Why The Merge Didn’t Solve Ethereum’s Scaling Problem

The largest update in Ethereum’s history—the Merge—took place on September 15, 2022. After seven years of hard work by developers, the second-largest cryptocurrency by market capitalization switched to the Proof-of-Stake consensus algorithm.

Many users eagerly awaited the upgrade, believing that the pressing scaling problem would be put to rest once and for all. However, it turned out otherwise: transaction speed and cost remained virtually at their previous levels.

ForkLog examined the features and significance of the recent update, debunked popular myths and outlined developers’ future plans to improve the project.

- The Merge reduced Ethereum’s inflation and energy consumption by more than 90%, laying the groundwork for future large-scale upgrades.

- The ability to withdraw ETH from staking will open after the Shanghai upgrade, in 6-12 months. Market participants will not be able to unlock all coins at once.

- The Ethereum network will become truly scalable after implementing sharding, Verkle trees and a range of optimizations as part of the upcoming stages — Surge, Verge, Purge and Splurge.

The Merge 101

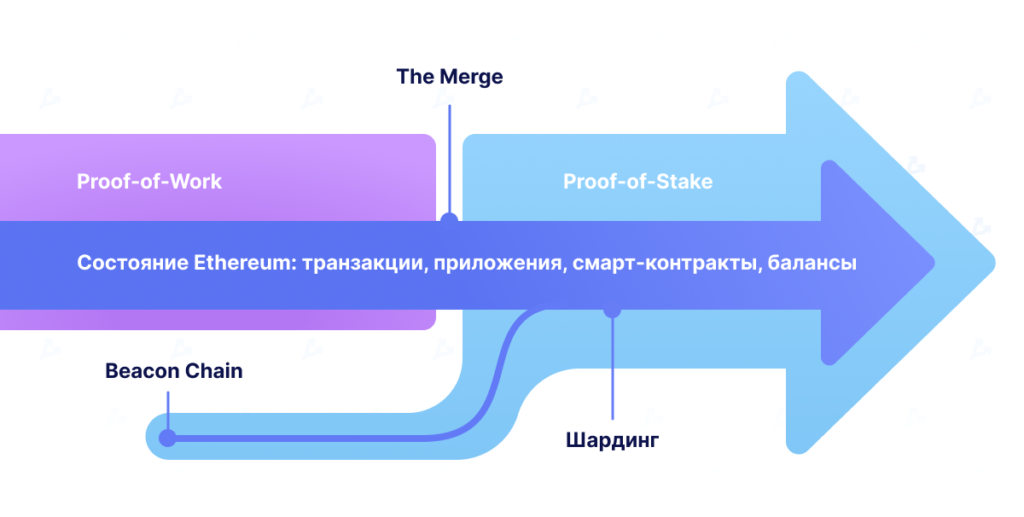

The Merge was the merging of the execution layer of Ethereum (the mainnet, operating since its launch on July 30, 2015) with a new consensus layer — Beacon Chain. The upgrade removed the need for energy-intensive mining. Security of the network is now provided by ETH staking.

«Это был поистине захватывающий шаг в реализации видения Ethereum — bольшая масштабируемость, безопасность и устойчивость», — отметили разработчики некоммерческой организации Ethereum Foundation.

By abandoning Proof-of-Work, the network’s energy consumption fell by about 99.95%, according to Ethereum.org.

С 1 декабря 2020 года Beacon Chain worked in parallel with the mainnet. Economic activity occurred predominantly on the mainnet, based on Proof-of-Work. It executed smart contracts, stored data about accounts, balances and the state of the blockchain.

To help users better understand the merger process and the shift away from the old algorithm, the non-profit participants proposed the following analogy:

«Представьте, что Ethereum — космический корабль, который уже запущен, но еще не готов к межзвездному путешествию. Сообщество создало Beacon Chain, которая представляет собой новый двигатель и укрепленный корпус. После основательных испытаний пришло время горячей замены старого двигателя на новый, прямо в полете».

Initially the new network did not process mainnet transactions. The Beacon Chain achieved consensus within its own state with validators’ funds on balance. After intensive and prolonged testing, the network matured to handle real data, including execution-level transactions, etc.

«The Merge represented an official transition to using Beacon Chain as the engine for producing blocks», — отметили в Ethereum Foundation.

Miners were replaced by validators, who now process transactions and propose blocks. All past data was preserved in the merge.

The Merge significantly affected the dynamics of Ethereum’s issuance, which depends on two main processes: issuance and burning.

