Who are airdrop hunters and how much do they earn?

Airdrops continue to be widely used by DeFi and NFT platforms to grow communities and generate demand for new utility tokens.

Some projects generously reward users without requiring any complex actions. But at times the criteria for selecting participants are quite stringent, demanding substantial time and significant transaction fees.

In this piece we examine the main types of airdrops, their pros and cons, platforms for tracking potential distributions, and possible pitfalls. We also learn who airdrop hunters are and how much they typically earn.

- Despite the abundance of scams and a large pool of “easy money” hunters, airdrops remain relevant and are widely practiced by various projects.

- Recently there has been a trend toward tightening the criteria for selecting participants in distributions. Transaction activity, the number of smart contracts used, total funds turned over, NFT issuance, DAO-votes, subscriptions to social media accounts and so forth are taken into account.

- Industry participants are divided on drophunters who try to chase as many potential token distributions as possible.

What are cryptocurrency airdrops and why do they matter?

Airdrops are free token distributions among selected users of crypto platforms. It is a common tactic in the blockchain industry aimed at attracting attention to projects.

To participate in a token distribution, users typically must meet various conditions and perform actions. For example, be early participants in the ecosystem, hold certain crypto assets in a Web3 wallet, or be followers of the project on social media.

One of the first and largest airdrops in the industry was conducted by Uniswap. On 17 September 2020, the leading non-custodial exchange allocated governance tokens UNI to more than 250,000 addresses.

All those who used the platform before 1 September 2020 received at least 400 UNI (roughly $2,200 as of 2 July 2023). 250,000 UNI were allocated to about 250 addresses, including active exchange users, major liquidity providers and traders Unisocks (SOCKS).

Soon after the famous Uniswap airdrop, many projects adopted a similar tactic, including 1inch, Opium Protocol, Lido, Mask Network, dYdX, Axie Infinity, Ethereum Name Service.

Over time, the requirements for participants tightened to prevent abuse. For example, the project ParaSwap “excluded” those who resorted to a Sybil attack or, in simple terms, used multiple accounts to maximise the amount of “easy money.” Priority went to users who used the platform regularly and conducted swaps with partner projects. Such filtering sparked an outcry in the crypto community.

However the trend continued. This is evident in the growing number of so-called “drop-hunters” — those who monitor potential token distributions of new projects and engage in relevant ecosystems. Some market participants operate hundreds of Web3 wallets in the hope of maximising earnings.

Pros and cons of airdrops

We list the positives of taking part in airdrops:

- the possibility of obtaining free tokens (large projects backed by renowned venture capitalists may award active ecosystem participants tokens worth $10,000 or more);

- the distributed coins are usually liquid from day one, as they quickly appear on DEX and on centralised exchange listings;

- to obtain tokens, simple actions and conditions are usually required: be an early user, perform several interactions with the platform (recently, the volume of transactions is often taken into account);

- active ecosystem participants can receive substantial sums, well in excess of their costs.

There are also negative aspects:

- no guarantee of being included in the distribution, even if the user starts using the platform on the launch day;

- some ambitious projects vaguely Sui shortly before the mainnet launch may deny rumours of a token distribution, provoking considerable anger among drophunters;

- many scams, phishing;

- most projects award tiny sums that do not cover users’ transaction fees;

- strong price pressure on the token, as many “easy money” recipients seek to sell the coins almost immediately after listing;

- time windows for token distribution (claiming may be available for, say, three months).

Types of airdrops

There are several main types of token distributions:

Retroactive airdrops

They occur when an existing blockchain project announces the launch of a native token. In such cases, early users of the protocol who showed a certain activity are typically rewarded. The amount of the reward largely depends on the scale of speculation around the possible token launch, as with zkSync.

Historically, this type of airdrops has been among the most generous. On the other hand, there is no guarantee that even relatively active users will not be filtered out — not every new project plans to distribute tokens to a broad circle of market participants.

Examples of retroactive airdrops: the aforementioned Uniswap and Ethereum Name Service, as well as Optimism.

