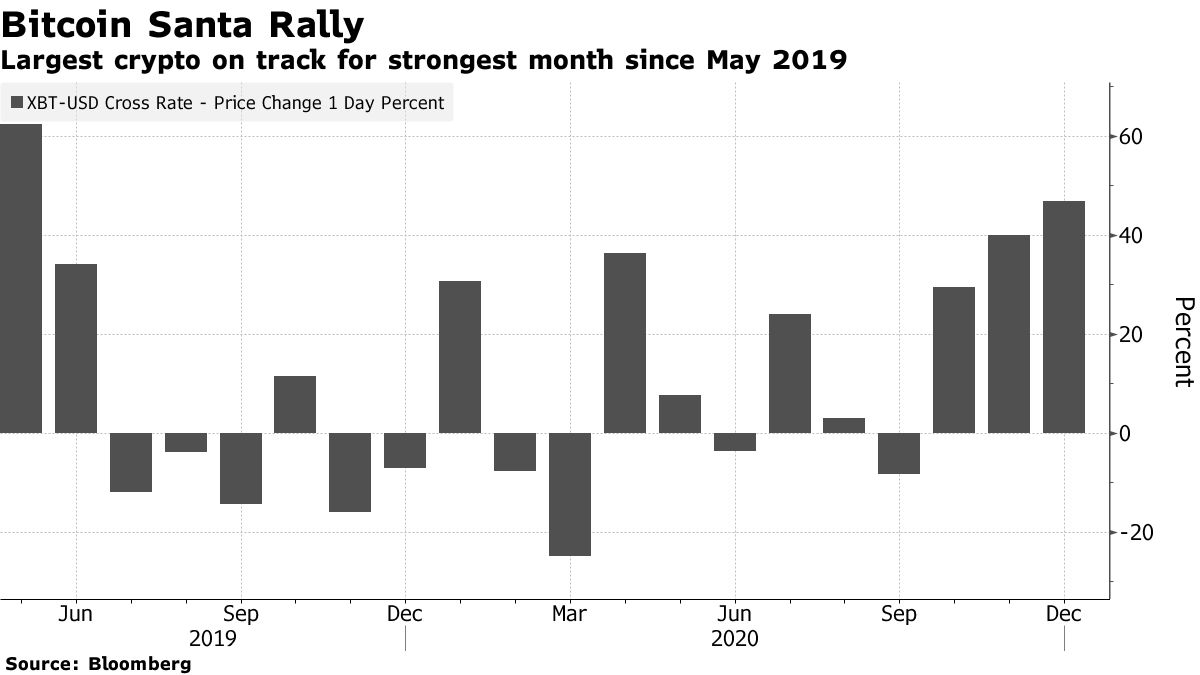

Opinion: Retail investors contributed as much as institutions to Bitcoin’s 40% December rally

According to the widely held view, the impressive rise in Bitcoin’s price in December has been primarily driven by institutional interest. But Paolo Ardoino, the CTO of Tether and Bitfinex, believes that retail investors made no less of a contribution.

“While rising institutional participation has been the driver of the current price rise, we are seeing growing retail interest in Bitcoin as a form of digital gold.”https://t.co/egIupCYKxF

— Paolo Ardoino (@paoloardoino) December 30, 2020

“While rising institutional participation has been the driver of the current price rise, we are seeing growing retail interest in Bitcoin as a form of digital gold,” he said in a Bloomberg interview.

Earlier, while commenting on the Christmas rally of the first cryptocurrency, Blockstream CEO Adam Back voiced a similar view.

So $25k* on 25th, three new ATHs $24.7, $24.8 and $25k in a day. You think institutions did that? On Christmas day? Retail did it — only people near a keyboard.

(*$25k if you pick @bitstamp or @krakenfx tho not quite on @bitfinex) pic.twitter.com/6PmiEcdn7v

— Adam Back (@adam3us) December 26, 2020

“Local highs of $24,700, $24,800 and $25,000 [on Christmas Day] 25 December. You think these were institutional investors? On Christmas? Retail — people at keyboards,” Back wrote.

Bitcoin hit a new all-time high at levels above $28,500.

As Bloomberg notes, the more-than-40% rise in December was Bitcoin’s highest since May 2019.

Earlier Citi analysts suggested that by the end of 2021 Bitcoin would firmly cement its status as digital gold in the 21st century. In principle this could push the first cryptocurrency’s price to around $318 315.

Similar views are shared by many other experts. According to Grayscale Investments director Michael Sonnenshein, new investors view Bitcoin as “a store of value, inflation hedge, digital gold and a new form of money”.

Renowned financier Dennis Gartman called Bitcoin “the millennials’ gold” and did not rule out further upside for the first cryptocurrency for decades.

Former George Soros associate and billionaire Stanley Druckenmiller also admitted that Bitcoin could prove to be a better store of value than gold.

As noted earlier, trader and analyst Tone Vays described the forecast for Bitcoin to reach $100,000 in the near term as “excessively conservative.” According to him, the leading cryptocurrency is preparing for another jump that could lift the price to $300,000 in 2021.

Subscribe to ForkLog news on Telegram: ForkLog FEED — the full news feed, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!