Poll: Bitcoin more likely to fall to $10,000 than to rebound to $30,000

60% of surveyed Bloomberg investors consider a price drop to $10 000 more likely. A rebound to $30 000 is the base scenario for the remaining 40%.

The survey involved 950 respondents.

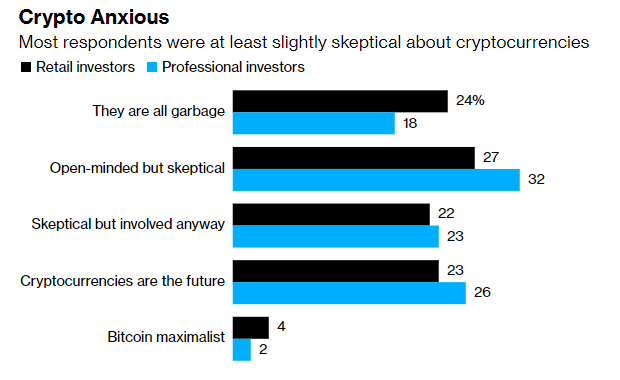

Compared with institutions, retail investors were more sceptical. Almost a quarter called the first cryptocurrency “junk” (among professional market participants — 18%).

The same split did not favour digital gold in the categories “unbiased, but sceptical” and “skeptical, but participate in one form or another” — 27% versus 32% and 22% versus 23% respectively.

Respondents expressed confidence that recent events in the crypto markets will prompt regulators to tighten oversight of the industry. This could boost trust and lead to further popularisation of digital assets.

Most respondents were confident in Bitcoin and Ethereum’s firm positions over the next five years, despite central banks’ active preparations to launch CBDCs.

Only 9% of participants view NFTs as an investment opportunity. For the rest, non-fungible tokens are art projects and status symbols, unlikely to return the previous hype.

Earlier, Galaxy Digital chief Mike Novogratz questioned the decline to $13 000.

Earlier, Rockefeller International’s head Ruchir Sharma noted that Bitcoin needs to shed excessive leverage to regain stability.

Read ForkLog’s Bitcoin news in our Telegram — crypto news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!