Airdrops for holders

In this case, distribution goes to holders of various tokens. The latter reside on public blockchains, and, therefore, developers can tailor airdrops to certain criteria. These distributions, like most others, serve marketing goals and aim to raise awareness of projects in the crypto community.

Examples of such airdrops:

- Yuga Labs in August 2021 distributed 10,000 tokens ($270,000 at the time) among holders of the NFT collection Bored Ape Yacht Club (BAYC);

- Stellar — where the distribution to Bitcoin holders is anticipated.

Bounty airdrops

These distributions involve completing various simple tasks, typically related to promoting the project. For example: subscribing to a project’s social account and/or newsletter, joining a Discord group, etc.

For completing such simple actions, points are awarded. Before minting tokens, users are often required to fill out a form and supply a wallet address.

Different testnet tasks are offered by the Venom project. At the end of each completed stage, the user mints an NFT.

Exclusive airdrops

To conduct such distributions, blockchain projects enter partnerships with other platforms. Under this scheme has conducted more than 400 campaigns, the well-known analytics service CoinMarketCap.

Exclusive airdrops typically include bounty-program elements, involving simple tasks and providing a wallet address. Sometimes such distributions involve a lottery, with a limited number of participants receiving tokens.

How much do airdrop-hunters earn?

Airdrop-hunting, in a sense, is a fairly straightforward activity. Its essence lies in identifying projects that may issue tokens for early supporters of the platform, and interacting with them for some time. Using substantial sums of money in ecosystems increases the chances of obtaining the coveted coins, as projects often pay attention to turnover and the number of transactions.

However, many associate airdrop hunters with those who abuse distributions, create many accounts and wallets, and carry out many transactions that lack economic sense.

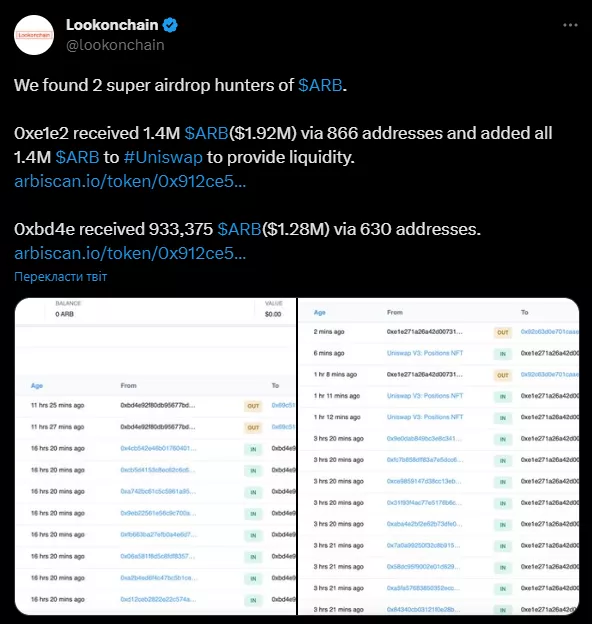

For example, after the fat airdrop for Arbitrum, two market participants consolidated ARB tokens worth $3.3 million on two addresses, tokens obtained from 1,496 wallets.

