PayPal statement, Bitcoin hits a new yearly high, and other events of the week

Looking back at the week just passed, we recall Bitcoin’s achievement of a new annual high against the backdrop of PayPal’s announcement, the closure of a legendary Berlin bar, OKEx problems and other key industry events.

Bitcoin hits 2020 high above $13,000

In the night of Thursday, October 22, the price of the first cryptocurrency rose above $13,200 (Bitstamp), marking a new record for the year.

Following a pullback, BTC traded back to around $12,800, but the uptrend remained intact. After a period of consolidation on the morning of October 25, the price again surged and updated the 2020 high — this time surpassing $13,360.

Source: TradingView.

As of writing BTC is trading in a sideways range around $13,000.

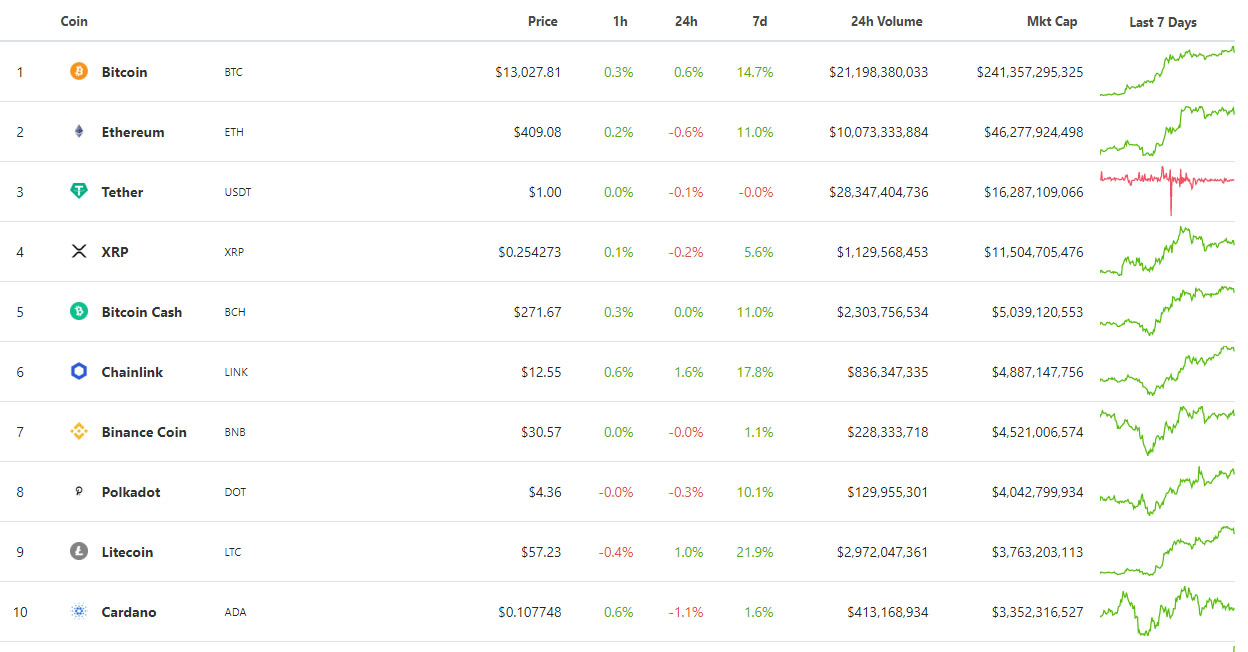

The price surge of the leading cryptocurrency pulled the market along — most of the top-capitalization altcoins posted double-digit gains over the week (CoinGecko).

Source: CoinGecko.

Ethereum (ETH) rose above $400.

The overall cryptocurrency market capitalization stands at over $401 billion with Bitcoin’s dominance index at 60%.

Analysts noted that the new rally in Bitcoin followed PayPal’s market-shaking announcement.

PayPal to add ability to buy and sell Bitcoin

The payment company PayPal will launch a feature to buy, sell and hold Bitcoin and other cryptocurrencies. Its mobile payments service Venmo will add this capability in 2021.

For US users, the new option will be available in the coming weeks.

Among the supported cryptocurrencies are Bitcoin, Bitcoin Cash, Ethereum and Litecoin.

PayPal expects the feature to spur global use of cryptocurrencies and to prepare the network for central bank digital currencies.

“We are working with central banks and thinking about all forms of digital currencies and the role PayPal could play,” said PayPal CEO Dan Schulman.

It is expected that PayPal customers will be able to use cryptocurrencies to pay for goods at 26 million merchants.

Crypto transactions will be automatically converted to fiat. This means merchants won’t have to leave their traditional systems, PayPal said.

To implement the new feature, the company obtained a limited license from the New York Department of Financial Services. This was made possible thanks to a partnership with Paxos, which had previously been licensed by the agency.

News of PayPal’s Bitcoin support pushed its market capitalization to new highs. On Wednesday, October 21, after-hours trading valued the company at nearly $250 billion, up 5.5%.

The new all-time high in PayPal’s stock price was $215.83. The previous high of $212.45 was recorded on September 2 this year.

The week closed with shares at $203.04.

Source: Finviz.

Following the Bitcoin news, media reported that PayPal is considering acquisitions of crypto companies to broaden its product lineup.

One of the candidates for acquisition is the custodial service BitGo.

