The Shift in Web3 Talent

How the Web3 jobs market closes out 2025

Over the past two years the Web3 jobs market has been reshaped. The industry has become more attractive to applicants, not least thanks to a wider range of roles for non-technical specialists. At the same time, rising pay and the faster concentration of talent in crypto hubs have set new hiring criteria.

This ForkLog piece sketches the portrait of today’s crypto employee, their ambitions, odds and opportunities.

Conviction and maturity

In 2022–2023 the industry endured a crypto winter and a wave of layoffs. By 2024 the picture had improved: at the market’s recovery stage, 86% of Web3 workers surveyed by ConsenSys were optimistic about the sector’s future.

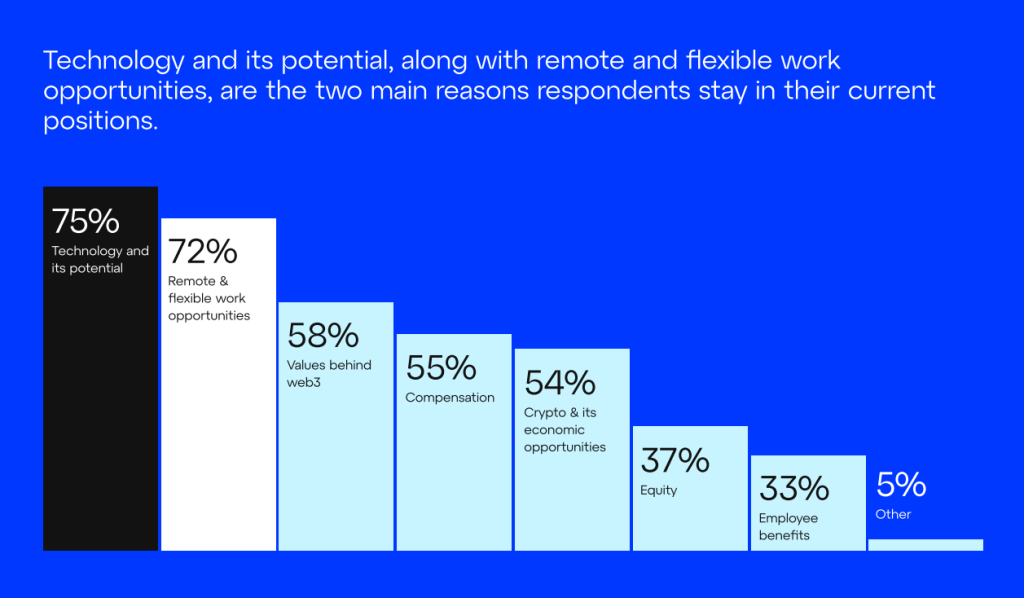

For most respondents—83% of whom are full-time employees—the core values were faith in the technology and remote work with flexible hours.

In the post-covid world, attitudes to work have become more adaptive. Over 75% of surveyed Web3 workers identify as digital nomads, and about 74% said the ability to work from different countries is a priority.

