What makes Berachain’s modular blockchain tick — and is an airdrop likely?

- Berachain is a modular, EVM-supporting layer-1 blockchain project that uses Proof-of-Liquidity consensus.

- The platform employs a three-token model: BERA for gas, BGT for governance and HONEY as a stablecoin, helping to prevent centralisation and spur on-chain activity.

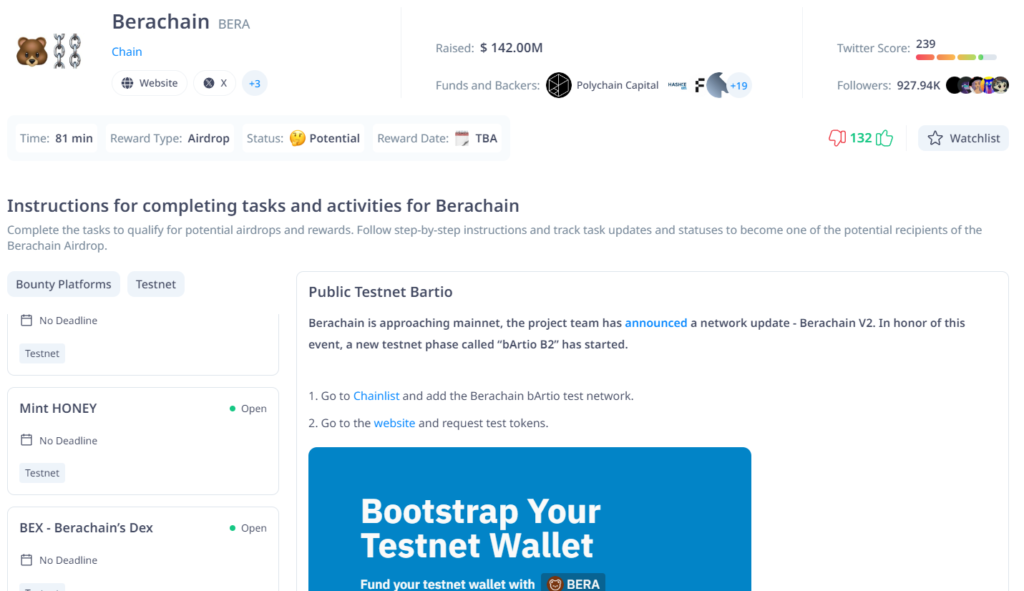

- Early participants in the Artio testnet can explore ecosystem apps such as BEX and BEND and prepare for a potential airdrop.

Proof-of-Stake (PoS) has become the most popular consensus mechanism thanks to its scalability, inclusiveness and energy efficiency. Yet it has drawbacks — notably the risk of low liquidity when large amounts of tokens are locked at the consensus layer, reducing their availability for other uses.

To tackle this, the L1 project Berachain proposes an innovation aimed at addressing liquidity constraints, allowing assets to be staked while simultaneously being used in DeFi protocols.

ForkLog examined the project’s main features; its mainnet launch is expected in late 2024.

EVM-identical and soulbound tokens

Berachain presents itself as an “EVM-identical” modular layer-1 blockchain using Proof-of-Liquidity (PoL) consensus. It is built with the Cosmos SDK.

PoL enables users to earn rewards for supplying liquidity in the form of non-transferable Berachain Governance Tokens (BGT), which determine the weight of future rewards for stakers.

The system lets users stake tokens and, at the same time, use them to provide liquidity in DeFi protocols.

“For example, imagine that ETH could be used both to secure the Ethereum network and to participate in other DeFi protocols such as Uniswap and MakerDAO,” said the developer under the pseudonym Smokey the Bera in an interview with The Block.

“EVM-identical” means Berachain can automatically adopt upgrades to the Ethereum Virtual Machine, ensuring full compatibility “with all RPC namespaces,” as stated on the project’s website.

This allows developers building for Ethereum to port their applications without significant code changes.

“Unlike EVM-equivalent and EVM-compatible solutions, which may require developers to make changes before deploying applications, Berachain precisely reproduces Ethereum’s execution environment,” explained CoinGecko analyst Joel Agbo.

The platform is built using BeaconKit, a modular framework for developing layer-1 blockchains and L2 solutions.

“The idea of Berachain is to develop a cost-effective, secure, high-performance, user-friendly and liquidity-rich network. This is reflected in the design of the execution and consensus layers,” Agbo noted.

