Polychain- and Galaxy-backed YU stablecoin loses its dollar peg

Yala’s YU stablecoin depegs; liquidity thins as team probes and communications lag.

On November 17, Yala’s YU stablecoin slipped its dollar peg, according to community reports.

刚睡醒,看见 $Yala 的稳定币 YU 又脱锚了

最低甚至掉到 0.47 美元,一度引发社区大恐慌

我查了下历史原因,其实这次的问题不是突然爆出来的,而是 历史漏洞 + 借贷危机 + 流动性不足 三个因素叠加

先回顾一下背景:

今年 9 月,Yala 用的 LayerZero 桥出现配置问题,黑客利用 OFT 设置不当直接… pic.twitter.com/cJnLpjF49Z

— 币圈老司机🔶BNB (@Bqlsj2023) November 17, 2025

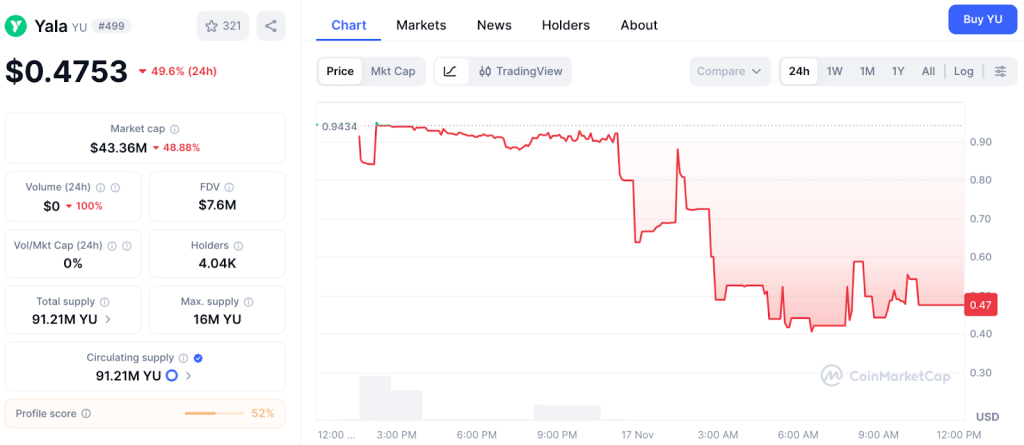

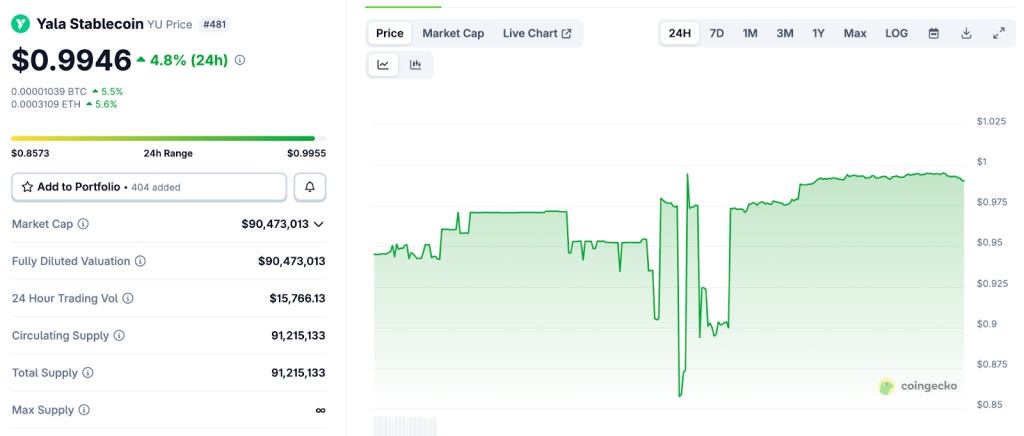

According to CoinMarketCap, the token fell 49.6% in 24 hours to $0.4.

On CoinGecko, however, the stablecoin is quoted at $0.9:

Users on X are actively discussing the depeg, noting suspicious activity by addresses associated with the Yala team.

On November 14, DeFi researchers YAM pointed to “red flags” indicating the project is in critical condition. In particular, a wallet linked to the issuer borrowed all available USDC and YU on Euler Finance and has not returned the funds.

We’re seeing some red flags about @yalaorg’s stablecoin $YU.

Back in September, $YU‘s backing lost around $7.6M as a result of a faulty OFT LayerZero bridge setup where an attacker gained unauthorized access to mint $YU. The Yala team claims that they found the exploiter and…

— YAM 🌱 (@yieldsandmore) November 14, 2025

Lenders cannot withdraw assets because they are locked. The Euler team disabled the ability to take out new loans against the aforementioned stablecoins.

Analysts also pointed to thin YU liquidity across EVM-compatible networks. On paper, the stablecoin pools look large, but about 90% consists of YU itself. Swapping to USDC is currently impossible.

All available liquidity, amounting to $1m in USDC, is concentrated on Solana, where the dollar peg still holds for now.

Experts added that they cannot reach the Yala team, which has not responded to requests on any social network.

On November 16, the issuer wrote on X that it was “aware of the recent community concerns” and is investigating. The developers promised to provide more information soon.

We’re aware of the recent community concerns and are actively looking into them. More updates coming soon.

— Yala (@yalaorg) November 16, 2025

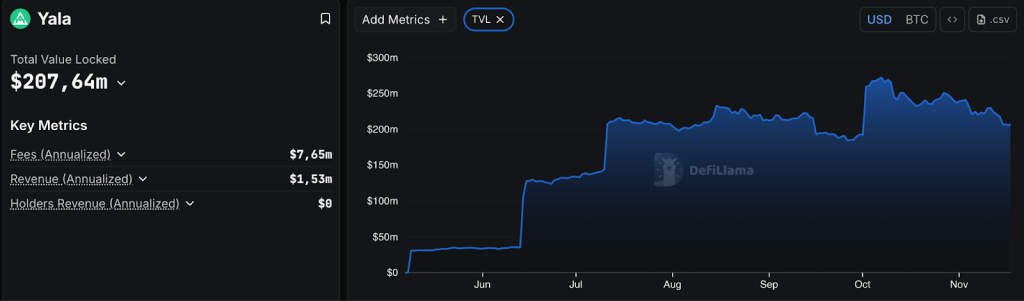

According to Yala’s site, 91.2m “legitimate” YU are in circulation. The total value locked in the protocol exceeds $207m.

DEX Screener shows liquidity in the pool YU/USDC on Uniswap is only about ~$195,000.

Yala hack

In September, the project was hit by a hack. The attacker minted 120m YU without authorization on Polygon’s L2 network, then swapped 7.71m tokens for 7.7m USDC on Ethereum and Solana.

With the proceeds, he bought 1,501 ETH and distributed it across several wallets.

The Yala team guaranteed full restoration of affected liquidity pools and the ability for users to swap YU for USDC at 1:1.

YU fell to $0.3 in the wake of the hack.

Earlier in November, Stable Labs’ USDX lost its dollar peg and fell to $0.3.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!