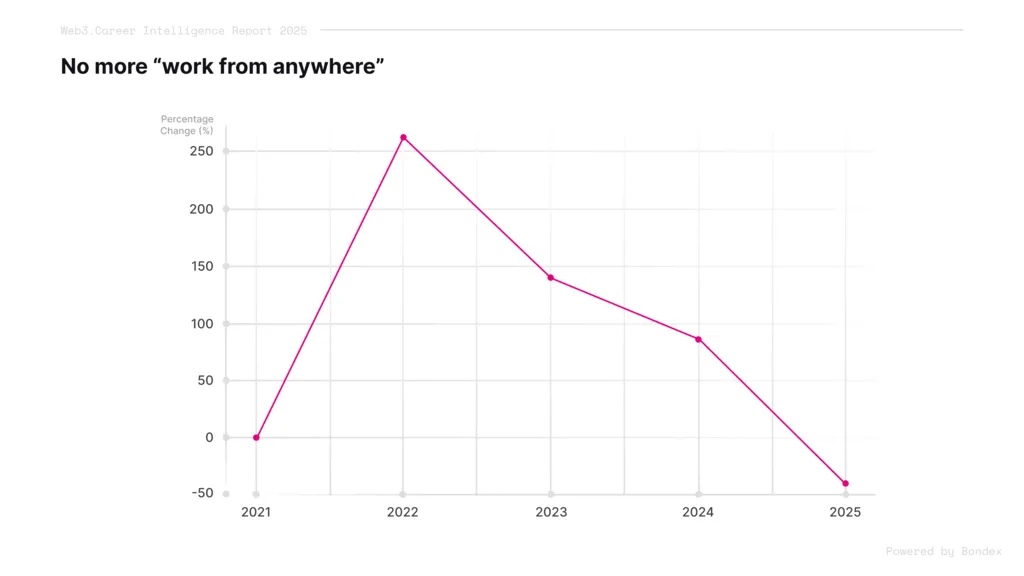

In 2025 the number of remote openings increased by 40% year on year—defying the broader return-to-office trend seen in fintech. Web3 remains structurally more distributed, according to Coincub.

Analysts at Web3.Career, by contrast, observe a decline in “remote” postings. They attribute this to big projects prioritising in-person collaboration, which is easier to ensure offline.

Most blockchain firms have settled on hybrid models that combine flexibility with face-to-face interaction. The sweet spot is three to four days in the office.

According to Web3.Career, three factors drive this:

- corporate maturity. Firms five to eight years old and exiting their startup phase need more structured knowledge-sharing and team co-ordination;

- trust and quality concerns. Incidents involving anonymous developers have increased demand for verifiable competence;

- knowledge transfer. The complexity of blockchain technology requires mentorship and close collaboration.

The geography of work

Coincub notes that the broader tech sector is struggling. Total openings remain below 2021–2022 levels. Despite growing demand in AI and new highs in the S&P 500, layoffs continue.

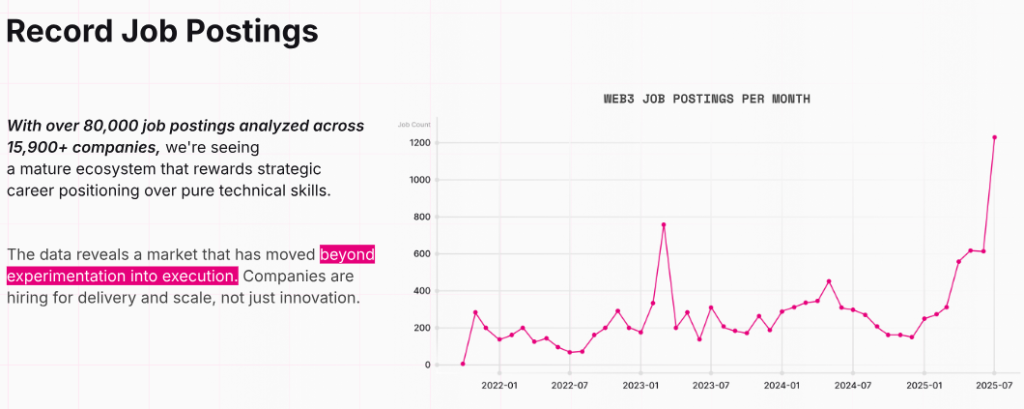

Against this backdrop, the Web3 market looks fairly upbeat. Analysts estimate that in 2025 it expanded to 66,494 new roles. Even so, the 47% rise on the previous year has not surpassed the peak of a strong 2022.

Web3.Career cites a higher figure—up to 80,000 postings.

As the blockchain industry matures, the notion of “work from anywhere” is losing its original meaning.

Even so, the Web3 labour market is seeing large-scale migration.