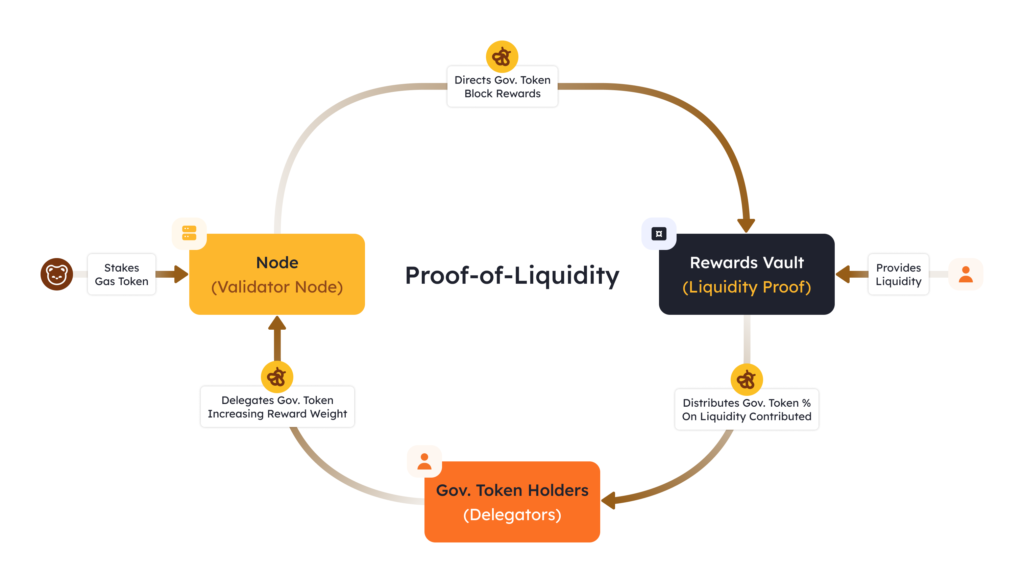

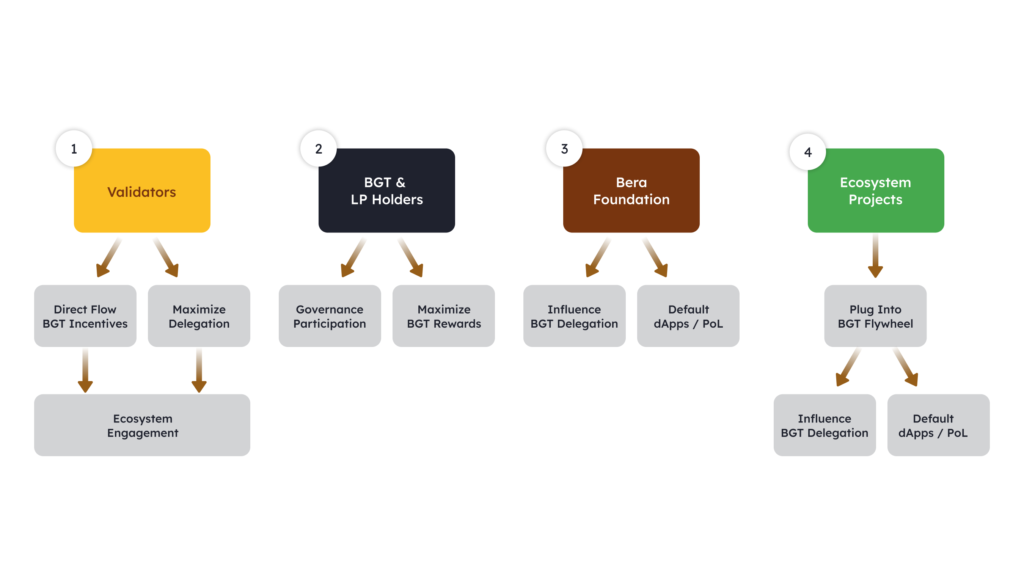

Proof-of-Liquidity and the “incentive flywheel”

