Opinion: Bitcoin volatility raises the appeal of gold investments

Bitcoin has not yet reached the maturity to compete with gold as a safe-haven asset. This was stated by Evolution Mining’s chief executive Jake Klein in an interview on CNBC.

According to the executive, Bitcoin still has a long way to go to demonstrate the “durability and security” inherent to gold.

Klein is convinced that Bitcoin’s price volatility will ultimately drive investors back to gold.

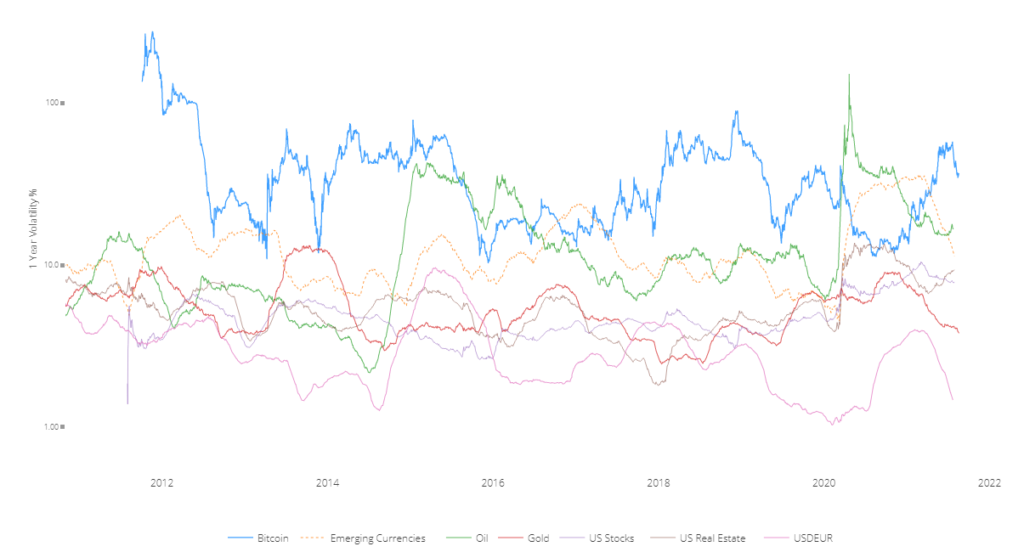

According to Woobull Charts, Bitcoin’s annual volatility is 9.1 times that of the main precious metal.

In the interview, Klein allowed for the two assets to coexist, and he did not endorse the view that Bitcoin threatens gold.

Earlier in May, JPMorgan predicted a transfer of capital from the first cryptocurrency to the precious metal amid a correction. A similar position was presented by their colleagues at Societe Generale.

At the end of 2020, CoinShares analysts allowed a transfer of funds from gold ETF to cryptocurrency-based funds.

Subscribe to ForkLog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!