What is Polymarket?

What is Polymarket?

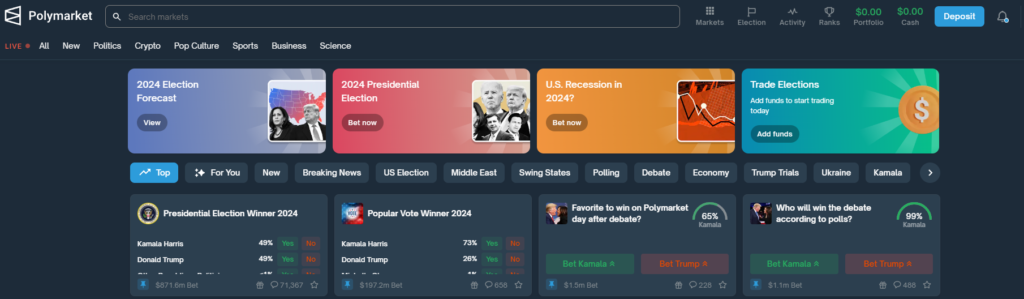

Polymarket is a decentralised prediction‑market platform that lets users wager on the outcomes of various events using cryptoassets.

“Research has shown that prediction markets are generally far more accurate than polls and expert forecasts. Traders take into account all available information: news, polls, and analysts’ opinions, making considered decisions based on this pooled knowledge,” says the project’s website.

Founded in 2020 by Shayne Coplan, the service uses blockchain technology and smart contracts. It initially ran on Ethereum, and later added support for Polygon, where transaction costs are relatively low.

How does Polymarket work?

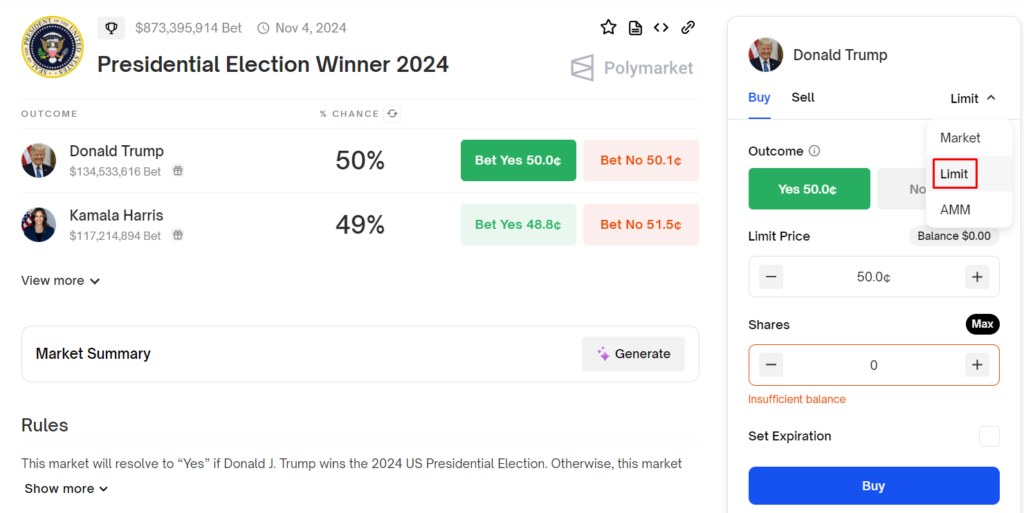

The Dapp lets users bet on real‑world events in areas from sport and politics to pop culture, and create new markets.

Participants trade “shares” in possible outcomes. The more users back a given result, the higher the price of the corresponding instruments rises. If the prediction is correct, traders receive rewards proportional to the amount staked.

Thus, prices reflect current probabilities of events.