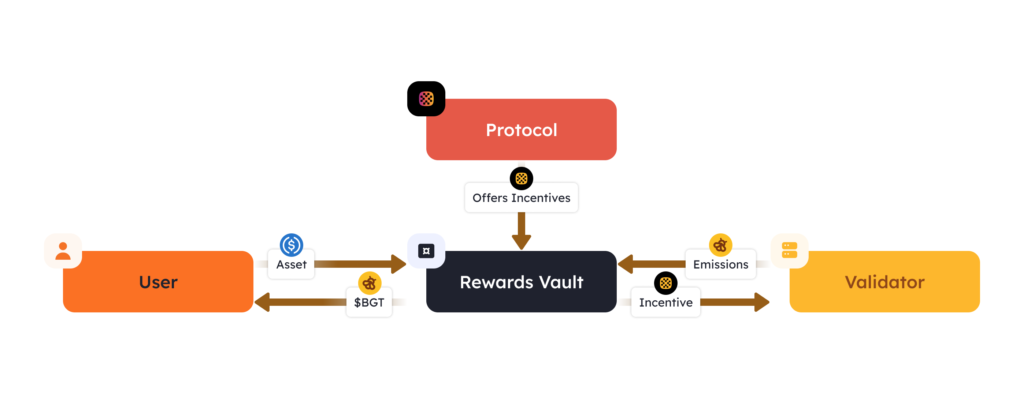

Ecosystem protocols can create vaults where users deposit assets that meet PoL criteria and earn a share of newly issued BGT.

Validators choose vaults based on incentives proposed by the protocol, typically expressed as an exchange rate between the token sent to the vault and another asset.

This mechanism creates an “incentive flywheel” that aligns all network participants:

- validators mint BGT for users who lock assets in vaults;

- this issuance can be delegated to network participants to earn more rewards;

- decentralised applications can also spur activity by awarding BGT.

Berachain’s original approach to on-chain liquidity stems from its consensus design.

“Proof-of-Liquidity is an adaptation of the established PoS algorithm with significant modifications to staking, asset management and reward distribution,” said Joel Agbo.

In particular, it uses a multi-token structure that separates security and governance. The mechanism aims to support the network economy by creating “sufficient value to reach consensus”.

BGT issuance resembles reward accrual in PoS networks, but distribution under PoL differs in several respects.

“Although validators issue BGT depending on the weight of tokens delegated to them, neither they nor their delegates receive BGT directly. Instead, they acquire the right to choose which rewards vault to direct their token issuance to,” Agbo explained.

In such rewards vaults, users can lock supported assets to receive a share of the BGT issuance that validators allocate to vaults. These can include LP tokens that represent a liquidity position.

This separates the recipients of BGT from the parties that distribute issuance. It also creates a market for applications that can compete for the asset.

“Applications will create incentives that set an exchange rate between BGT sent to a vault and a certain amount of another asset. For instance, a vault may offer incentives to validators by paying 30 USDC for every 1 BGT that flows into the vault. In turn, a DEX may offer 10 of its native tokens for each 1 BGT,” the expert noted.

A three-token economy

BERA is the network’s native (“gas”) token. It pays fees for transactions and smart-contract operations.

Holders of BERA can stake tokens to earn rewards in BGT.

BGT is a non-transferable governance token. Market participants who secure the network receive it by depositing BERA and other assets into vaults.

Validators participate in staking BGT, receiving these tokens as rewards for verifying blocks. Although they cannot dispose of the coins directly, they may direct them to rewards vaults in exchange for additional incentives.

BGT will be used in the DAO as a governance token. Holders can vote directly or delegate their rights to others.

The DAO will decide on key matters for the ecosystem:

- the range of assets supported by vaults;

- proposals concerning the development of dapps, and so on.

BGT can be swapped for BERA at a 1:1 rate via a burn process.

HONEY is Berachain’s native stablecoin with a “soft peg” to the US dollar. According to the project, it is designed to provide a stable, reliable medium of exchange within and beyond the ecosystem.

The token is issued through a dynamic procedure controlled by a vault router — a smart contract that accepts collateral stablecoins to mint HONEY and manages the deposited collateral.

Berachain controls several vaults for supported stablecoins. The vault router moves collateral into the appropriate asset vault and creates an equivalent amount of HONEY. The pace of issuance, fees and accepted collateral for minting can change over time by DAO decision.

HONEY can be used like other stablecoins — for transfers and integrations into DeFi protocols such as lending platforms and perpetuals trading applications.

Bear-themed dapps

The Berachain test network already hosts several native dapps that implement some of the protocol’s unique features.

A brief look at some of them.