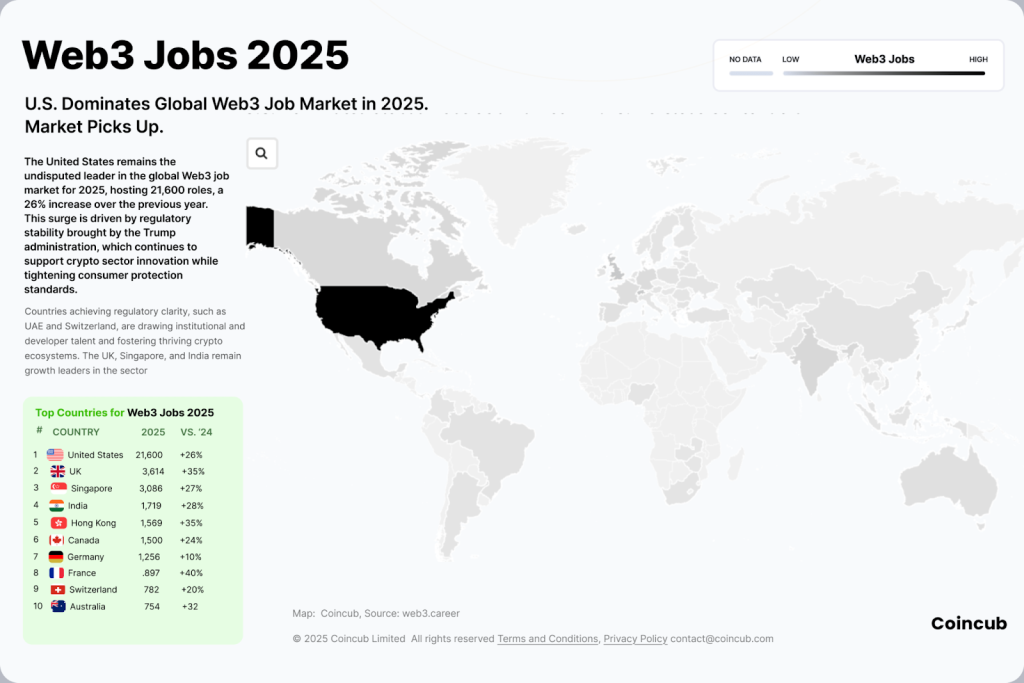

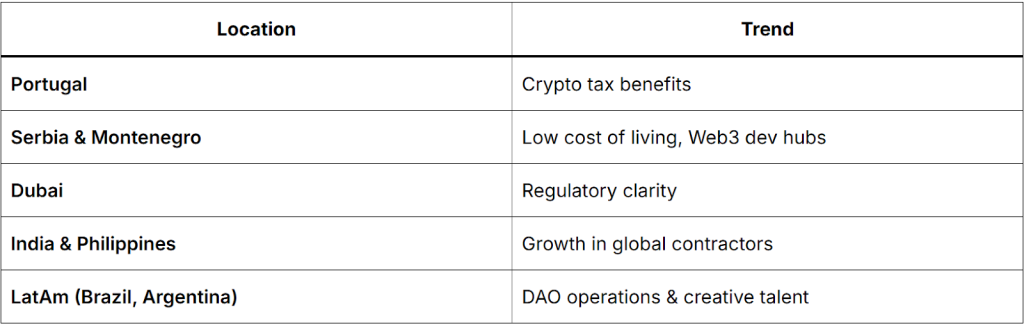

Compared with the 2022–2023 cycle, when Europe was the main hub for blockchain jobs, 2025 has seen a marked shift towards the United States.

Analysts say Europe’s position continues to weaken from 2023 levels, as hiring hubs consolidate in the US and in Asian crypto centres—especially Singapore, Hong Kong and Taiwan—owing in no small part to looser rules.

North America leads regions with more than 23,000 open roles. Asia has 10,420 vacancies amid steady activity in both mature economies and the fast-growing markets of South-East Asia. Europe has 10,263 openings.

The markets of Latin America, the Caribbean, Africa and Australia together account for 2313 vacancies, indicating limited but growing participation beyond the main hubs. Latin America stands out with 1097 openings and an 89% increase on last year.