Issuance means the creation of new cryptocurrency. Burning is the destruction or withdrawal from circulation of previously issued assets.

The pace of issuance and burning is determined by on-chain activity, and the balance between these processes makes Ethereum inflationary or deflationary.

According to Ethereum Foundation analysts, prior to the merger, the total daily miners’ rewards were about 13,000 ETH, and the corresponding validator metric was about 1,600 ETH. The inflation rate stood at 4.62%.

After The Merge, miners were out of the consensus, no longer earning income. With ~1,600 ETH still staked per day, new coin issuance fell by about 90%. Inflation moved toward zero (roughly 0.24% at the time of writing).

Validators are responsible for storing data, processing transactions, and adding blocks to the blockchain. Their rewards (or penalties) are calculated and distributed every epoch lasting 6.4 minutes.

Validator rewards will continue to accrue on their balances until the Shanghai hard fork, planned for the future. After this upgrade, funds on accounts will become withdrawable.

«This means that new ETH issuance is isolated from the market until the upgrade», — пояснили представители Ethereum Foundation.

However, according to them, not all stakers will be able to withdraw funds at once.

«To ensure stable operation, the number of validators withdrawing coins simultaneously is limited. Only six of them can exit within an epoch», — подчеркнули разработчики.

ETH burning is the process opposite to issuance. This mechanism was introduced with the London hard fork.

To execute a transaction on the Ethereum network, a user must pay a minimum fee (base fee). The fees are then burned, removing ETH from circulation and thereby reducing the circulating supply of the cryptocurrency.

The system can penalize validators for being offline or for misbehavior that threatens network security. Such penalties reduce ETH on participants’ balances, further lowering supply.

«Moreover, The Merge laid the groundwork for further scaling improvements that are not possible with Proof-of-Work. Ethereum is one step closer to achieving full scalability, security and resilience», — отметили в Ethereum Foundation.

Popular myths

Some market participants are convinced that The Merge should have reduced transaction fees, but it did not.

According to Ethereum Foundation representatives, the update was designed to change the consensus mechanism, not to reduce users’ gas costs.

«Fees depend on transaction demand and network throughput. The Merge rejected Proof-of-Work in favour of a Proof-of-Stake consensus algorithm, but did not substantively change any parameters that directly affect network performance», — пояснили разработчики.

They stressed that Ethereum’s development roadmap is focused on layer-2 scaling solutions with an emphasis on rollups, and the transition to Proof-of-Stake (PoS) is the key step toward its implementation.

Many also expected that The Merge would significantly speed up transactions on the Ethereum network.

«Despite minor changes, on-chain transaction speed at Layer 1 remains roughly the same as before the merge», — подчеркнули разработчики.

Historically under Proof-of-Work, new blocks were produced roughly every 13.3 seconds. Under Proof-of-Stake, timeslots appear every 12 seconds, giving validators the chance to publish a block.

«Under the new algorithm, blocks are produced about 10% faster than with Proof-of-Work. This is a fairly minor change that users are unlikely to notice», — отметили в Ethereum Foundation.

There was also a belief that after The Merge ETH could be withdrawn from staking. However, this option will become available after the Shanghai upgrade, in 6-12 months. As noted, stakers will not be able to unlock their coins all at once.

According to the developers, the “tips” for transactions and MEV accrued are credited to a non-staked account controlled by the validator, making them liquid coins.

Surge, Verge, Purge and Splurge

In early December, Ethereum founder Vitalik Buterin congratulated participants on Beacon Chain’s anniversary and published an updated diagram of the project’s roadmap.

Happy birthday beacon chain!

Here’s an updated roadmap diagram for where Ethereum protocol development is at and what’s coming in what order.

(I’m sure this is missing a lot, as all diagrams are, but it covers a lot of the important stuff!) pic.twitter.com/puWP7hwDlx

— vitalik.eth (@VitalikButerin) December 2, 2021

Alongside The Merge, it includes other major milestones: Surge, Verge, Purge and Splurge.