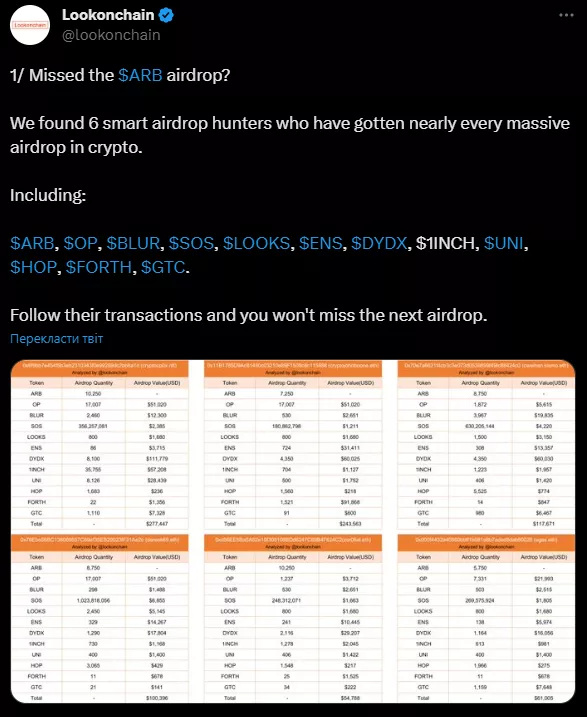

On 20 March, Lookonchain analyst identified six “smart drop-hunters” who participated in nearly every major token distribution.

Chris Bradbury, CEO of the Oasis.app platform, told Cointelegraph that professional “easy money” hunters would use scripts to consolidate many different addresses.

Researchers X-explore and journalist Colin Wu are generally positive about the new trend. According to their observations, most airdrop hunters are early Ethereum users. They show much greater activity on NFT platforms and DEX, trading and staying engaged in projects after receiving tokens.

For example, more than 95% of addresses in the premium group are among the top 10% by trading volume on decentralised exchanges. For NFT marketplaces, the figure stands at 68%. Premium players conduct an average of 50 Ethereum transactions per month, while ordinary participants perform 21.

After an airdrop, hype around the ecosystem subsides. Yet the most advanced airdrop hunters continue to show relatively high activity for some time. This was noticeable after the OP token airdrop from Optimism. The distribution strategy for OP is well thought out and oriented toward the long term.

«The results show that many previously inactive premium hunters began to take an interest in OP after receiving the airdrop, and also actively interact with various ecosystem projects»,

According to them, well-considered rules for distributions can positively influence drop-hunters. Equally important is a developed, credible ecosystem.

According to the study, the average income of a standard airdrop hunter per address was $9,384 (median $6,497). For the premium segment, the figures were $18,935 and $14,288.

But X-explore and Colin Wu do not deny the presence of abuses. In their assessment, up to 20% of Arbitrum’s airdrop volume in March was claimed by so-called “free riders” using the Sybil attack. In most cases, drop-hunters periodically conduct transactions of little economic meaning.

Where to track airdrops?