Make way for the humanities

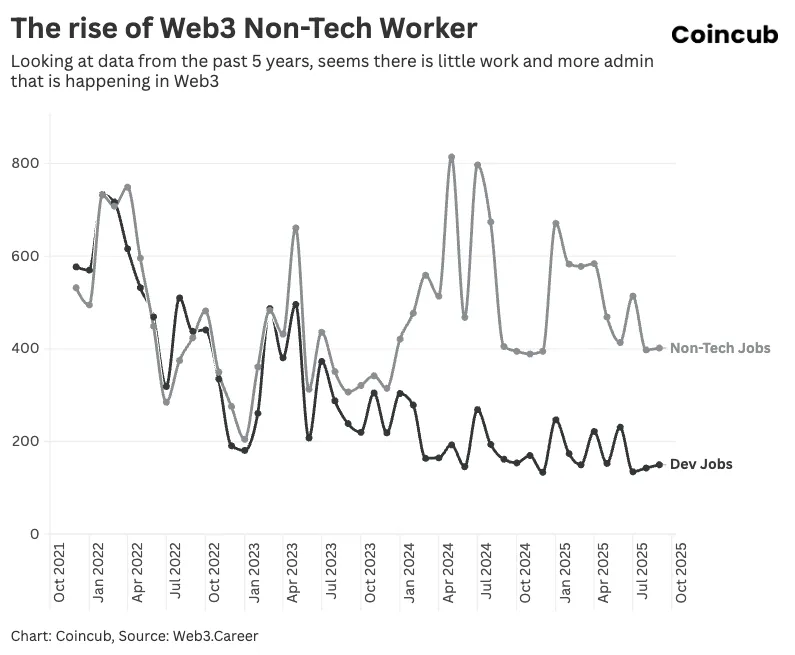

In 2020–2022 HR teams at crypto startups hunted for rare developers with experience programming smart contracts and knowledge of Solidity and Rust. From 2023 the picture began to change.

Most data point to a rise in non-technical specialists on the wish lists of leading Web3 recruiters.

According to Coincub, by end-2024 developer roles attracted almost 450 applications per vacancy, versus just 60–120 for non-technical roles. That implies an oversupply among “techies”. The gap persists even though the volume of “humanities” roles often exceeds pure programming positions—the demand-supply imbalance favours the former.

Analysts say non-technical roles have come to the fore for several reasons:

- the industry has shifted from building to execution;

- regulation has tightened;

- AI tools have boosted developer productivity;

- capital is being allocated more cautiously than in the previous cycle.

In the execution phase of 2023–2025, value creation lies in managing complexity. Firms must integrate multiple blockchains, navigate regulatory requirements, work with enterprise clients and co-ordinate global teams. The scarce resource is the ability to translate technical capability into business outcomes.

“We are witnessing the emergence of a new professional archetype: the Web3 systems thinker — a specialist who understands both the technical base and the coordination layer built on top of it,” the Web3.Career report says.

The European MiCA regime has spurred demand for compliance professionals.

According to RecruitBlock, in the first quarter of 2025 openings for compliance specialists grew by 40%. The agency also notes that institutional players have stepped up hiring of Web3 specialists.

Firms such as BlackRock, JPMorgan and Fidelity are actively recruiting quant traders, risk analysts and smart-contract engineers to expand their digital-asset operations. Traditional financial companies also offer salaries up to 30% higher than crypto startups.

