica Martinez in a conversation with CoinDesk.

The CLARITY Act — a bill that would create a regulatory framework for the entire crypto sector — is currently before the authorities. On 18 July, the US Congress approved it. Republicans had planned to pass the initiative by the end of September, but in the event of a shutdown the timeline will slip.

A shutdown could also slow work at the SEC, which is reviewing applications for spot crypto ETFs and developing rules for the crypto market.

“A combination of less information and slower oversight usually unnerves risk markets. Cryptocurrencies, already sensitive to market sentiment, may display even sharper swings,” Lyman said.

What about bitcoin?

Investor Ted Pillows cited historical data. In his view, the S&P 500 and the crypto market usually fall ahead of a US government shutdown.

“I reckon this week it may cause significant volatility,” he emphasised.

A researcher under the pseudonym Zac agreed with this view. He called the shutdown “political theater with short-term costs, but no lasting market damage”.

Government shutdowns = political theater, real short-term costs, no lasting market damage. Looming 2025 shutdown (Sept 30 fiscal year end, Oct 1 freeze) has ~66% odds priced in.

Key difference now: Bitcoin and crypto are tied to macro cycles, liquidity flows, regulatory delays.… pic.twitter.com/h857BFsfU5

— 🛡️Zac (@zacxbtc) September 23, 2025

Web3 researcher Vladimir Menaskop suggested looking at the situation through three lenses: bureaucratic, political and economic.

In his opinion, although bureaucratic delays and political confusion may provoke a jittery reaction among speculators, the key to understanding the outlook lies in the deeper economic context.

“A shutdown is not a cause but a consequence; you have to dig deeper: the problem is that the story with tariffs by Trump, for that matter, is not clear to everyone and not accepted by all. And in general it is aimed at the same as the support for stablecoins — the return of US dominance in the global economy. Therefore I would not overlay the short-term effect (bureaucratic and political) on long-term trends: while two giants fight (the US and China), crypto-enthusiasts may well feel at ease, and Web 3.0 and Web3 can develop,” he told ForkLog.

A potential shutdown in 2025 would not be the first the crypto market has lived through. In October 2013 it lasted 16 days. Bitcoin’s price then rose by 14% — from $132 to $151.

But the first cryptocurrency’s upward trend in such periods is not a rule. The longest shutdown began in December 2018 and lasted 35 days. Over that time, the price of digital gold fell by 6% — from $3802 to $3575.

CryptoQuant head of research Julio Moreno noted that during the shutdowns in 2013 and 2018 bitcoin was “in completely different markets”.

“Demand for the asset was growing strongly as it was entering the final stage of a bull cycle [in 2013],” he told Decrypt, adding that by the time of the 2018 shutdown demand for the cryptocurrency was shrinking during a bear market.

In his view, bitcoin today looks more like it did in 2013 than in 2018.

At the time of writing, digital gold is trading around $113,400. Over the past 24 hours its price has risen by 1.2%.

Earlier, Glassnode analysts recorded a capitulation of bitcoin speculators. Market participants suggested the correction is nearing its end.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!