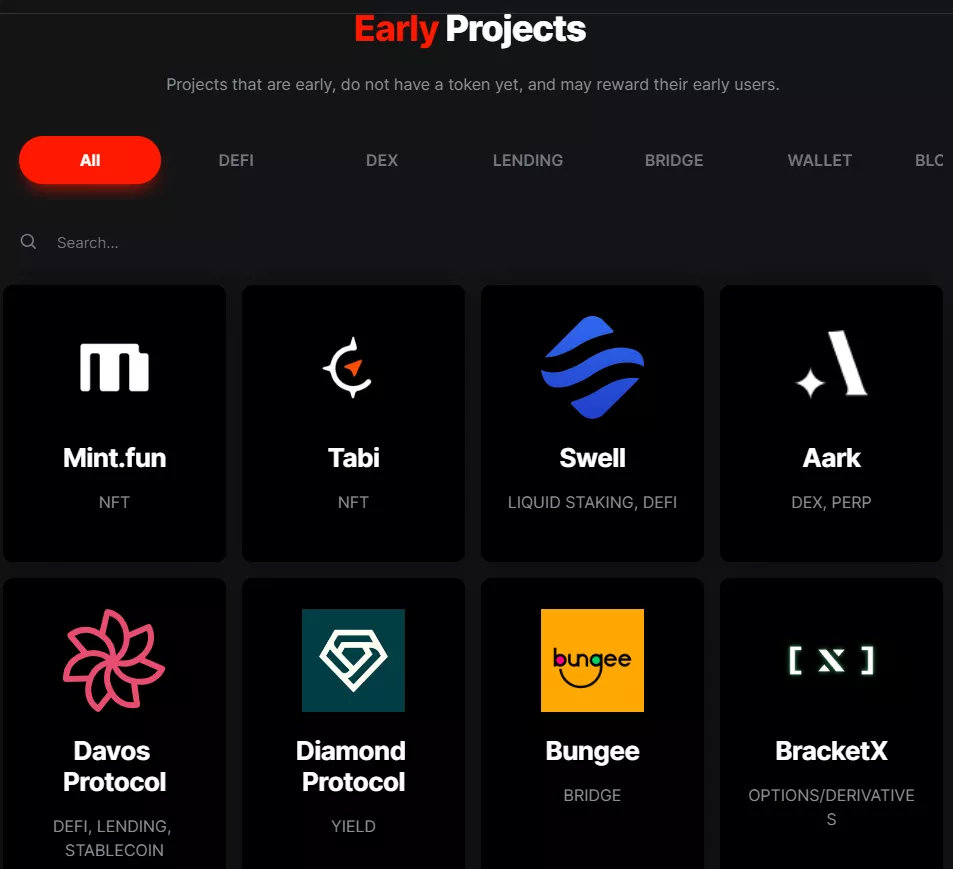

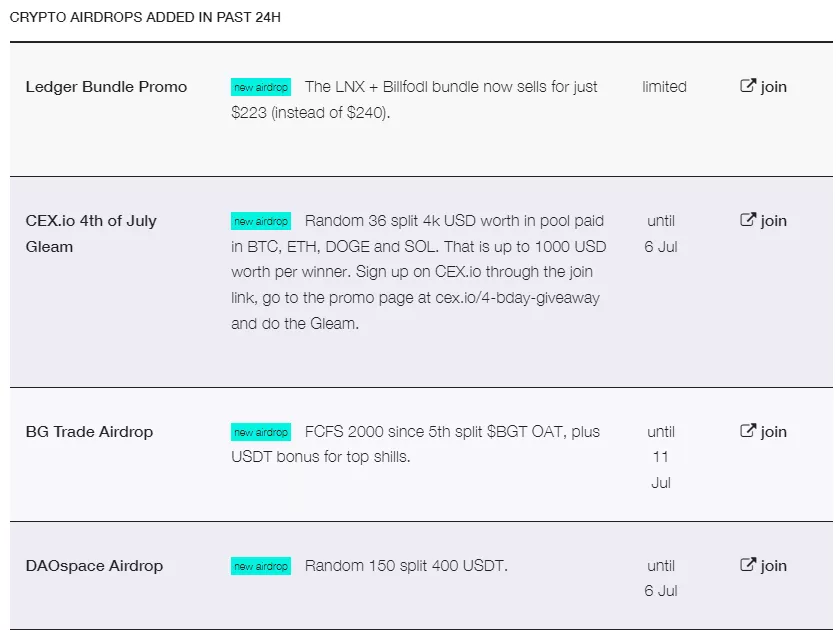

There are already quite a few services designed to ease the workload and save the drophunter time. One such is Alpha Drops. The site publishes information about projects from which a token airdrop can be expected with some probability. For example, in the Airdrops section there is a list of “early” projects that have not yet issued a native token.

In the Faucets section there are “faucets” for obtaining tokens that can be used to engage activity in various test networks.

In the blog there are manuals describing projects, algorithms for interacting with ecosystems and other steps that increase the chances of obtaining “easy money.”

Founder of Alpha Drops — Aram Barzani from the Iraqi city of Erbil. According to him, the strategies on the site are largely based on successful airdrops in which transaction volume and the number of interactions with app smart contracts were taken into account.

According to Barzani’s estimates, airdrops are conducted by 10-15% of new projects. The founder of Alpha Drops himself adopts a cautious approach, using only a few wallets.

As the expert explained, many projects monitor clusters of interlinked addresses. This is done to exclude from the list unscrupulous drop-hunters who try to “game the system” and maximise earnings.