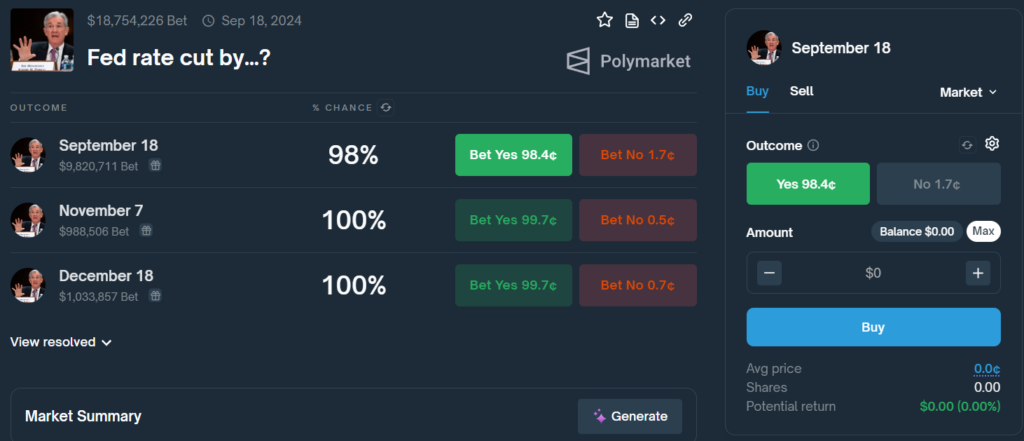

For example, in the Fed rate cut by…? market, “shares” for 18 September trade at 98.4 cents. This implies a crowd‑implied 98% probability of a cut.

If most participants in this market turn out to be right, each purchased “Yes” share will be worth $1—so the profit per share will be roughly 2 cents. Conversely, those who bought “No” will see their stake go to zero.

“But you are not locked into your trade: you can sell your ‘shares’ at any time at the current odds,” the Polymarket developers note.

They say users should look for markets where they disagree with current probability estimates and “profit by staking according to their convictions.”

The project uses UMA’s Optimistic Oracle, a system of blockchain oracles. Users can exit markets freely before resolution thanks to the AMM.

How to earn passive income on Polymarket?

