Pantera Capital Predicts Collapse of Small Crypto Treasuries

In 2026, DAT companies will face "fierce consolidation," with only a few large players surviving.

In 2026, DAT companies will face “fierce consolidation,” with only a few of the largest players with Bitcoin and Ethereum on their balance sheets surviving, according to analysts at Pantera Capital.

— Pantera Capital (@PanteraCapital) January 21, 2026

“The rest will either be absorbed or left behind, except perhaps for one or two fortunate players with alternative tokens,” they noted.

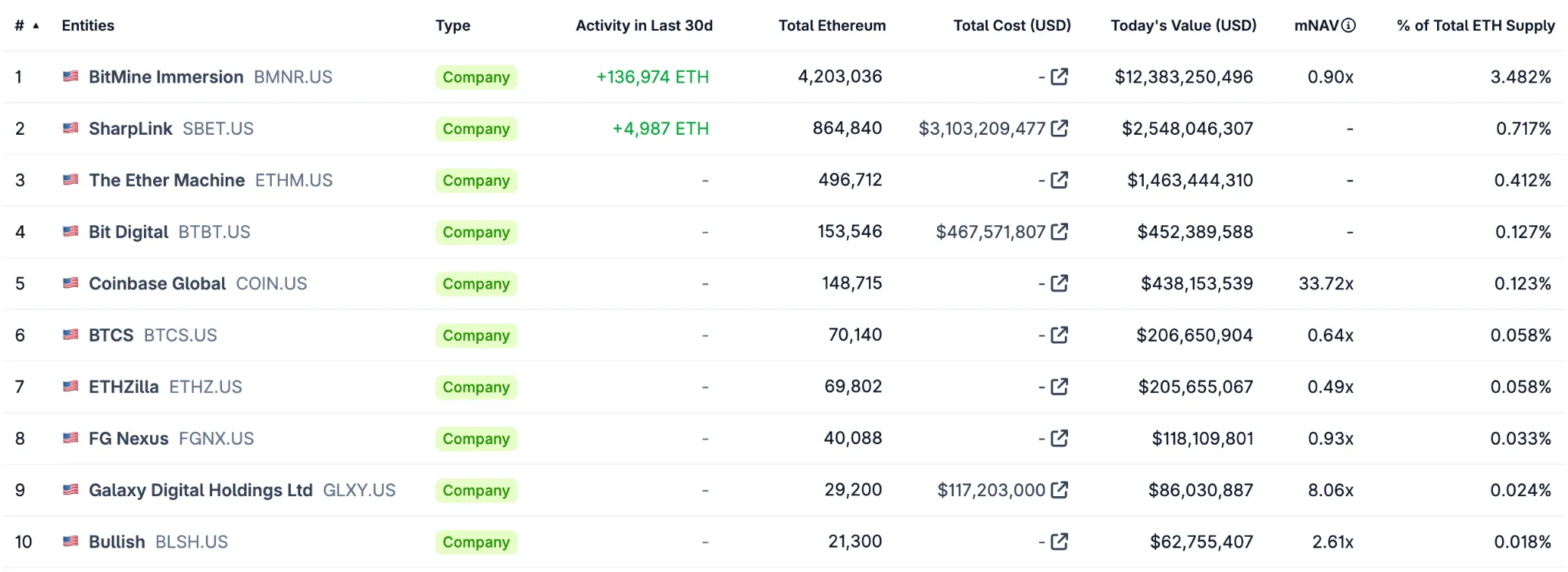

Experts say the trend is already noticeable: asset accumulation is concentrated among a limited number of corporations. This is particularly evident in the treasury sector of the second-largest cryptocurrency by market capitalization.

Ethereum Advocates

BitMine is solidifying its status as the largest holder of the second-largest cryptocurrency by market capitalization. Just last week, the company invested $104 million to purchase 35,268 ETH. Since the beginning of the year, the firm’s portfolio has grown by 92,511 ETH ($277 million).

At the time of writing, the company manages over 4.2 million ETH ($12.9 billion), accounting for 3.48% of the total supply of the asset.

BitMine has also engaged in staking — the firm has locked a total of 1,943,200 ETH ($5.71 billion).

Tom Lee(@fundstrat)’s #Bitmine staked another 171,264 $ETH($503.2M) 6 hours ago.

In total, #Bitmine has now staked 1,943,200 $ETH($5.71B).https://t.co/P684j5YQaG pic.twitter.com/xrFAF4KKau

— Lookonchain (@lookonchain) January 23, 2026

The second-largest Ethereum treasury, SharpLink, acquired 4,987 ETH ($14 million). Other DATs have not reported new cryptocurrency purchases for some time — a similar pattern is observed in the sector of companies accumulating Bitcoin.