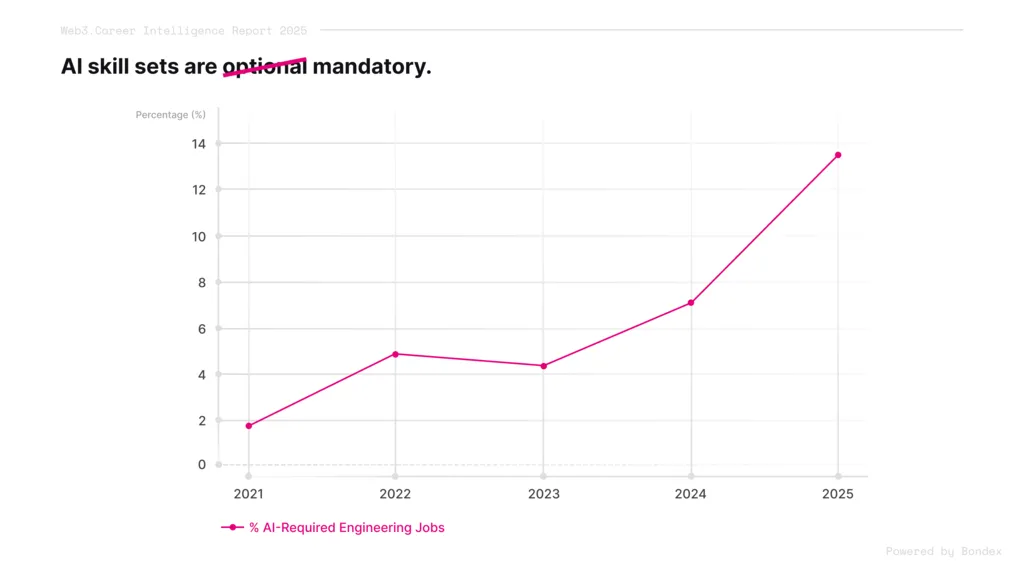

Corporate priorities have shifted towards business outcomes, and the “war for talent” increasingly rewards professionals who combine technical literacy with competent use of AI.

Used well, the technology lifts productivity by 30% or more. Integrating a “digital assistant” is now a basic standard, not a competitive edge, says Web3.Career.

Analysts list the AI skills now required in hiring:

- baseline: prompt engineering, proficiency with tools such as ChatGPT and Claude, and integrating AI into workflows;

- advanced: building custom applications and process optimisation.

Web3.Career reports that the share of postings requiring AI skills rose from 2% in 2021 to 14% in 2025. Even so, analysts believe those figures understate the true scale of the shift.

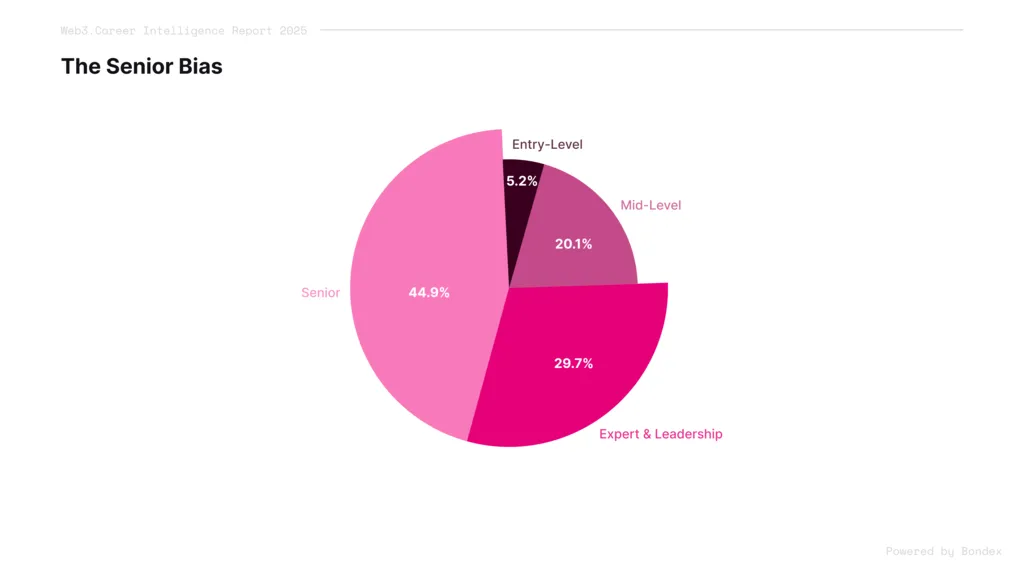

The company also notes a clear preference for experienced developers. The preponderance of seniors creates a rare chance for mid-levels who are ready to refine their positioning.