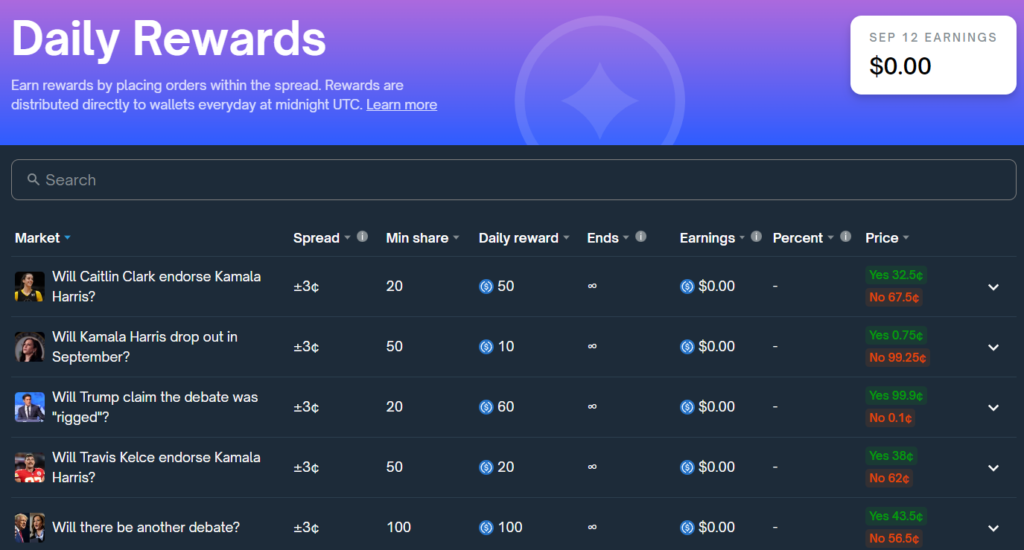

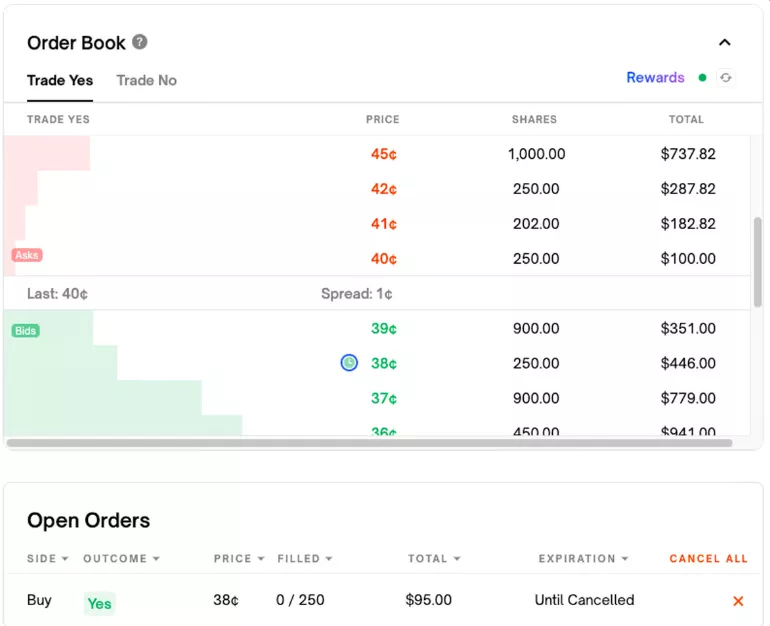

Polymarket has a liquidity‑rewards programme: users can earn by placing limit orders that support market activity and balance.

“The closer your orders are to the market mid, the more you earn. Your reward depends on the usefulness of your orders—their size and price level compared to other participants. The more competitive your limit orders, the more you can earn,” the project’s website explains.

Payouts are made daily based on how much liquidity a user’s orders add. The Rewards section shows accrued rewards and other market information.

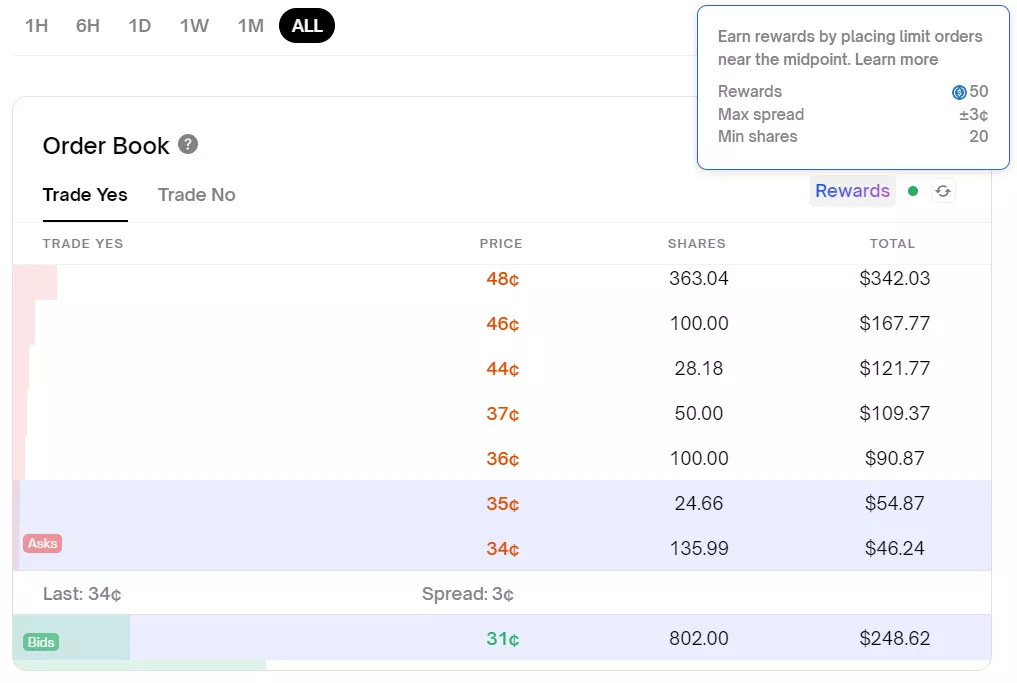

Each market has an order book. Users can hover over the Rewards button to see the amount of rewards available.

