OneCoin founder Ruja Ignatova named in FinCEN dossier

The international investigative project Cassandra carried out an investigation into the leak of more than 2,100 suspicious activity reports (SARs) filed by global banks with FinCEN. Two of them contained information about Ruja Ignatova, the founder and figurehead of the OneCoin pyramid.

Surprise surprise — OneCoin & Ruja Ignatova appears in the #FinCENFiles. (Bank of Mellon, NY filed 2 SARS relating to $137m). https://t.co/2NvxfhtZL3 pic.twitter.com/PIE3UiagFt

— Jamie Bartlett (@JamieJBartlett) September 20, 2020

The report notes a $4 billion loss tied to OneCoin’s ‘cryptocurrency’.

The scam of the decade: how a Doctor of Law organized the OneCoin pyramid and disappeared with billions of euros

In March 2019, the U.S. Department of Justice charged Ignatova with conspiracy to commit wire fraud, securities fraud and money laundering. Ignatova is at large and her whereabouts are unknown.

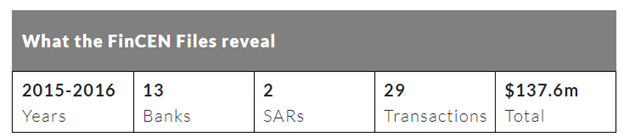

According to the documents, in February 2017 Bank of New York Mellon reported suspicious payments by a group of companies linked to OneCoin totaling $137.6 million. Bank staff in these operations detected signs of the so-called

FinCEN documents concerning OneCoin’s suspicious financial activity. Data: ICIJ.

The SAR disclosed one of the schemes to transfer $30 million through three banks in three countries on three continents as a loan to CryptoReal, OneCoin’s investment trust. The sender was Fenero Equity Investments, registered in the British Virgin Islands, which received funds from one-day companies associated with the pyramid.

That operation featured in emails seized by U.S. authorities that formed the basis for charges against OneCoin lawyer Mark Scott for money laundering of $400 million. Scott arranged a $30 million loan from Fenero for a supposed oil field purchase from Barta Holdings.

Emails showed that the loan was never repaid and that $10 million of the mentioned $30 million was actually spent by one of OneCoin’s co-founders.

The FinCEN leak uncovered criminal schemes from 1999 to 2017 totaling $2 trillion.

Major banks found themselves in a $2 trillion laundering scandal for oligarchs and criminals

Earlier, in September FinCEN proposed tightening rules for anti-money-laundering and financing of terrorism relating to cryptocurrency companies and exchanges.

Subscribe to ForkLog news on VK!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!