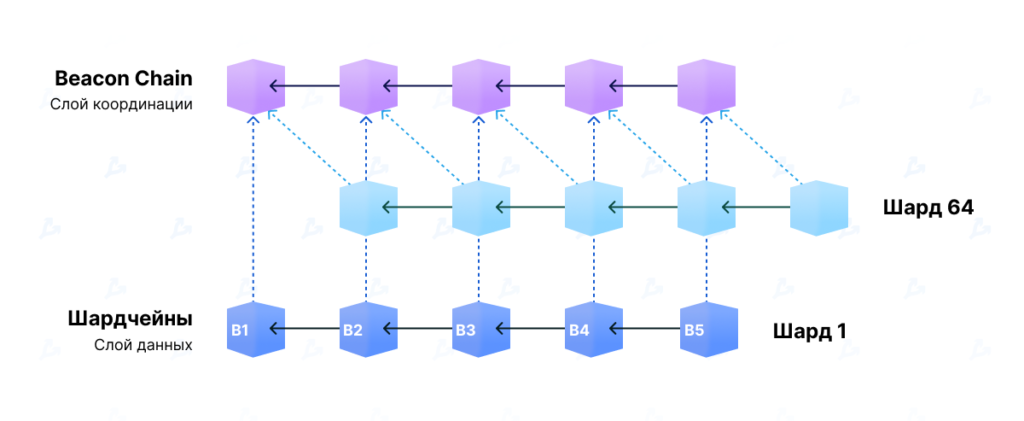

The implementation of The Surge is slated for 2023. It envisages the introduction of sharding, which splits the blockchain into parts (“shards”) to increase network scalability.

2. THE SURGE (2023)

The introduction of Sharding on Ethereum.

Sharding splits a blockchain’s entire network into smaller partitions, known as «shards.»

This will significantly increase the network’s scalability. pic.twitter.com/KILB9bdZAh

— Miles Deutscher (@milesdeutscher) July 22, 2022

«Изначальный план состоял в работе над шардингом до The Merge для решения проблемы масштабирования. Однако на фоне бума решений второго уровня приоритет сместился в сторону перехода на Proof-of-Stake», — отметили представители Ethereum Foundation.

ForkLog asked Anton Bukov, co-founder of 1inch Network, what is more relevant and effective for increasing Ethereum’s performance — sharding or Rollups. He replied:

«Каждое из этих решений по-своему масштабирует эфир, но не решает проблему масштабирования DeFi, которому в его нынешнем виде не подходит неатомарная среда исполнения».

According to him, Rollups are more timely today — because there are still years before sharding.

«Но в то же время шардинга в их текущей концепции вряд ли смогут тягаться по пропускной способности с роллапами. Я бы не сказал, что концепция шардинга эфириума финализирована. Поэтому и сравнивать пока что не очень корректно», — добавил сооснователь 1inch Network.

Then follows The Verge, where Verkle trees are introduced. As Buterin explained, they perform a function similar to Merkle trees — aggregating all transactions in a block and producing a proof for the entire data set for a user who wishes to verify its authenticity.

«The key property of Verkle trees is that they are far more efficient with respect to proof sizes», — отметил основатель Ethereum.

According to him, reducing the amount of information will be sufficient for enabling stateless clients.

Overall, the move is aimed at optimizing data storage and node size.

3. THE VERGE

Introduces verkle trees, a «powerful upgrade to Merkle proofs that allow for much smaller proof sizes.»

This will optimise storage on Ethereum and help reduce node size. Ultimately, this assists $ETH in becoming more scalable. pic.twitter.com/5AphZ84EqL

— Miles Deutscher (@milesdeutscher) July 22, 2022

«В конечном счете это помогает Ethereum стать более масштабируемым», — подчеркнул криптоинвестор и аналитик Майлз Дойчер.

The Purge is designed to reduce the amount of data validators need to store. This approach will lower hardware requirements for network participants and boost overall system efficiency.

4. THE PURGE

Reduces the hard drive space needed for validators. This eliminates historical data and bad debt.

Streamlines storage, which in turn reduces network congestion. pic.twitter.com/WufVzh52ec

— Miles Deutscher (@milesdeutscher) July 22, 2022

This step is also meant to minimise network congestion and improve throughput. By the end of the phase, Ethereum is expected to process up to 100,000 transactions per second. The next phase — The Splurge — comprises a set of minor updates designed to ensure smooth operation after the previous steps and facilitate user experience. This phase marks the end of Ethereum’s lengthy scaling journey.

Community sentiment

Cardano founder Charles Hoskinson expressed the view that Ethereum’s switch to Proof-of-Stake did not impact blockchain performance, operating costs or liquidity.

«ETH 2.0 requires at least [Shanghai hard fork] in 2023. My forecast remains unchanged. You understand that nothing has changed?», — заявил он.

Anton Bukov also holds a different view. He said ordinary users have already felt the effect of Ethereum’s updates.