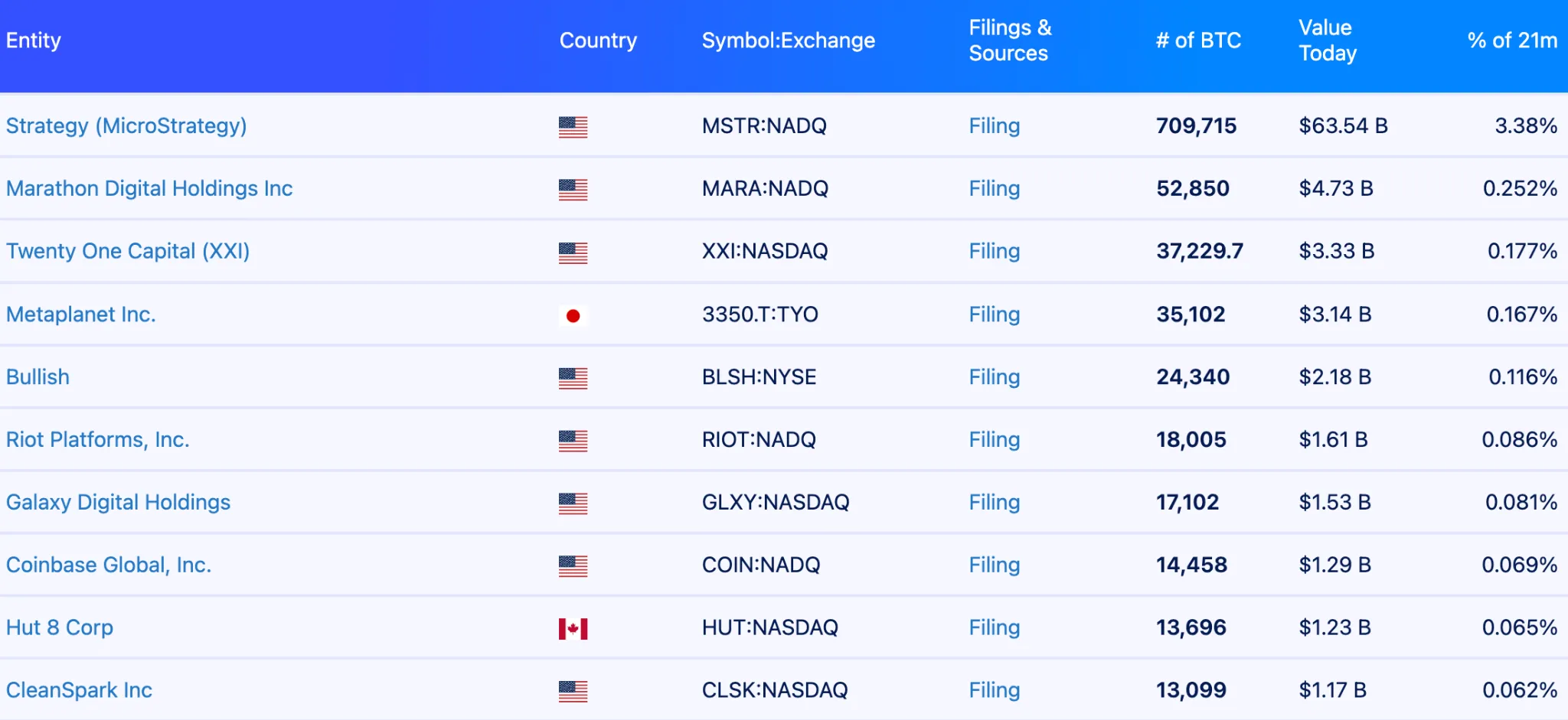

Bitcoin Treasuries

The largest player here remains Strategy Michael Saylor, which owns 709,715 BTC ($63.5 billion) and continues to replenish its reserve.

The company accounts for the majority of assets managed by public corporate structures (1 million BTC worth $96.7 billion).

In comparison, the second-largest treasury holds 52,850 BTC ($4.7 billion) — more than 11 times less than Strategy.

The growing gap raises questions about the sustainability of smaller treasuries, especially those that raised capital through debt or equity issuance during bull market phases. Some have already faced consequences — at the end of December, ETHZilla sold 24,291 ETH worth $74.5 million to repay debt obligations.

Earlier, French firm Sequans Communications resorted to asset liquidation: the company had to sell 970 BTC ($94.5 million) to meet convertible debt payments.

Back in November, Bitwise’s Chief Investment Officer Matt Hougan highlighted the inefficiency of crypto treasuries.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!