The rewards

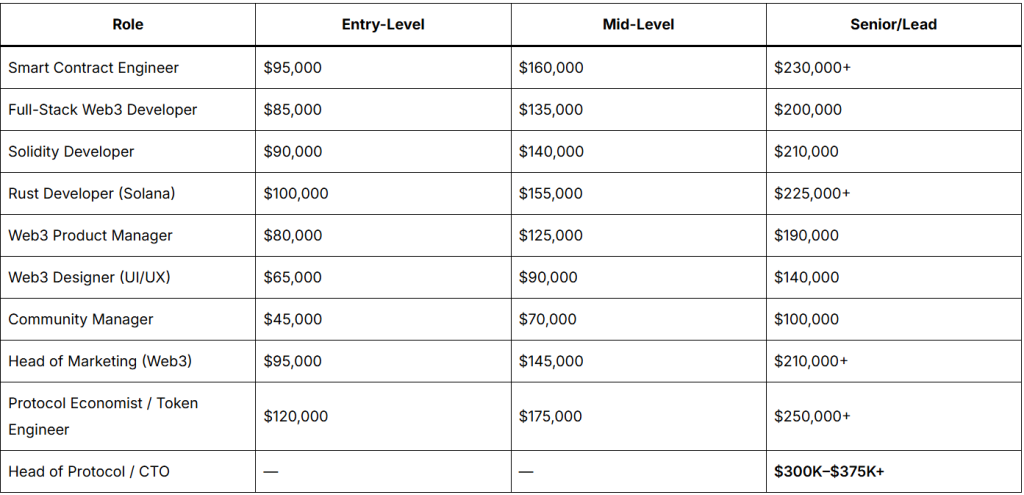

In their 2025 Web3 salary report, analysts at The Crypto Recruiters mapped global compensation. Depending on role, location and experience, the market offers from $45,000 to $375,000 a year.

Recruiters highlight the best-paid roles:

- smart-contract engineers. The most sought-after specialists in the industry. In-demand skills include proficiency in Solidity or Rust, the ability to conduct security audits, gas optimisation and rigorous testing;

- tokenomics specialists. Candidates with crypto-native modelling and management experience are in high demand;

- protocol developers. Deep knowledge of Cosmos SDK, Substrate and the ability to build bespoke L2 solutions command pay on a par with offers from Web2 giants;

- product managers. Leaders who understand the lifecycle of smart contracts, the principles of decentralised governance and crypto-user behaviour receive six-figure offers.

Developers in Web3 earn on average 15–30% more than in traditional IT. The pay leaders are the US, Switzerland, Singapore and the UAE.

Specialists note more offers of crypto-denominated pay. From 22% in 2023, such offers appear in 38% of Web3 job ads in 2025. The most popular tokens for compensation are USDC, USDT, DAI, ETH, FDUSD and PYUSD.

A tricky market

Working in Web3 has many virtues, but also serious drawbacks—the chief one being dependence on market conditions.

During prolonged crypto sell-offs, startup leaders cut staff. Traditional markets are not immune either, but they tend to resort to drastic measures only as a last resort.

Recruiters at The Crypto Recruiters described the situation in their November study.

They say the 2025 market euphoria enabled a hiring spree. Job ads surged, salaries rose. Firms that barely survived 2023–2024 suddenly announced “urgent” openings.

“And then reality set in. And the same companies that in October were shouting ‘we are hiring actively!’ fell silent by early November. What does this show? They were never oriented towards [long-term] building. They were simply reacting to the token price,” the specialists noted.

The team offered a few pointers to both sides of the labour market.

For employers:

- Do not lower the hiring bar—change the positioning. Candidate quality must remain high. But your communication should reflect reality: “Yes, the market is volatile. That’s why we keep building. Here is our runway. Here is what we ship regardless of the token price.”

- Move faster than competitors. While others “pause to reassess”, close deals. The best candidates leave the market within two weeks.

- Provide clarity, not just compensation. Answer key questions before they are asked. What is the token burn plan? What is the runway? What are the next milestones? What happens if the market falls another 20%?

- Assess resilience. Ask candidates about their work during the crypto winter and other tough times.

For candidates:

- A personal GitHub matters more than ever. When firms are cautious, demonstrable experience is decisive. Your commit history should show steady engagement.

- Ask hard questions early. Do not wait for an offer to raise awkward points. Transparent companies respect this. Those who dodge answers are already signalling.

- Be strategic when choosing between contract and full-time. Over 70% of Web3 hiring in November was on a contract basis. Do not dismiss it: it is a way into a project. Strong contractors are often converted to staff on good terms.

- Choose mission and team, not just pay. The projects that survive are those whose mission matters in itself, not those tied to token prices. Financial growth will follow.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!