Blue lines indicate the maximum spread—the distance a user’s limit order can be from the market mid‑price to earn rewards. In the example: if the spread is 3 cents, every order within 3 cents of the mid will be eligible.

When rewards are accruing, users will see a clock icon outlined in blue:

Payouts are processed automatically each day around midnight UTC.

How to get started with Polymarket?

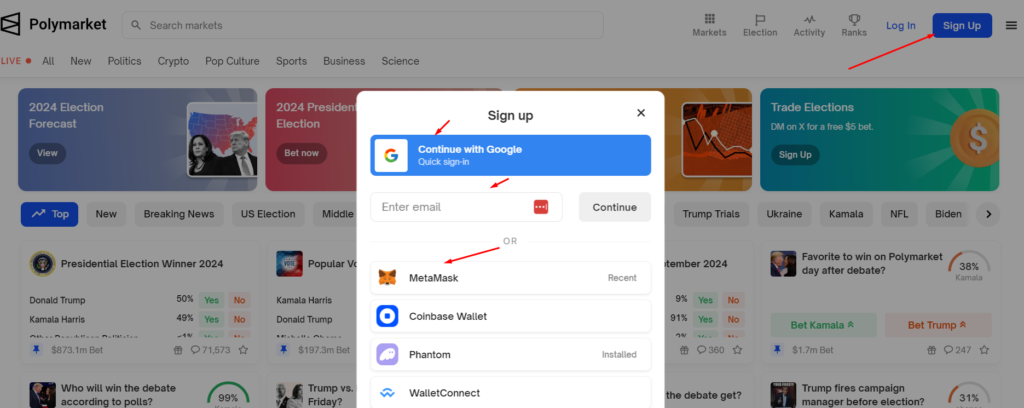

You can register on Polymarket using email or a Google account, or via a popular Web3 wallet such as MetaMask, Phantom or Coinbase Wallet.

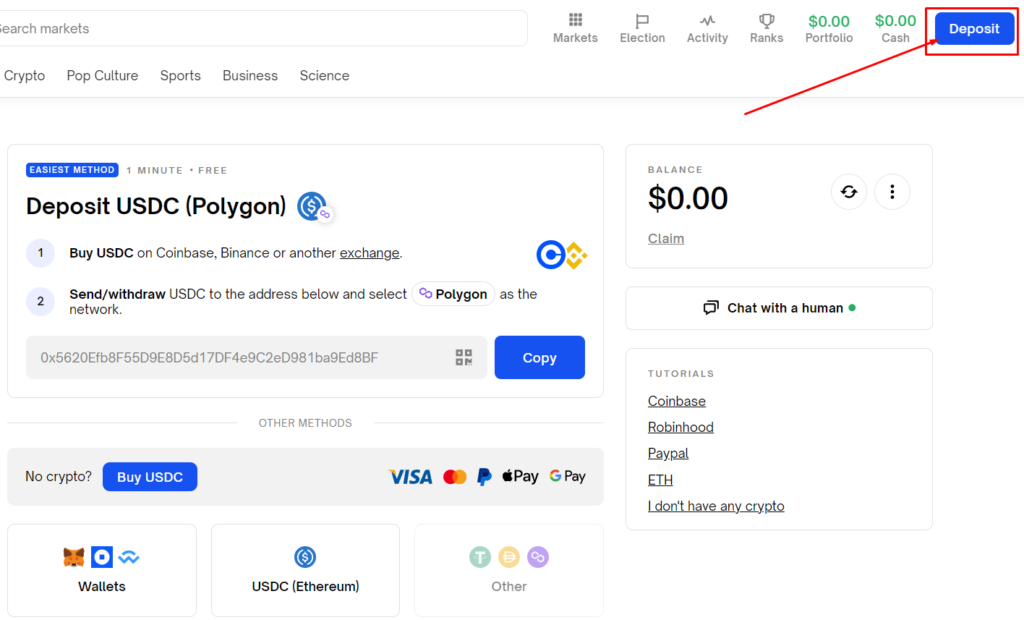

After logging in, deposit funds by clicking the Deposit button at the top right. The platform will prompt you to send USDC on Polygon to a generated address:

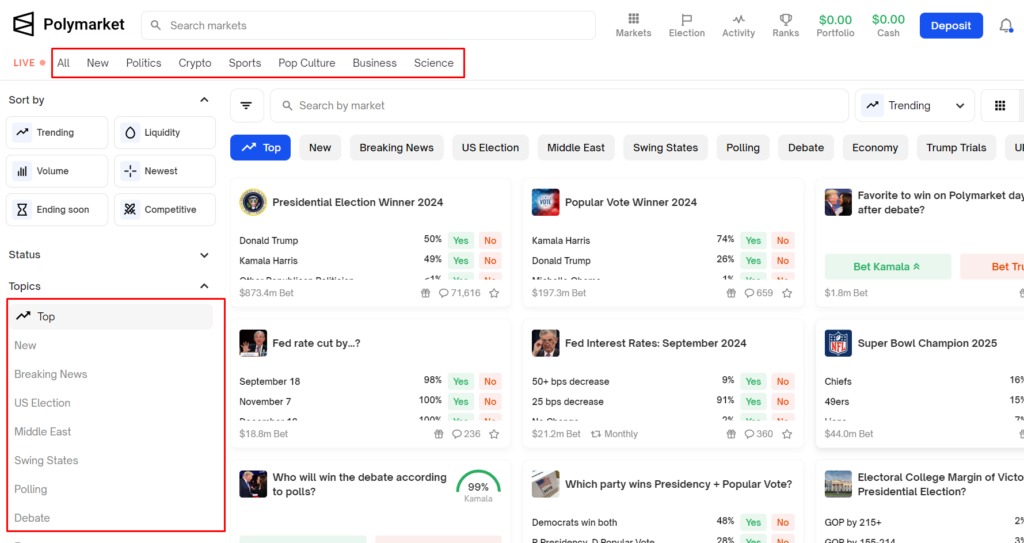

Then choose markets to bet on future events, sorting them (Sort by) by parameters such as novelty, liquidity, volume and trendiness.

To place a bet, click Yes or No on the chosen market, enter the Amount and hit Buy. The example below shows purchasing shares at the market price.

You can also use limit orders, which execute only at a specified price:

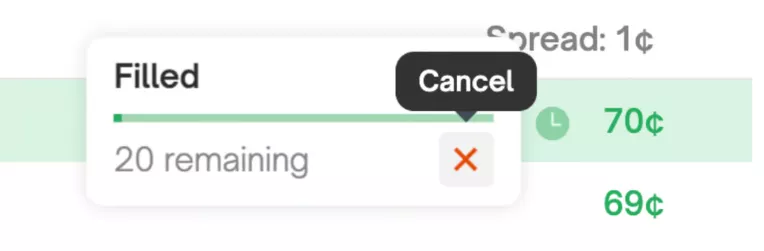

There is an option to set an order expiry date. If the order is not filled at the set price within the chosen period, it closes automatically.

To cancel an open order, click the red cross that appears when you hover over it.

How is Polymarket developing?