According to Bloomberg, the deal could take place in the coming weeks. If talks derail, PayPal is prepared to pivot to other options.

Мишустин назвал биткоин угрозой для финансовой системы

Russian Prime Minister Mikhail Mishustin stated that cryptocurrencies and stablecoins threaten the stability of the existing financial system.

According to the head of government, large digital giants building digital platforms exert a negative influence on financial regulation in countries.

“Cryptocurrencies and all derivatives of digital financial assets, widely used by the younger generation, pose a threat to central reserve systems, central banks, and financial institutions,” Mishustin said.

However, he believes Russia itself should become a digital platform to compete with IT giants.

Анатолий Аксаков заявил о поддержке властями РФ внедрения блокчейна и отсутствии у биткоина будущего

There are no opponents of blockchain among the authorities, but there are diverse positions on cryptocurrencies. This, during a speech at the Blockchain Life 2020 forum stated Anatoly Aksakov, chairman of the State Duma committee on the financial market.

He noted that Russian authorities intend to stimulate, cultivate and develop blockchain.

“This is a technology of the future, everyone understands it,” said Aksakov.

At the same time he confirmed that critics of cryptocurrencies mainly emphasise the risks they pose to the financial system and to citizens.

In his view, Bitcoin and other cryptocurrencies without a single issuer have no future. He said this at an online conference “Digital technologies in business: legal regulation and protection of innovation”.

This does not apply to digital currencies such as Libra, he noted. These coins are more aligned with the Russian legal framework’s definition of digital financial assets (DFA), he emphasised.

В Берлине закрылся бар, принимавший биткоины с 2011 года

Entrepreneur Jorg Platzer shut down the legendary Room 77 bar, where customers could pay for orders with Bitcoin.

According to the owner, the first crypto payment at Room 77 was accepted in 2011. The venue in the Kreuzberg district attracted interest from representatives of the Bitcoin community.

In this bar, brothers Jeremias and Nikolas Kangas began work on the famous peer-to-peer platform LocalBitcoins. Andreas Schildbach also worked on the first mobile Bitcoin wallet there.

“This place will forever remain a part of Bitcoin history,” wrote Bitcoin Core developer Eric Lombrozo.

Platzer did not disclose the reason for the closure. Patrons linked the decision to restrictions stemming from the coronavirus. In Lombrozo’s view, the problem also lies in the use of Room 77 for Bitcoin, which is “too risky”.

OKEx возобновила торги на p2p-платформе, но не вывод средств. В сообществе предложили свои варианты

OKEx exchange announced the resumption of trading in fiat pairs on its p2p platform. On October 21, users gained access to operations in pairs with Chinese yuan, Vietnamese dong and Indian rupees.

Trading on OKEx halted on October 16, concurrently with withdrawals being suspended.

By the end of the workweek on Friday, October 23, the exchange team confirmed that the option was still unavailable, and user funds were safe

Update Oct 23: We’re working diligently to restore full exchange functionality & get back to business as usual. For now, withdrawals are still paused.

We want to extend a huge thank you to our community for your incredible patience.

Further details: https://t.co/1fxZsOAHtR

— OKEx (@OKEx) October 23, 2020

Amid OKEx’s troubles, the community began exploring ways to assist its customers.

Blockchain developer Zulu Republic together with liquidity provider Alameda Research and the Whalepool traders’ community proposed to institutional investors a paid service for withdrawing Bitcoin and USDT from the exchange.

The minimum order size is 100 BTC. Withdrawals are executed via escrow accounts and specially created ERC-20 tokens NOBTC and NOUSDT.

User fees amount to 1% of the swap value.

According to the developers, five institutional investors used the service in its early hours.

The Tron Foundation launched its aid program to restore TRX for OKEx users.

However, on October 22 it was forced to close it after two days of operation.

The Tron Foundation allowed unlimited TRX withdrawals via internal transfers. However, the exchange began blocking the organization’s accounts, forcing it to suspend the compensation program.

According to Tron Foundation CEO Justin Sun, at least 20 users managed to use the solution.

The protracted OKEx situation spilled over to other players in the industry. The DragonEx exchange paused deposits/withdrawals amid a trust crisis — users began withdrawing funds en masse, affecting its operations.

Впервые британская публичная компания перевела часть капитала в биткоин

Mode Global Holdings, listed on the London Stock Exchange, announced that it had purchased Bitcoin worth around £750,000 from its cash reserves, according to Forbes.

The publication noted that this makes it the first publicly traded company in the United Kingdom to hold BTC on its balance sheet.

Mode plans to convert 10% of its reserves into Bitcoin.

“This decision is part of the long-term strategy to protect investors’ assets from currency depreciation,” the company said.

Custodians for Mode’s crypto assets include BitGo and Coinbase Custody.

Что еще почитать и посмотреть

ForkLog published the first installments of Dmitry Bondar’s series on non-fungible tokens (NFTs). Get to know the NFT market here and here.

Over the week since the Filecoin mainnet launch, a series of events around the project—from accusations of token dumping by the team to miner strikes—took place. We gathered, all that is known to date in a feature.

On ForkLog Max Bit, Vladimir Koen spoke with Vladimir Koen about fundamental market analysis. They also discussed correlations with Bitcoin, exchange manipulation and reviewed OKEx, BitMEX and Bittrex cases.

Subscribe to ForkLog news on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!