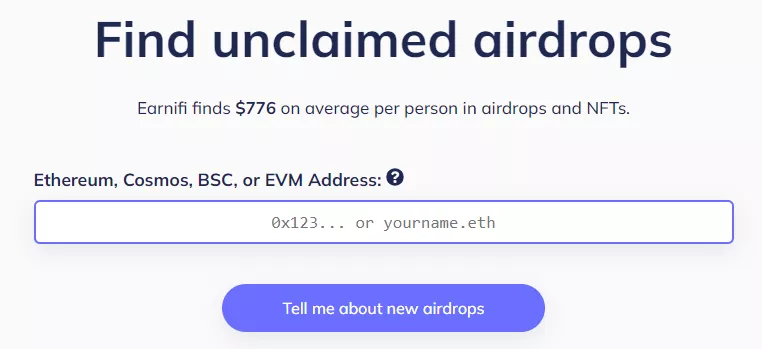

There is also a service Earn.fi — something like a search engine for uncovering potential distributions.

After entering a Web3 wallet address, the platform returns information on unclaimed airdrops the user may have forgotten about. It also displays current DAO votes across ecosystems that could increase the likelihood of obtaining “easy money” in the future.

In the Learn section there are strategies for obtaining potential airdrops, analytics on various projects, educational materials and links to useful resources.

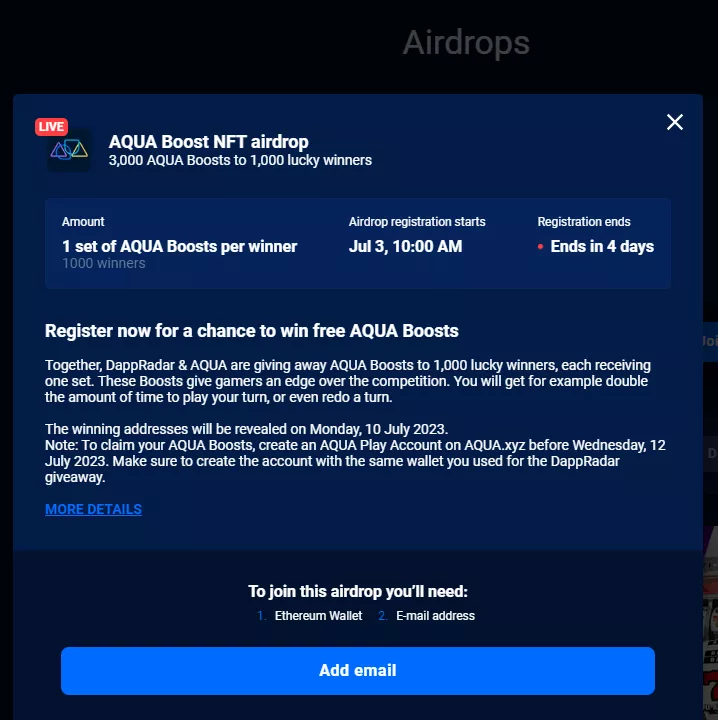

The aggregator of decentralised applications DappRadar also has a corresponding section. Users can participate in token airdrops in a few clicks — simply by entering their email and connecting a Web3 wallet.

The service works similarly to CoinMarketCap — airdrops are usually lottery-like, and thus do not guarantee a win for everyone.