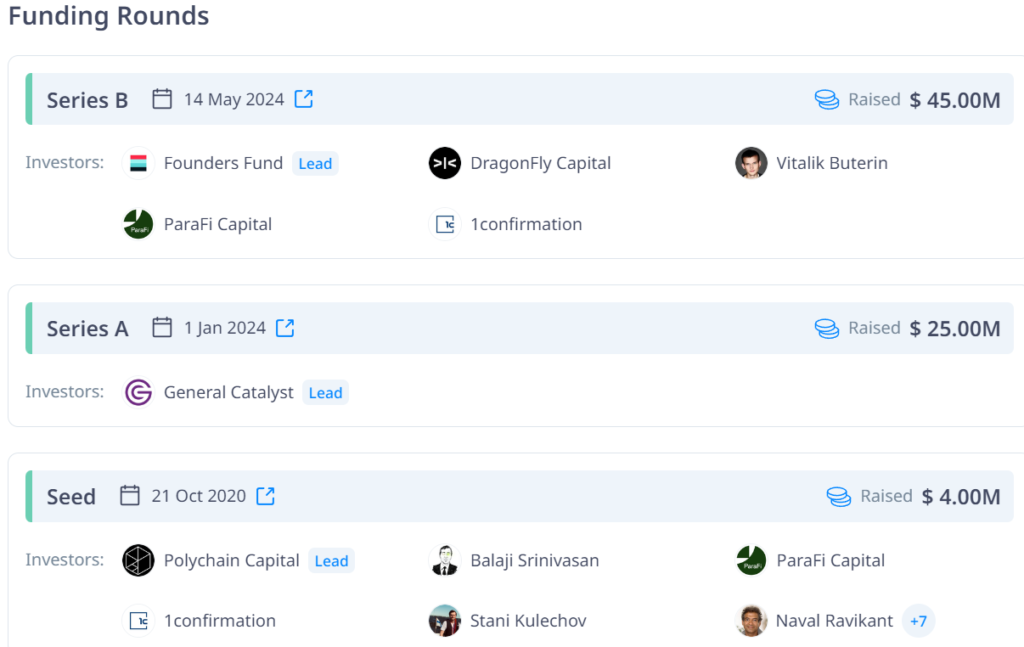

Polymarket’s beta launched in 2020, soon raising $4m in seed funding from Polychain Capital, AngelList chief Naval Ravikant, former Coinbase CEO Balaji Srinivasan and CoinShares’ chief strategy officer Meltem Demirors.

Within three months of launch, trading volume on Polymarket surpassed $1m. Community interest intensified amid America’s election campaign.

In late 2021 America’s Commodity Futures Trading Commission (CFTC) opened an investigation into Polymarket, examining whether the firm violated laws by offering swaps and binary options and whether it needed to register with the agency.

In early 2022 the CFTC fined the prediction‑market platform $1.4m. Officials stressed that “all derivatives markets must operate in accordance with the law, regardless of the technology used.”

As part of the settlement, Polymarket restricted trading access for users in the United States.

Despite regulatory hurdles, the platform continued to grow rapidly—its popularity has accelerated since May 2024. That month the project raised $70m across two rounds, with participation from General Catalyst, DragonFly Capital, ParaFi Capital, Vitalik Buterin and others.