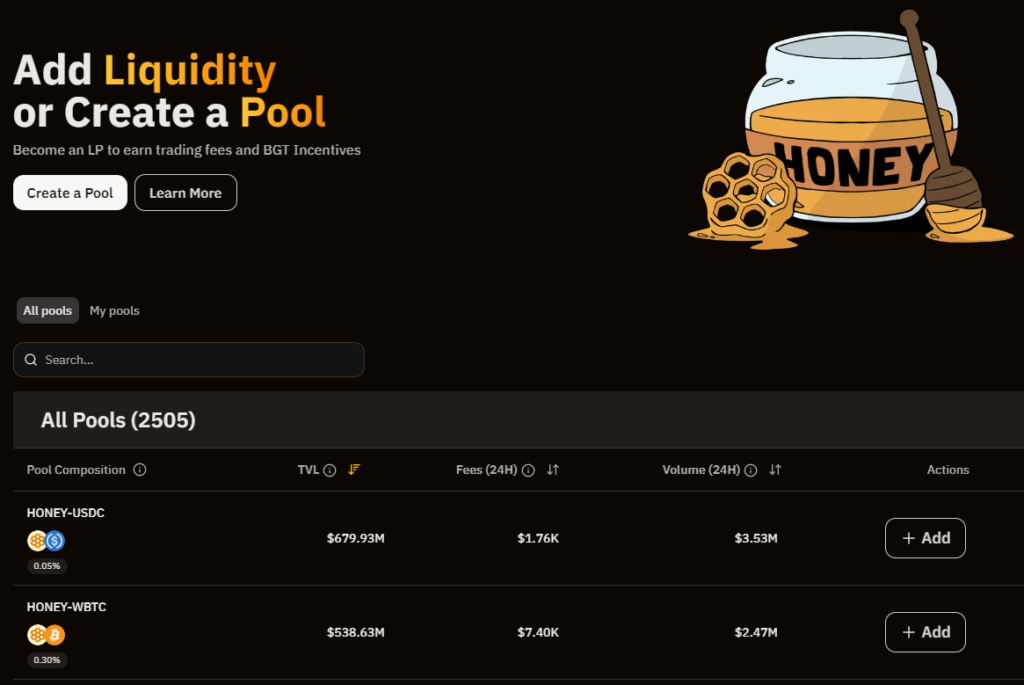

Non-custodial exchange BEX

BEX is an AMM platform whose liquidity pools can be converted into PoL rewards vaults. LP tokens should be deposited into the relevant vault to earn BGT.

The platform offers gasless transactions and low-fee swaps. However, BEX will charge trading fees from 0.05% to 1% depending on the volatility of the assets involved. An additional 0.1% fee will be distributed among BGT holders.

The gasless feature will allow users to pay for operations using the asset being swapped instead of the native “gas” token BERA.

Account abstraction will also be implemented to improve the user experience. Off-chain transactions using relayers will be available, opening up deferred transactions and helping users save on fees.

Another option on BEX is exclusive (permissioned) pools. Access may be conditioned on specific parameters or actions.

The DEX also allows storage of idle user assets. Excess collateral offers a simpler way to trade on the exchange, saving users the hassle and cost of transferring tokens for each transaction.

Lending platform BEND

BEND lets users borrow stablecoins against their crypto assets. The platform uses Berachain’s native stablecoin HONEY.

Market participants receive BGT as an additional incentive. Unlike BEX, where users must deposit supported LP tokens into rewards vaults to earn BGT, on BEND borrowers can directly claim their soulbound assets.

