Opinion: Bitcoin price fell victim to margin trading

One of the main reasons for Bitcoin’s price falling by roughly $3,000 was the mass liquidation of leveraged positions. This view was expressed by Stack Funds CEO Matthew Dibb in a conversation with CoinDesk.

“Bitcoin became a victim of massive liquidations of leveraged trades on major derivatives exchanges,” the expert said.

Over the 24 hours, the total value of liquidated positions across crypto derivatives amounted to $2 billion. In the last 12 hours alone, the figure exceeded $1.6 billion, according to data from Bybt.

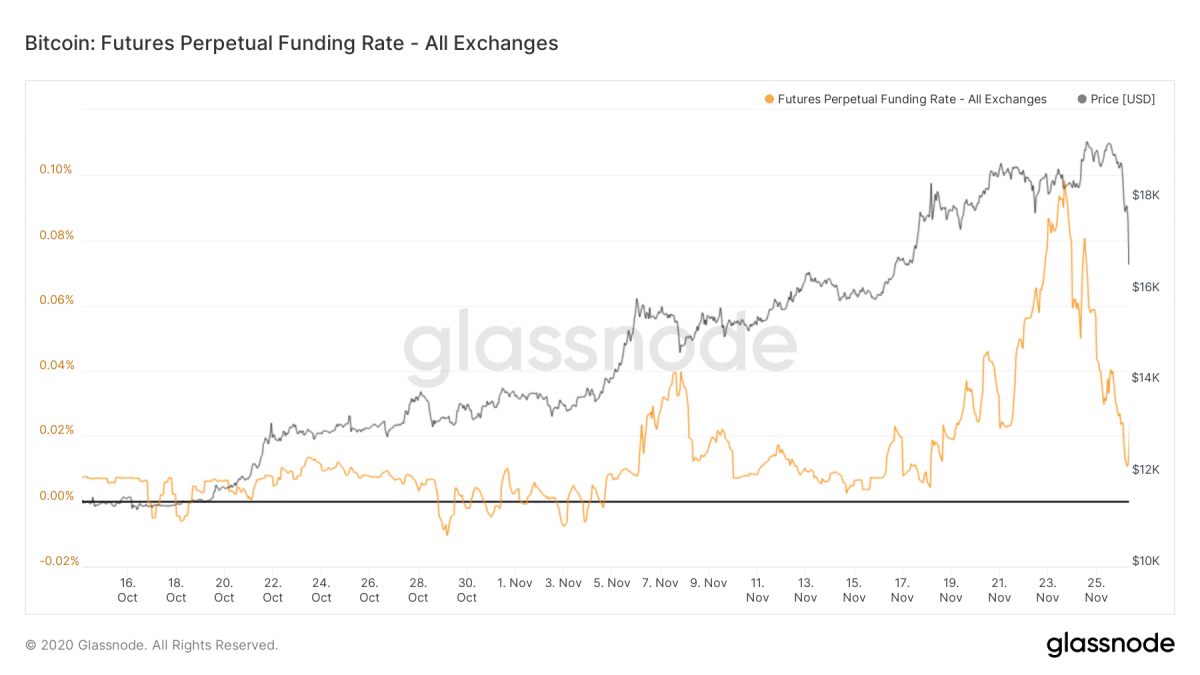

Against this backdrop, the cost of holding a long position in the perpetual-contract market, known as the funding rate, rose to 0.098%. This signals excessive use of leverage, pointing to overheating in the market.

The metric tumbled amid a sharp drop in the price of the leading cryptocurrency.

Dynamics of the funding rate for perpetual contracts and Bitcoin price. Data: Glassnode.

“This is a healthy pullback,” emphasized Dibb.

Economist Alex Krüger echoed the Stack Funds chief’s view.

“What happened to Bitcoin??? I would bet that tomorrow everyone will be asking and trying to answer this question. Leverage happened, that’s all. Greedy traders decided to jump into leveraged longs at the highs, but then exited the game. That’s how markets work,” the expert explained.

The downturn could also have been amplified by renewal of withdrawal capabilities from the major cryptocurrency exchange OKEx.

“Unrealized profit on most of the OKEx-held Bitcoins was around 70%. Once these coins could move freely again, many traders presumably sold them for dollars and stablecoins to lock in that profit. This gave a significant push to selling,” shared CF Benchmarks chief Sui Chung.

As of writing, Bitcoin is trading around $16,725, down 11.7% in the last 24 hours (data from CoinGecko).

Krüger is confident that Bitcoin’s path of least resistance lies upward, and the latest sharp price drop is no more than “noise in the context of a larger bullish trend.”

“Bitcoin still has a target to reach a peak. I see many professional traders opening positions in the first cryptocurrency. These are healthy positions, because such market participants do not go all-in, but gradually add funds as the asset grows or falls,” said the chief operating officer of Mumbai-based exchange WazirX.

Earlier ForkLog reported that Bitcoin had dropped below the $17,000 level, although shortly before that the cryptocurrency traded above $19,000.

Follow ForkLog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!