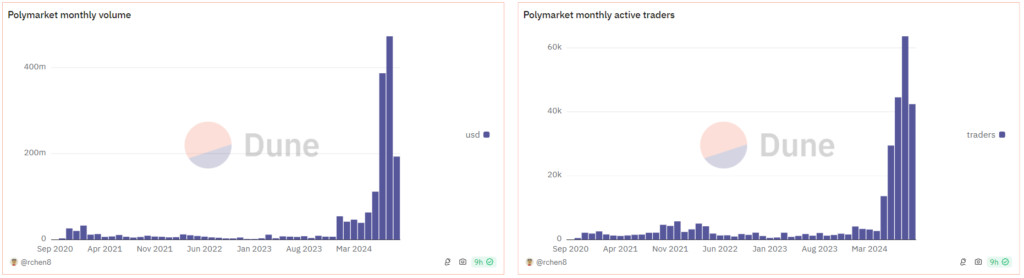

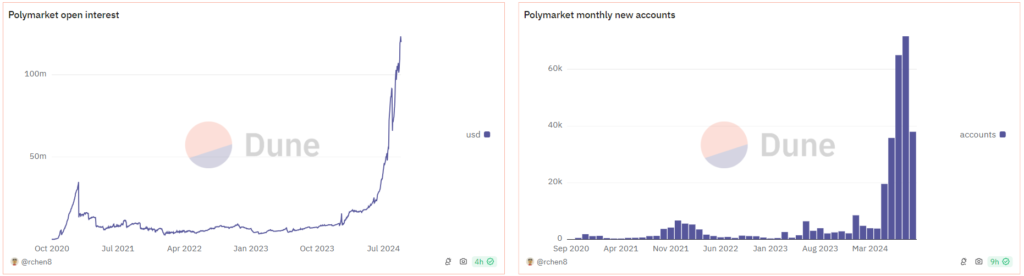

In July, monthly trading volume on Polymarket hit a record $472m, and the number of active traders exceeded 60,000—nearly 16 times April 2024’s tally.

Open interest continues to climb, and new accounts are appearing:

The project does not yet have a native token.

In early September Shayne Coplan announced the integration of the decentralised prediction platform into a computer system from Bloomberg.

“What was once a fringe, sci‑fi idea for transforming the flow of information has now become a new reality. Tens of millions of people are developing the habit of relying on Polymarket’s forecasts as a source of truth to understand what is happening in the world. And these are still the early days,” he wrote.

Who competes with Polymarket?

The most obvious rival is BET from the team behind the Drift perpetuals protocol. Daily stakes on the launched in August Solana platform soon topped $23m.

The new service offers features such as cross‑margin trading and structured bets. It uses a liquidity pool and the Drift stack.

PancakeSwap in June launched a prediction market. Users can bet on the direction of Ethereum’s price, guided by AI‑generated forecasts.

In September developers of the leading DEX on BSC launched a Telegram bot that lets users predict the movement of BNB’s price every five minutes.

To take part, a stake as small as 0.001 BNB is enough. Correct predictions earn a share of the prize pool.

The Gnosis protocol, launched in 2015, stands out for high decentralisation and flexibility in creating prediction markets. It uses Gnosis Conditional Tokens to split assets into scenarios tied to specific events.

The Gnosis ecosystem includes the multisig wallet Safe, the DEX aggregator CoW Protocol, the Ethereum sidechain Gnosis Chain and Gnosis Auction, a decentralised platform for running auctions.

Augur is one of the earliest Web3 prediction‑market projects. Created in 2014, the platform enables forecasting via Ethereum smart contracts.

With the 2020 upgrade to Augur v2, support was added for the over‑collateralised stablecoin DAI and IPFS, the user interface was improved, and oracles from Chainlink were integrated.

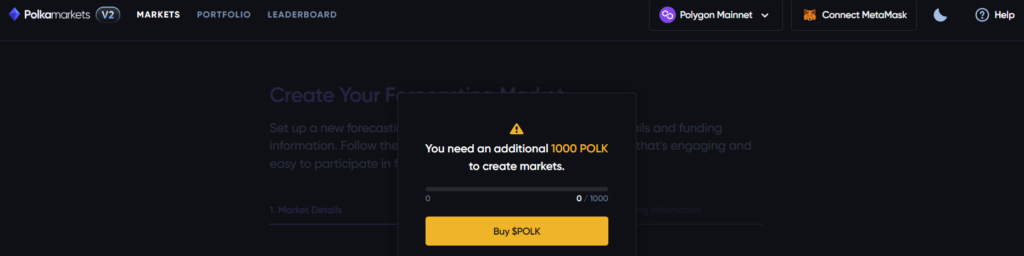

The Polkamarkets project runs on Ethereum, Moonbeam and Polygon, using an AMM to provide liquidity. Creating a market requires 1,000 POLK tokens; LPs receive a share of fees.

SX Bet is a “prediction exchange” launched in 2021 with its own SX token of the ERC‑20 standard. The coin can be staked to earn additional rewards and reduce betting fees. Wagers can be placed using the utility token as well as the USDC stablecoin.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!