World Liberty Financial Raises $590 Million Through Dual Token Sales

The Trump family’s DeFi project, World Liberty Financial (WLFI), has completed its second round of token sales, bringing the total funds raised to $590 million.

Initially, the crypto platform aimed to raise $300 million from the sale of 100 billion WLFI tokens. These tokens serve as the project’s governance tokens on Ethereum.

In January, the team conducted the first round, raising $160 million.

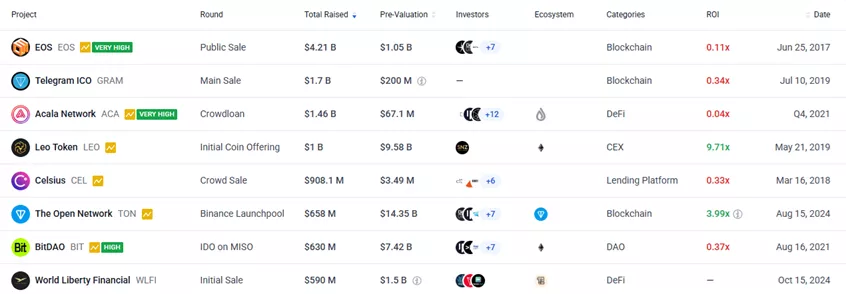

According to ICO Drops, the project ranked among the top 10 in terms of funds raised.

In February, World Liberty Financial co-founder Zak Folkman attributed the success of the token sale to investments by TRON Foundation founder Justin Sun, amounting to $30 million.

WLFI is available only to accredited participants. The token cannot be transferred or publicly sold on exchanges. No date has been set for its listing on trading platforms.

In the project’s gold paper, the U.S. President is named as the “chief crypto advocate,” while his sons Eric, Barron, and Donald Trump Jr. are listed as Web3 ambassadors. Paxos co-founder Rich Teo has been appointed head of stablecoins and payments. Luke Pearson from Polychain Capital is noted as an advisor.

Trump Sr.’s company, DT Marks DEFI LLC, will receive 22.5 billion WLFI and 75% of World Liberty Financial’s net income, after deducting operating expenses and the initial $30 million allocated for creating an operational reserve.

In March, ahead of a crypto summit at the White House, World Liberty Financial purchased ETH, WBTC, and MOVE worth $21.5 million, increasing the total investment in digital assets to $336 million.

The platform’s portfolio includes ETH, WBTC, TRX, LINK, AAVE, ENA, MOVE, ONDO, and SEI. Since most funds have been transferred to the centralized exchange Coinbase, it is unclear whether they have been sold.

According to Arkham Intelligence, at the time of writing, the value of WLFI’s portfolio stands at $77.6 million.

In February, World Liberty Financial announced a strategic cryptocurrency reserve called Macro Strategy. The initiative aims to “support leading coins like Bitcoin, Ethereum, and other popular assets.”

In Congress, Trump was accused of a conflict of interest, noting the similarity between the SBR and WLFI’s crypto reserve.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!