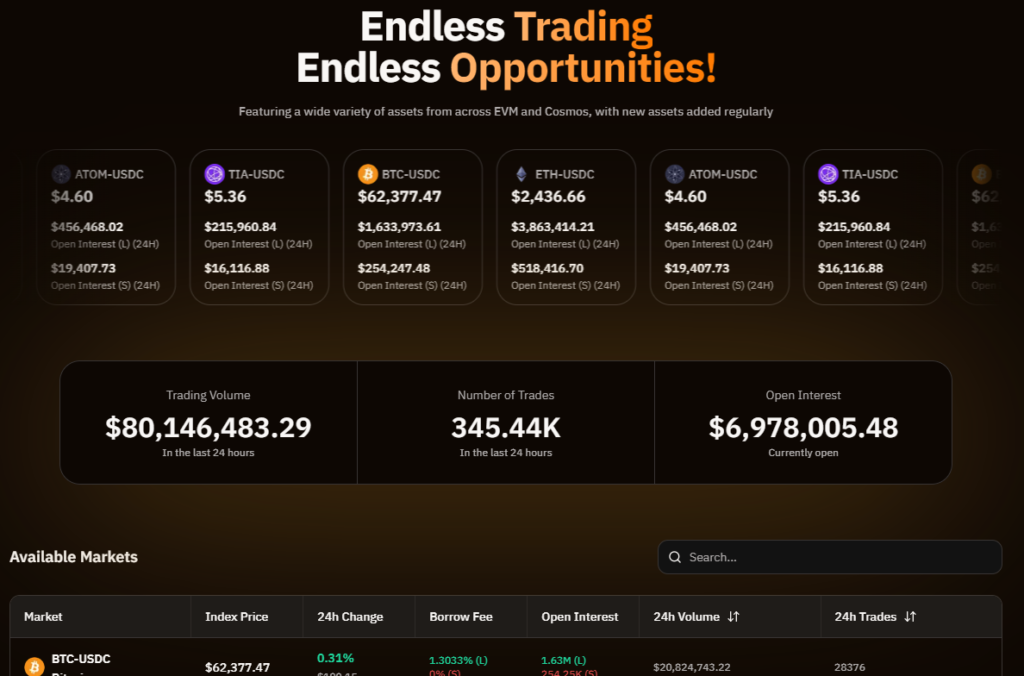

BERP — a platform for trading perpetual contracts

The trading platform uses HONEY as the base token and enables liquidity providers to deposit the native stablecoin into a vault to earn BGT. Traders can use stablecoins to execute transactions.

How the project is progressing — and when an airdrop?

The blockchain has been in development since late 2021. It began as the NFT project Bong Bears, founded by pseudonymous market participants Smokey the Bera, Dev Bear and Papa Bear.

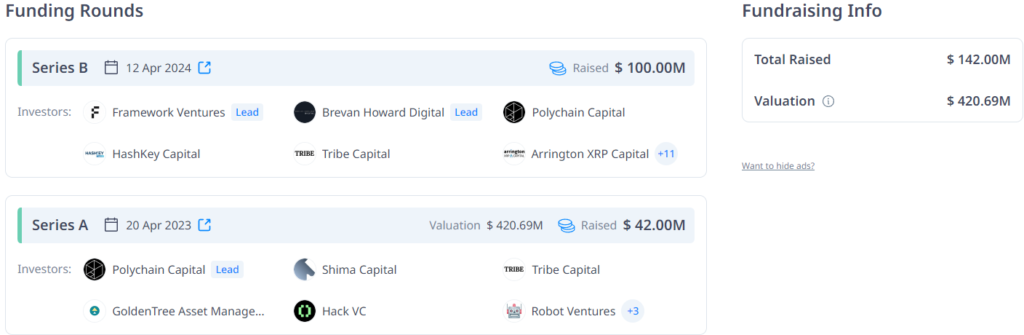

In April 2023 the Berachain team raised $42m in a Series A funding round led by Polychain Capital. Participants included Hack VC, Shima Capital, Robot Ventures, Goldentree Asset Management, Tendermint co-founder Zaki Manian and Celestia founder Mustafa Al-Bassam.

In early 2024 the developers launched the public Artio testnet.

In April the project raised $100m in a Series B round led by Framework Ventures. Other investors included Brevan Howard Digital, HashKey Capital, Tribe Capital and Arrington XRP Capital. Berachain’s valuation exceeded $420m.

Earlier, CoinGecko analysts assessed the likelihood of an airdrop and offered tips on preparing for a potential distribution.

On the possible token distribution, journalist Colin Wu’s team concurred with the analytics portal’s view. In February it included Berachain in a list of airdrops expected in 2024.

The WuBlockchain team has counted larger-scale projects that may have airdrops in 2024, including: zkSync, LayerZero, Magic Eden, EigenLayer, Berachain, Taiko, Blast, Aevo, Puffer Finance, EtherFi, Backpack and Friendtech. Among them, there are many L2 and related LRT and… pic.twitter.com/Yuaeji4GwS

— Wu Blockchain (@WuBlockchain) February 20, 2024

CoinGecko specialists noted that many platforms in the past rewarded users for interacting with testnets. However, they also warned that the team has not announced an airdrop, and any actions do not guarantee participation in a potential distribution.

A detailed guide for those who want to interact with the Berachain testnet is also available on CryptoRank.

The latest version of the public testnet went live in June.

Berachain’s Public Testnet bArtio B2 is now live.

Hot Bera Summer begins at:

? https://t.co/Wozhn32KfW ? pic.twitter.com/jwv4IQNoPB

— Berachain ?⛓ (@berachain) June 9, 2024

The mainnet launch is scheduled for the fourth quarter of 2024.

Conclusions

Berachain’s distinctives lie in its modular architecture and Proof-of-Liquidity consensus, which couples liquidity provision with network security.

The three-token set — BERA for gas, BGT for governance and HONEY as a stablecoin — cleanly separates functions, bolstering decentralisation and governance efficiency.

Berachain has attracted substantial investment and strong community interest. The ambitious project could yet become a rival to other L1 networks such as Ethereum, Solana or Monad.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!