«Blocks appear every 12 seconds, which provides a slightly more predictable time for a transaction to get into a block. And blocks becoming faster from 13.5 seconds to 12 seconds increased network throughput by 11%», — отметил сооснователь 1inch Network.

Hoskinson later even criticized the developers, saying that the transition to PoS turned out to be delayed. заявил that Ethereum should have implemented the Snow White protocol, which among the first provided comprehensive formal security proofs for PoS algorithms. He also accused Ethereum developers of ignoring Ouroboros — the Cardano-style PoS blockchain — over the past five years.

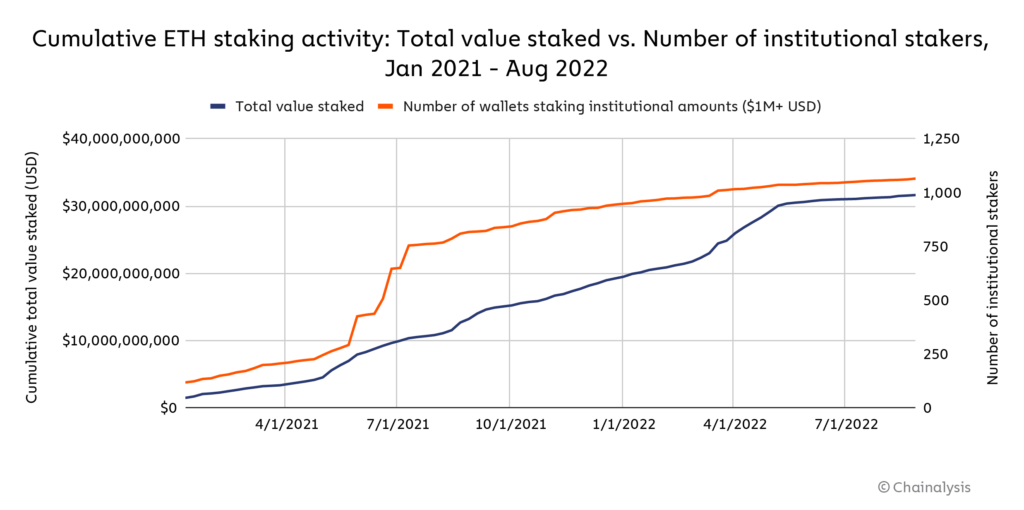

Analysts at Chainalysis predicted that Ethereum’s price could show independent dynamics after The Merge. They argued staking would make ETH resemble a bond or commodity.

Experts projected growing interest from institutional investors due to high expected yields of ETH relative to traditional instruments like bonds.

According to Chainalysis, the number of institutional Ethereum investors (with balances above $1 million in ETH terms) has “steadily grown” — from fewer than 200 in January 2021 to about 1,100 by August this year.

«The Shanghai upgrade (within 6-12 months of The Merge) […] will allow withdrawal of assets, providing greater liquidity for players and making staking more attractive», — говорится в отчете.

Experts noted the move away from energy-inefficient mining with a reduction in energy consumption by more than 99%. In their view, this will appeal to ESG-conscious investors.

Mike Brunn, who leads the Change the Code/Not the Climate campaign against climate change, told Time that:

«Ethereum showed that you can transition to an energy-efficient protocol that entails far less pollution, and cleaner air and water».

ConsenSys founder Joseph Lubin said he had spoken with several “major financial institutions”. They reportedly expected The Merge to allow them to participate more substantially in Ethereum.

Lubin is confident that developers will eventually implement all roadmap milestones and achieve meaningful scaling for Ethereum’s second-largest market cap cryptocurrency.

«To achieve this, it will take substantial time. But it will bring us to an architecture with virtually unlimited throughput», — подчеркнул он.

But some Bitcoin maximalists critique Ethereum and other PoS coins.

Dear Proof of Stakers,

The fact that you can vote on something to change its properties is proof that it’s a security.

Love, Bitcoin

— Nick (@NickDPayton) July 11, 2022

«Уважаемые сторонники PoS. Факт того, что вы можете проголосовать за что-либо, способное изменить свойства [системы], является доказательством того, что это ценная бумага», — написал маркетолог проекта SwanBitcoin Ник Пейтон.

Vitalik Buterin called this claim “blatant lies.” He states that Proof-of-Stake does not entail voting on protocol parameters, just as Proof-of-Work does not.

PoS is regularly criticized for supposed “insufficient decentralisation.” For instance, long-time Bitcoin advocate Jimmy Song once claimed that the PoS mechanism cannot solve the Byzantine generals problem.

