What is coin burning and how does it affect prices?

What is coin burning?

It is the irreversible removal from circulation of a set amount of coins, either at the owner’s discretion or under a predefined algorithm. Burn addresses and smart contracts can be used to destroy assets. The procedure may also run automatically when transactions are executed.

Coins can be removed from circulation by various actors: private individuals, companies, trading platforms and decentralised applications. Burning is embedded in the design of many cryptocurrencies.

Different sources of assets can be used. Funds may be part of a custodial or decentralised exchange’s profit. Transaction fees can be burned, as implemented by some cryptocurrencies. There is also a Proof-of-Burn (PoB) consensus mechanism that removes a portion of validators’ assets from circulation.

The procedure is used, for example, to create deflationary currencies. Projects may burn to distribute profits among holders. Burning can also serve practical purposes: reducing network load, protecting against spam, or enabling a specific consensus mechanism.

How is coin burning implemented technically?

Sending coins to an address for which no private key exists destroys them. One can send funds to an erroneous address or to one deliberately generated for that purpose; creating such addresses is straightforward.

Addresses intended for burning can be found on various information resources. They exist on the Bitcoin network (discussion), Ethereum, and other blockchains.

For example, there is the bitcoin address 1BitcoinEaterAddressDontSendf59kuE, used for this purpose. A significant amount has already accumulated there. You can view the balance and transaction details using a blockchain explorer.

There is currently no technology that lets one derive a private key from a known recipient address. This guarantees that coins sent to such accounts are irretrievably lost. Many use this method to destroy digital assets. Such addresses and burn transactions can be found when analysing different blockchains.

In modern networks, a dedicated smart contract is used to destroy funds. In Ethereum, the burn function allows ETH and tokens of various standards to be removed from circulation.

When burning, the number of coins to be removed must be specified. If the user’s balance suffices, the smart contract locks the specified amount of tokens and destroys them permanently.

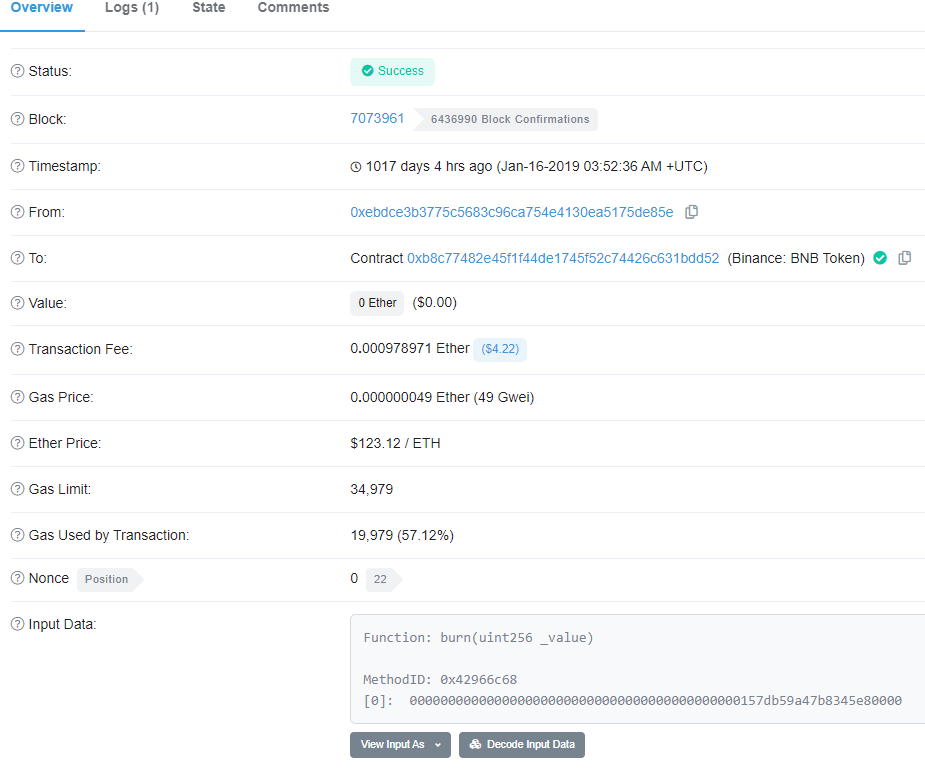

You can view the details of one such operation on Etherscan. The transaction data include information about the coins removed from circulation (in this case, BNB).

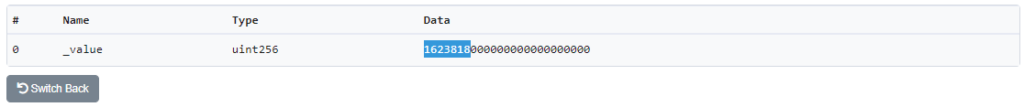

After clicking Decode Input Data, you can see the details:

The number contains 18 decimal places and shows that 1,623,818 BNB were burned. Execution of the smart contract guarantees the removal of these assets from circulation.

In some cases, burning is built into a project’s or cryptocurrency’s algorithm. Removal from circulation is an additional operation executed when assets are transferred. As a rule, the transaction fee (partially or in full) is burned.