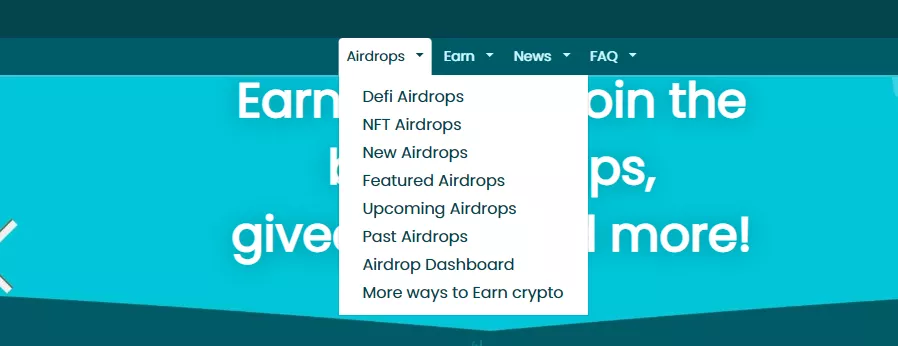

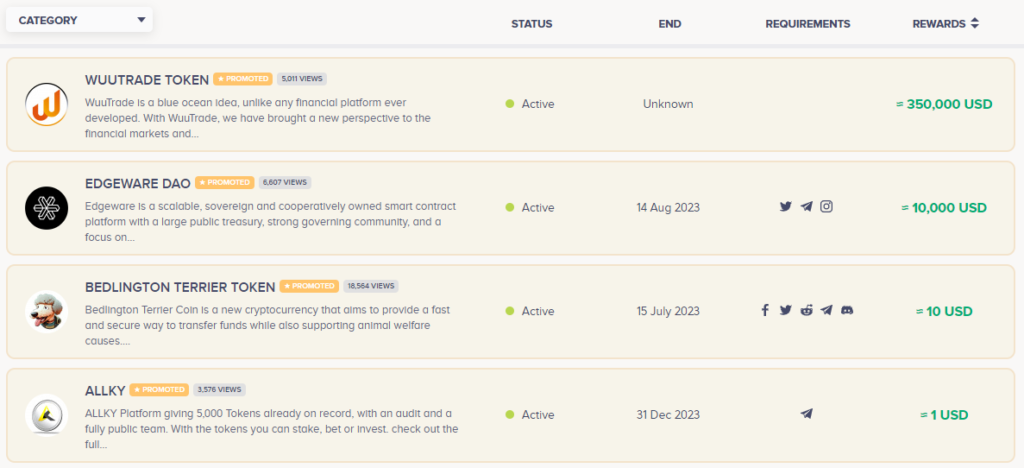

On Airdrops.io there are step-by-step instructions for current and potential airdrops. After a campaign ends, the platform publishes key details about it, including the amount distributed.

The aggregator AirdropsAlert classifies token distributions by categories: DeFi, NFT, new, past, upcoming, etc. The service boasts more than 400,000 newsletter subscribers.

AltcoinTrading also provides information on the most promising and long-awaited airdrops, bounty programs and exchange promotions.

In addition to primary coin offerings, the site ICOMarks also publishes information on current airdrops.

The service provides information on the timing of distributions and, importantly, an approximate estimate of the amounts distributed. It also offers step-by-step instructions for users seeking to participate in potential airdrops.

AirdropBob— a relatively small airdrop aggregator that publishes information about notable events in the industry.

An interesting section is the Calendar. It lists campaigns, including exchange campaigns, with deadlines approaching.

