Spot Bitcoin ETFs Shed $188 Million Ahead of Christmas

In 2025, the first cryptocurrency remained institutions’ clear favourite

On 23 December, at the start of the Christmas holidays, exchange-traded funds based on the two largest cryptocurrencies by market capitalisation recorded combined outflows of $284.1m.

Investors pulled $188.6m from bitcoin ETFs — the negative streak extended to a fourth straight day.

IBIT from BlackRock alone accounted for $157.3m. FBTC from Fidelity, GBTC from Grayscale and BITB from Bitwise shed $15.3m, $10.2m and $5.7m, respectively.

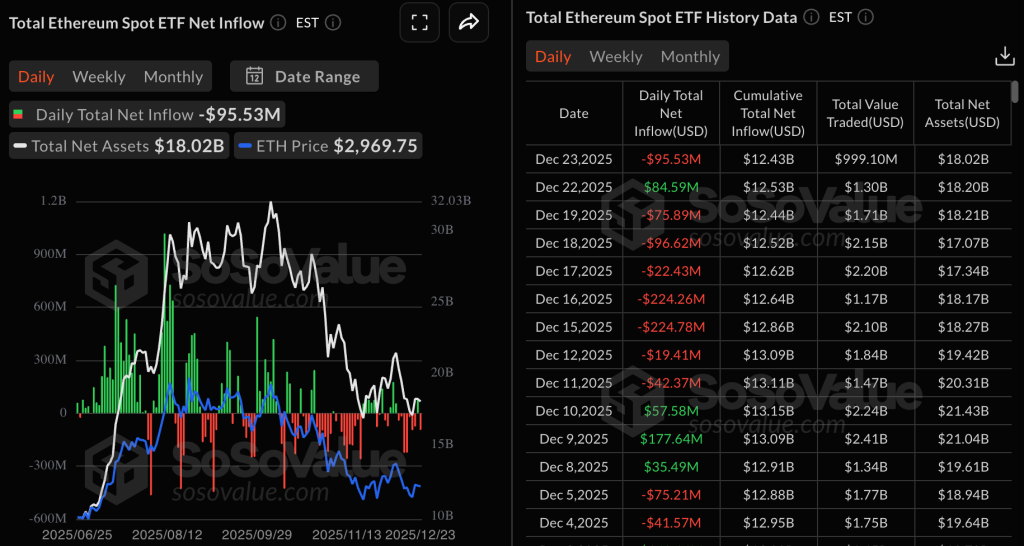

Ethereum funds lost $95.5m, a day after attracting $84.6m.

ETHE from Grayscale led the outflows, with $50.9m withdrawn. ETHA from BlackRock, ETHW from Bitwise and EZET from Franklin Templeton went “into the red” by $25m, $13.9m and $5.6m, respectively.

Kronos Research chief investment officer Vincent Liu explained the sector’s weakness by seasonal technical factors rather than a shift in long-term sentiment. In his view, the market is being driven by thinner holiday liquidity, routine portfolio rebalancing and natural year-end profit-taking.

“The flows have been unstable over the past couple of months, and some degree of end-of-year risk reduction and tidying up of the balance sheet is normal, especially after a volatile fourth quarter,” added Presto Research research fellow Rick Maeda.

Altcoin ETFs

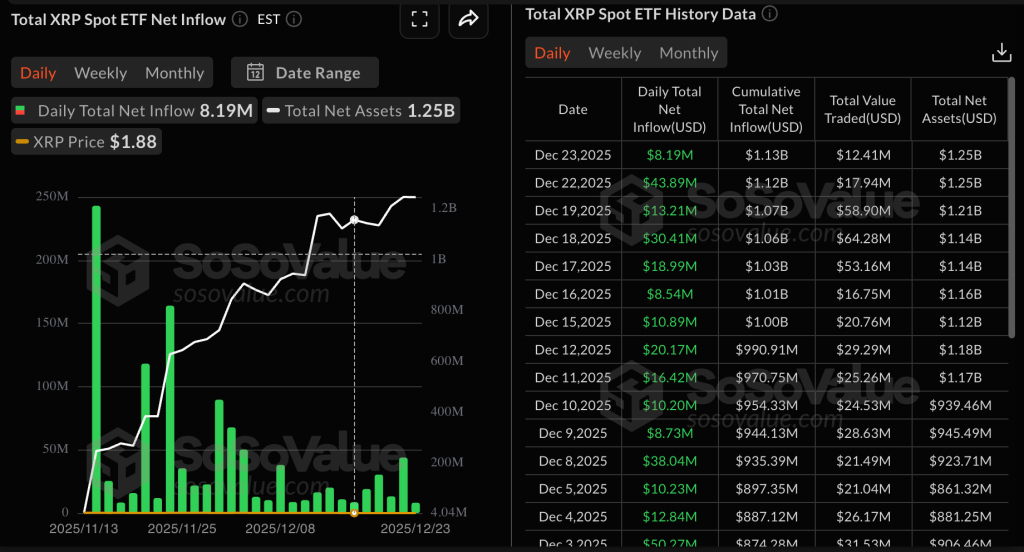

Exchange-traded funds based on XRP have drawn capital for the 27th consecutive trading session. On 23 December, inflows totalled $8.1m, bringing cumulative intake since launch to $1.1bn.

Assets under management across these products stand at $1.2bn — 0.98% of the coin’s total supply. The largest fund is XRPC from Canary.

Solana ETFs also continue to post positive figures. On 22 December, the products took in $7.4m. Cumulative inflows reached $754.2m.

Funds based on the altcoin manage $940.9m, or 1.3% of Solana’s supply.

Institutional favourite

In 2025, bitcoin remained the favourite among institutional investors. Its share of the ETF sector consistently hovered between 70% and 85%, writes The Block.

Big players view the first cryptocurrency as the primary point of entry to the market. They approach other digital assets with far more selectivity and caution.

Since January, bitcoin-focused products have attracted more than $21.7bn. However, total assets under management fell from $119bn to $114bn amid a pullback in the asset.

Trading volumes held steady, but a shift emerged in December: throughout the month, daily turnover rarely reached $5bn.

Ethereum captured 15-30% of the crypto-ETF sector, signalling improved sentiment toward altcoins overall. These vehicles have drawn $5.8bn since the start of the year.

In December, one of the world’s largest asset managers, Vanguard Group, opened access to trading exchange-traded funds based on cryptocurrencies.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!