Miners can also remove coins from circulation using special software. This can be implemented by foregoing transaction fees when confirming a block. If the transfer of funds to the miner is not recorded on-chain, those assets go to no one.

The project Slimcoin was among the first to implement Proof-of-Burn consensus. The algorithm requires miners to send coins to burn addresses. The result of the transaction is a special hash that allows PoB blocks to be formed. These alternate with Proof-of-Work (PoW) blocks. Burned coins gradually “decay” (Decay). Technically, this is implemented using a multiplier that depends on the number of coins removed and the time elapsed since then. For example, the multiplier for a burn transaction of 60 coins will triple after 1,000 days. The same result is achieved by destroying 20 tokens after the specified time. Thus, 40 coins have “decayed” since the first transaction.

The probability of generating a PoW block is proportional to the computing power bought with capital. By analogy, the probability of finding a PoB block depends on the number of coins expended (burned). The algorithm allows participants to forgo purchasing hardware to gain advantage. Instead, they can burn coins now to seek higher future income without capital investment.

Where do the funds for burning come from?

Assets are burned at the owner’s voluntary decision. If token destruction is embedded in a project’s design, developers disclose this in advance, typically in the whitepaper. Users can therefore avoid projects that burn tokens (including as part of paid fees).

Those initiating burns pursue certain aims—stated or unstated. To achieve the desired effect, they may disclose the sources of funds used.

A project may burn part of its own income. This model is used by several crypto exchanges, which deploy revenue to buy tokens on the open market. Such actions create additional demand for the project’s native token. After purchase, the tokens are destroyed. An alternative to buybacks is removing exchange-owned funds from circulation.

Burning reduces total supply. All else equal, this supports the asset’s price if demand is steady or rising.

Burning is also used to remove fees on various platforms, exchanges and other projects. In August 2021 the Ethereum network executed the London hard fork. One of its changes, EIP-1559, introduced the burning of part of transaction fees. As a result, conditions were created under which ETH can become a deflationary cryptocurrency.

With EIP-1559 a base fee was introduced, which adjusts algorithmically and differs for every block. Even during heavy network congestion its value is predictable and known in advance. This avoids situations where fees in adjacent blocks differ by multiples. In the current implementation the base fee is burned entirely.

There is also a priority fee that grants the sender preferential inclusion of a transaction. This fee, as well as the block reward, is paid to the miner.

Depending on network load, ETH’s total supply can decrease or increase. Its evolution can be tracked using ultrasound.money. Deflationary blocks may appear when the base fee exceeds the priority fee and the block reward. In such cases more value is burned than issued. The emergence of deflationary blocks is linked to higher network load (more transactions). Detailed analytics are available via Deflationary blocks.

Fee burning can serve multiple aims, including spam protection. In this case, fees are burned partially or fully. Such a mechanism is implemented in Avalanche, Ripple and other projects.

Burning was used by Neblio during its ICO. The operation destroyed unsold tokens from the primary sale.

Which projects burn coins periodically?

The Binance platform conducts quarterly burns. Its whitepaper planned the removal of the native BNB token using 20% of profit for the period. Burns will continue until total supply falls to 100m coins.

Token burns are announced and covered on the platform. Initially destruction took place on Ethereum, with the amount calculated from spot trading volumes. BNB is now burned on Binance Chain.

The platform’s growth has created additional revenue sources. At present the amount burned is calculated from total trading volume. Developers also propose an improvement to Binance Smart Chain that, by analogy with Ethereum, would burn part of transaction fees.

Bitfinex, owned by iFinex, also removes coins from circulation. In 2019 the operator issued the UNUS SED LEO (LEO) token with a supply of 1bn. According to the whitepaper, iFinex undertakes to buy and burn LEO monthly using more than 27% of consolidated revenues. The company lets users track token removals in real time.

The non-custodial platform PancakeSwap also periodically burns coins. CAKE tokens from different sources are removed from circulation.

Various projects regularly burn coins and provide detailed disclosures. To track planned burns, use one of the cryptocurrency calendars. For example, up-to-date information is available from Coindar (select the tag burn).

How does burning affect an asset’s price?

Depending on the stated goals and the algorithm under which coins are destroyed, burning can affect an asset’s price differently in the short and long term.

Exchanges and other projects that spend part of their income to buy tokens on the market and destroy them exert the strongest influence. Price is closely linked to the balance of demand and supply. Regular purchases therefore tend to support prices.

Buying or burning a significant sum can trigger a sharp price jump. Over the long term, such actions can deliver additional appreciation. These events influence the market similarly to currency intervention.

Some projects hold substantial amounts of their native tokens. They can burn part of their existing holdings using earned income. Supply falls, but no market purchases are required. This creates positive newsflow, though compared with buybacks the impact is smaller. Even so, lower supply can support prices.

PoW cryptocurrencies reward miners via block rewards and transaction fees. The burning of fees or validators’ funds cannot be viewed in isolation. In such settings, burning occurs in parallel with issuance. As a result, the number of coins can rise or fall. It is also possible for burned tokens to return to circulation after some time.

The impact of such actions is indirect. A pronounced fall in circulating supply is typically good news, boosting an asset’s popularity and price. To understand the picture, analyse supply dynamics and the number of deflationary blocks. This information is available from specialised analytics resources.

Follow ForkLog on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!