In response, Hoskinson wrote that the level of stupidity in such a statement is beyond explanation.

The level of stupid here is beyond explanation https://t.co/2ARGkcpBgG

— Charles Hoskinson (@IOHK_Charles) July 4, 2022

Contrasting the critics, DeFi researcher Vivek Ramamurthy emphasised that PoS can give Ethereum a set of properties that could challenge Bitcoin’s dominance in crypto space.

It is worth repeating: the ETH Merge is one of the most impressive engineering feats in blockchain history

Under a fully PoS regime, #ETH will have the economic structure to increase security, scale with L2s, grow its DeFi and NFT platforms, and overtake #BTC‘s throne

(11/11)

— VivekVentures.eth 🦇🔊 (@VivekVentures) July 10, 2022

He called The Merge one of the most impressive developments in blockchain history.

Anton Bukov allowed for the so-called The Flippening to occur in 80% by 2025.

«Bitcoin undoubtedly remains the primary and foundational distributed ledger technology, but Ethereum can arguably be called the next generation of blockchain», — поделился мыслями разработчик.

According to him, Ethereum has emerged as a leader in innovation and intends to become the “third generation” blockchain.

But not all is smooth — regulatory risks abound. For example, head of the SEC Gary Gensler allowed the recognition of PoS cryptocurrencies as securities.

«In 2022, for the first time there was a real, not illusory risk of censorship of transactions and blocks. Neither Proof-of-Work nor Proof-of-Stake consents have dedicated technical means to protect against censorship», — отметил Буков.

He notes that many developers are wrestling with this question. Perhaps in 1-2 years there will be an elegant technical solution to this problem.

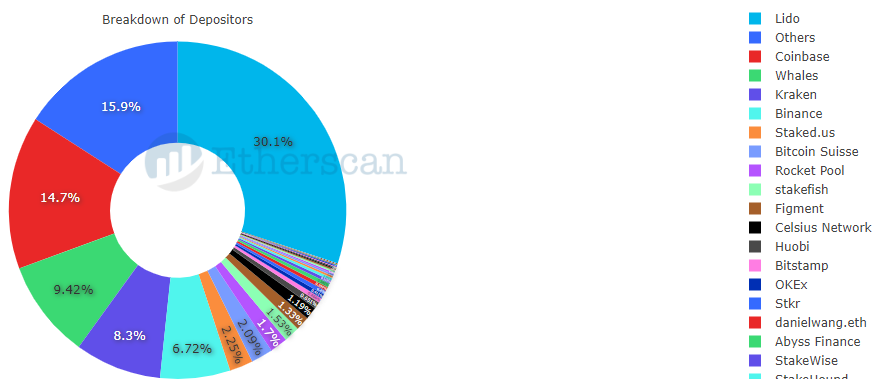

Some community members argue that Ethereum cannot be truly decentralised given the evident dominance of Lido and Coinbase in liquid staking.

According to Anton Bukov, decentralisation can be understood in different ways:

«Depends on what you value most in decentralisation. If you care about censorship-resistance, then danksharding partially addresses this problem».

The developer stressed that if liquid staking services abuse user trust, they could quickly lose a significant portion of their liquidity.

MEV is gaining popularity — a way for miners or validators to extract additional profit by changing the order of transactions before a new block is validated.

Elías Simos, who studied the first 24,500 blocks after The Merge, concluded that 18% of them were mined using a modified mechanism called MEV-Boost.

On the question of whether validator earnings from MEV will continue to grow amid rising MEV-Boost popularity, Bukov replied:

«In the short term — yes; in the long term, more solutions will emerge to counter MEV. I expect this problem to be largely solved within five years».

Conclusions

The Merge not only made Ethereum energy-efficient and nearly inflation-free, but also laid the groundwork for future large-scale upgrades.

Sharding remains relevant, yet developers are focusing primarily on Rollups and other technically complex solutions. It will take substantial time for full scaling of the second-largest cryptocurrency.

There are a variety of risks, including regulatory. For instance, the SEC chief is firmly convinced that the industry needs a “watchdog” regulator, and PoS-based cryptocurrencies may be securities.

It is unlikely that the path to the developers’ goals will be easy. The community should be prepared for future price volatility and remember that bear markets are typically rich in meaningful developments and, overall, beneficial for the industry.

Read ForkLog’s Bitcoin news on our Telegram — crypto news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!