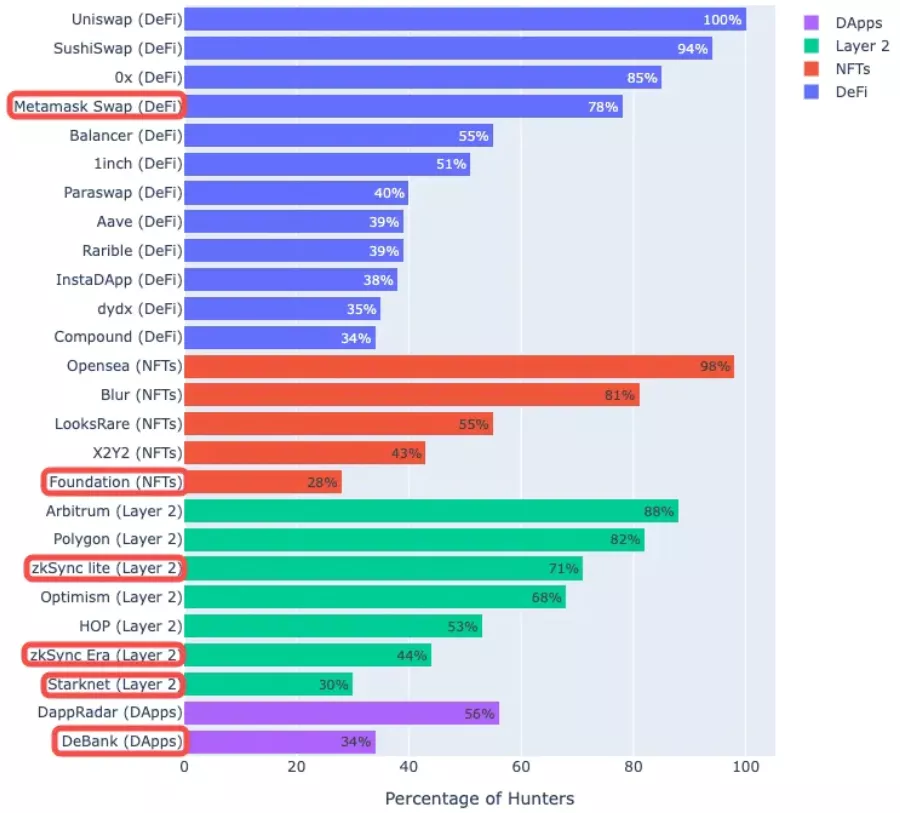

X-explore researchers and journalist Colin Wu, based on on‑chain activity, provide a list of the main targets for airdrop hunters:

- DeFi: Uniswap, SushiSwap, 0x, Metamask Swap, Balancer, 1inch, Paraswap, Aave, Rarible, InstaDApp, dYdX, Compound;

- NFT: OpenSea, Blur, LooksRare, X2Y2, Foundation;

- L2-solutions and cross‑chain protocols: Arbitrum, Polygon, zkSync Lite and zkSync Era, Optimism, HOP, Starknet;

- dapps: DeBank.

Pitfalls of airdrops

Chris Bradbury is convinced that drop-hunters should pay attention to all sorts of risks, especially when interacting with new, unvetted projects.

«The nature of retroactive airdrops is such that you often use new protocols that have not stood the test of time. And in most cases you must place your assets into these protocols, exposing yourself to the risk of loss due to bugs or hacking attacks»,

Also, according to him, the costs of engaging with different ecosystems can exceed the airdrop’s value, especially if the protocols are not “high-end.”

«Airdrop-hunting is not an exact science»,

The expert nicknamed FastLife added that such activity requires substantial time and patience.

Bradbury noted that it can be hard to complete all necessary activities — protocols are increasingly inventing innovative criteria for token recipients.

«If you do a lot of things that do not meet the criteria, it can end in losses. And most protocols now try to devise innovative ways to determine recipients of the airdrop. So the likelihood of spending time and money on something that won’t count grows»,

In summary, here are the main precautionary measures when engaging with ecosystems in the hope of “easy money”:

- projects should be thoroughly and comprehensively researched to avoid scams;

- wallets should be connected only on trusted platforms, verifying URLs to avoid phishing;

- never share your seed phrase with anyone — no project can require this from you;

- for drop-hunting it is advisable to use a separate wallet with a small balance (especially when interacting with many lesser-known platforms);

- never send money to anyone. Earning a reward from an airdrop does not require any outlay, except for transaction fees when interacting with a smart contract.

Conclusion

Airdrops are an intriguing phenomenon unique to the crypto industry. It is unsurprising that generous distributions have spawned a cadre of “easy money” hunters.

Recent entrants are eagerly exploring new ecosystems, often testing still-raw DEXs and cross‑chain bridges at their own risk. Such activity provides the decentralised platforms with essential liquidity. The governance token is then used in votes on various questions related to protocol development initiated by the DAO.

To curb abuse, projects are adopting increasingly sophisticated, at times elaborate, rules and criteria for participant selection. In most cases, a handful of transactions is no longer sufficient, as was the case with retroactive airdrops of past years.

Market participants should not forget the risks, bearing in mind that the industry is rife with scammers. Hacks, exit scams and other misfortunes are possible.

Therefore, before engaging in airdrop-related activities, one should thoroughly study projects and avoid interacting with unvetted platforms. Also, be prepared to incur transaction fees.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!