Nvidia shares prove more volatile than Bitcoin

In 2025, Bitcoin's volatility was lower than Nvidia's shares.

In 2025, the volatility of the leading cryptocurrency was lower than that of the tech giant Nvidia’s shares, analysts at Bitwise observed.

In 2026…

… $BTC, $ETH, and $SOL will set new all-time highs, bets on @Polymarket will grow significantly, crypto equities will outperform tech stocks, and 7 other crypto predictions for 2026 by the @BitwiseInvest Research Team.

Please note: As with all predictions, these are…

— Bitwise (@BitwiseInvest) December 17, 2025

Experts attributed the trend shift to a “fundamental reduction in risks” of the asset. The introduction of spot ETFs and other traditional instruments attracted new categories of investors.

Bitwise believes that the volatility of digital gold has steadily decreased over the past decade and will remain below Nvidia’s levels in 2026.

Figures and Comparisons

In 2025, Bitcoin’s price fluctuation was 68%, moving from a low of $75,000 in April to a historical high of $126,000 in early October.

Nvidia shares exhibited a greater amplitude of 120%, trading between $94 and $207. Since the beginning of the year, the chipmaker’s market capitalization rose by 27%, whereas digital gold corrected by 8%.

The cryptocurrency market demonstrated a decoupling from the stock sector, Bitwise highlighted.

Future Predictions

Experts anticipate Bitcoin’s price to reach a new all-time high and suggest a break from the traditional four-year cycle. According to analysts, the impact of halving, interest rates, and speculative waves is waning.

Bitwise expects financial giants like Citigroup, Morgan Stanley, Wells Fargo, and Merrill Lynch to join the industry. This will accelerate the development of on-chain solutions and increase capital inflow into ETFs in 2026.

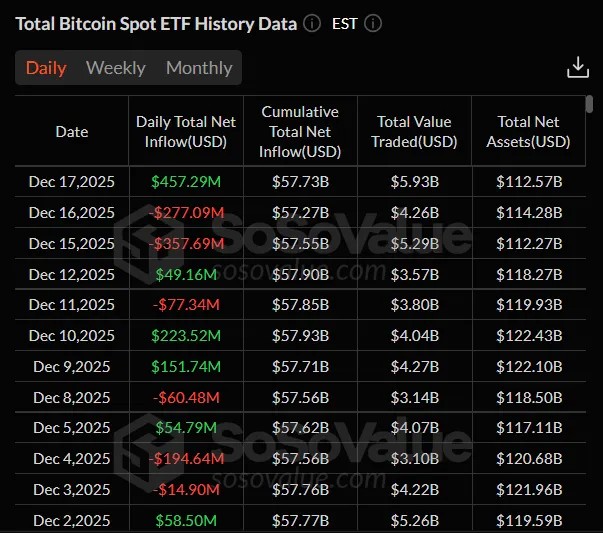

Growing interest is confirmed by figures: on December 17, inflows into US spot Bitcoin funds reached $457.29 million — the best result since November 11.

Specialists explained the capital inflow as a return of institutional players, who anticipate a market rebound.

Long-term Investors Begin Selling

An analyst known as IT Tech observed a sharp reduction in Bitcoin positions by long-term holders (LTH). The expert described the current sell-off as one of the largest in the past five years.

Long-Term Bitcoin Holders Are Unloading Into Strength Again

“This 30-day LTH distribution spike is one of the largest in the last 5 years, and these usually show up near macro tops, not bottoms.” – By @IT_Tech_PL pic.twitter.com/1Vp7avT648

— CryptoQuant.com (@cryptoquant_com) December 16, 2025

According to the specialist, such active sell-offs typically occur near market peaks. Current spot prices significantly exceed the realized price for this category of investors, indicating profit-taking by “old” coin holders rather than capitulation.

IT Tech emphasized that such distribution spikes usually occur near macroeconomic market peaks. He characterized the situation as “late-cycle distribution” and risk reduction, contrasting it with the accumulation phase.

The analyst advised segment participants to adjust their risk management strategies.

Another Bearish Factor

A supply imbalance between Bitcoin and Ethereum is intensifying in the cryptocurrency market. The current situation mirrors patterns observed when the first cryptocurrency’s price was above $100,000, stated an analyst under the pseudonym Mignolet.

The Supply Imbalance Between Bitcoin and Ethereum Is Intensifying Again

“Historically, this imbalance has only been corrected through price declines. That is exactly what happened above the $100,000 level, and the same pattern is now reemerging.” – By @mignoletkr pic.twitter.com/qBEhv9HlE5

— CryptoQuant.com (@cryptoquant_com) December 18, 2025

He noted that buying activity is declining. Remaining liquidity is not growing but merely circulating within the market. This leads to stagnation: without fresh capital inflow, the imbalance cannot be corrected.

The expert pointed out that historically, such imbalances have only been corrected through price declines. This scenario unfolded after breaking the $100,000 level, and it is forming again now.

Mignolet believes that without new funds, the market faces prolonged consolidation or short-term rebounds. However, these movements will not change the overall picture and are likely to end in further decline, he concluded.

Earlier, the head of research at K33 Research, Vetle Lunde, stated that long-term Bitcoin holders have nearly completed the phase of active selling.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!